Equities finished Tuesday higher with the Dow leading large caps adding 36bps, while the broad market S&P 500 added 15bps and the Nasdaq checked in up 17bps at the close. Futures for Wednesday have opened positive with the Dow after hours index showing a +0.51% reading. The 10yr treasury yield fell to 4.33% and WTI crude Oil moved lower while Brent appreciated modestly. Gold was off 1.02% with Bitcoin down 2.8%

The JOLTS report came in at its lowest reading in 3-years with market watchers expecting the report to give the Fed. cover to lower rates later this year.

Eco Data Releases | Wednesday June 5th, 2024

| Date Time | Event | Survey | Actual | Prior | Revised | |

| 06/05/2024 07:00 | MBA Mortgage Applications | 31-May | — | — | -5.70% | — |

| 06/05/2024 08:15 | ADP Employment Change | May | 175k | — | 192k | — |

| 06/05/2024 09:45 | S&P Global US Services PMI | May F | 54.8 | — | 54.8 | — |

| 06/05/2024 09:45 | S&P Global US Composite PMI | May F | 54.2 | — | 54.4 | — |

| 06/05/2024 10:00 | ISM Services Index | May | 51 | — | 49.4 | — |

| 06/05/2024 10:00 | ISM Services Prices Paid | May | 59 | — | 59.2 | — |

| 06/05/2024 10:00 | ISM Services Employment | May | 47.2 | — | 45.9 | — |

| 06/05/2024 10:00 | ISM Services New Orders | May | 53.2 | — | 52.2 | — |

S&P 500 Constituent Earnings Announcements by GICS Sector | Wednesday June 5th, 2024

Several economic releases due on Wednesday headlined by Mortgage Apps at 7AM. Housing prices have started to slump amid mounting unsold inventories. We’ve detailed the weak consumer dynamics, but it will be interesting to see how sensitive demand is to changes in interest rates with the benchmark US 10yr Yield now heading lower in the near-term. Unlikely to affect this month’s release, but worth keeping an eye on.

Earnings feature a trio of Staples co.’s. DLTR and BF/B have had it particularly rough this year.

Worldwide Wednesday: US still leads, but more intriguing areas are showing up ex-US!

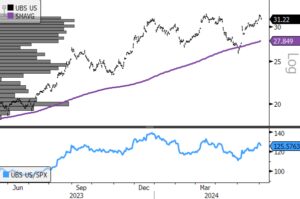

We’ve noticed some decent charts popping up in the European banking sector. Credit Agricole and UBS are both examples of a now long-term bullish reversal manifesting in the industry.

- UBS (200-day m.a.| Relative to S&P 500)

- UBS has outperformed the S&P 500 by 25% over the past 12 months net of total return.

Sources: Bloomberg