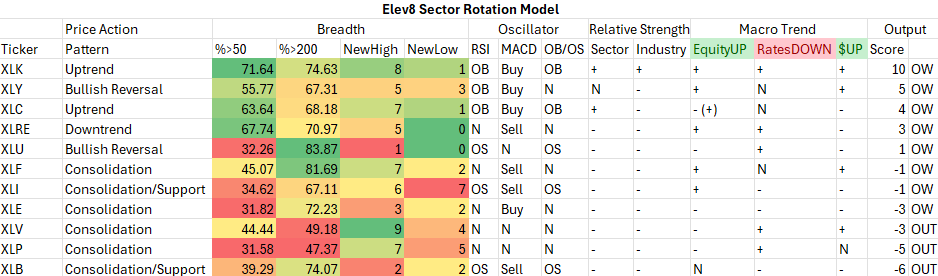

We introduced the Elev8 Sector Rotation Model in June. Here’s a look under the hood at the inputs we use to score the 11 GICS Sectors. Under ideal circumstances the model has up to 18 inputs that can affect the score. Currently the USD component of the model is not throwing off a signal one way or another as the DXY Index has been range-bound. Otherwise, our scores are a mixture of price action, momentum, breadth, relative strength and macro trend coincident performance.

The table below shows the model’s scores for July. Ideally the Elev8 Portfolio wants to own Sectors that score positively, but with leadership running narrow, we aren’t getting as many positive scores as are typical.

Model Inputs

Key: Pattern = L/T (1yr+) Price Pattern of the Sector ETF, %>50 = # of constituents with price ABOVE its 50-day moving average, %>200 = # of constituents with price ABOVE its 200-day moving average, NewHigh = # of constituents making new 52-wk highs in the past month, NewLow = # of constituents making nw 52-wk lows in the past month

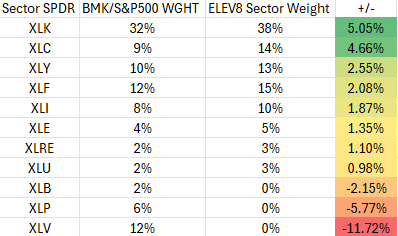

Elev8 Sector Rotation Model Portfolio: July Positioning

Elev8 SRMP: June 2024 Performance (-20bps)

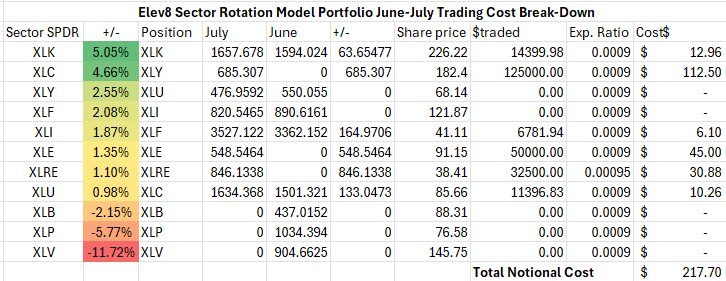

It was a tough end to the inaugural month for the Elev8 model. We started the month positioned for some continued weakness from Consumer Discretionary stocks on the short side, tried to hedge-out commodities exposure as we didn’t have a high conviction view there by shorting XLE and going long XLB and XLI. On the long side we were rightly OW XLK and XLC, but our performance was hindered by resilience in XLY as our biggest short. The model ended the month down 20bps. Below is the profit (loss) total return curve for the month and below that a look at our change in positioning for July with rebalancing costs.

Rebalance/Trading Costs (Excl: bid/ask spread)

Conclusion

Going naked the Discretionary Sector during a month where it ended up outperforming resulted in a small loss (-20bps). We start out July with more beta in the portfolio and bigger bets on leadership sectors given the improving status of monthly inflation gauges and continued strength in Growth oriented themes.