A lot can change in a week. We were singing a paean to hot dogs and fireworks last week as we toasted the US of A and the prosperity of our financial markets. A new week has brought us face to face with some stark potential realities. Former POTUS Donald Trump was fired upon at a campaign rally in Pennsylvania, an attempted assassination. The culprit (now deceased) was a 20-year-old who lived somewhat locally to the campaign stop. An investigation now unfolds into the motive and circumstance of this unacceptable act. We should not shrug at this occurrence even though we will undoubtedly be told about all the other times a similar event has happened in our country’s history. Even though this event may well be a symptom of increasing political polarization, it will certainly be framed and packaged as such by our (social) media apparatus. We will be told whose fault it was and what will be done to make sure security is better next time. What probably won’t be talked about is how so many of us (without exaggerating, I can say “almost all of us”) would never dream of resorting to the desperation of a planned murder as a political act. We all have plenty of things we could list as frustrations in 2024. We would all do well though at a time like this to remember that when the country has faced challenges in the past, we have eventually overcome them together.

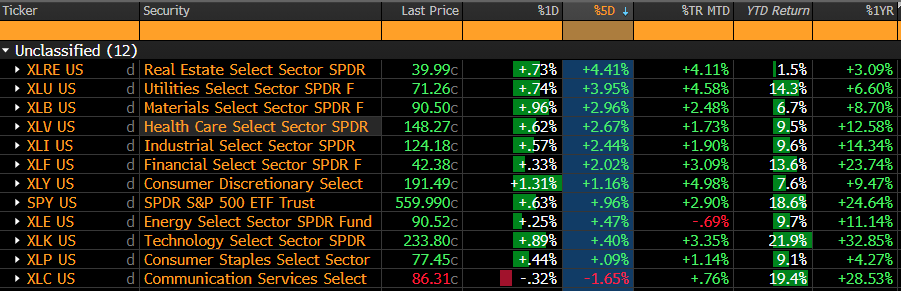

Consider a more mundane event that happened this past week. On July 11, momentum leadership faltered. Bets on an easing of monetary policy gave laggard sectors of the market XLU, XLRE, XLV, XLB, XLF and XLI a tailwind on reflation bets as YTD leadership funded the rotation with redemptions in YTD winners XLC and XLK. Market Breadth improved and the Yield on the 10yr Treasury reconfirmed its near-term downtrend settling at 4.18%, a 3-month low. It is safe to say that anyone who manages US equity money and had internet access last week is making plans on how they would approach more sustained rotation. XLC’s rank in our Elev8 Sector Rotation Model has moved lower, and we will be taking in our long there if Monday’s tape shows continued XLC weakness. Correct or incorrect this is a typical strategic action in response to an event in the financial markets.

We need to turn some more focus onto managing the contours of our politics and society, pay more attention to the long-term drivers of our triumphs and our failures. We need a process in our politics and our associations that is based on reason and result, and we can’t do it if we disengage. I most certainly include myself in this exhortation. I was left sitting there not knowing what to do or say when I heard the news, but I know the prosperity we have as a nation comes from each other and violence against fellow Americans must be met with united intolerance and disdain or no shared prosperity is possible. As investors, we are a sober bunch interested in facts, methodologically sound research and effective solutions. We all know those qualities often go lacking in our politics. We can help and its likely time we should.

–Patrick Torbert, CMT | Chief Strategist, ETFsector.com

ETF’s/The Week in Review

What’s Hot!

Sectors

Fed. messaging put downward pressure on the US 10yr Yield and other interest rate gages last week. This resulted in YTD laggard sectors outperforming as investors positioned for a more dovish Fed. in the 2nd half and spurred some profit taking in XLC. XLP and XLE remain weak among the laggards. Historically the Tech. Sector has outperformed in rising and falling interest rate environments, but it adds more alpha when rates rise as the traditionally do during economic expansions. With increased political volatility coming over the weekend, we would expect low vol. sectors could carry the edge forward into the new week as US bonds typically attract assets in times of increased uncertainty.

Signal Review: Elev8 Sector Model close to a Tactical Sell Signal after last week’s momentum sell-off

As we bring you onboard with our trend-following sector investing strategy, we want to spend time familiarizing you with our process for deriving buy and sell signals for sector positioning. We had started July with the XLC as our 2nd largest OVERWEIGHT allocation in Elev8. We are vulnerable to a sustained rotation away from leadership based on that allocation (We are also long XLK). We expect a sell signal will be generated on Monday if there is further selling in XLC to start the week. Below is a review of the trend thresholds we follow.

Price Pattern & Oscillator Inputs

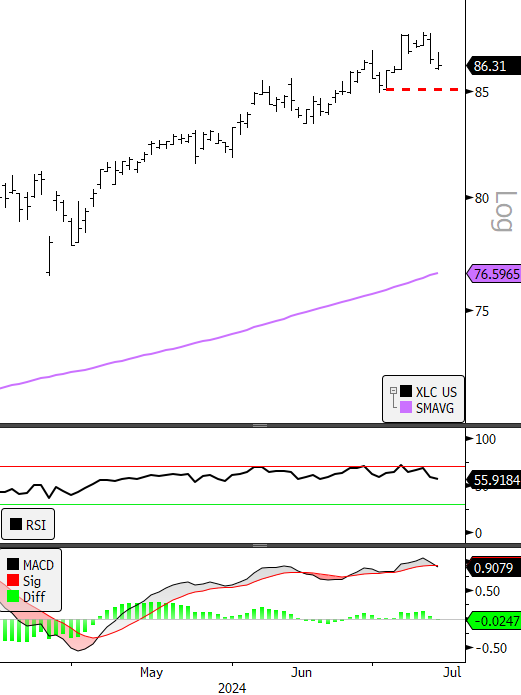

Referring to the chart below, XLC would trigger a tactical sell on price with a close below $85. This would flip the pattern from an uptrend to a near-term consolidation. The RSI oscillator is coming down from a near-term overbought condition while the MACD (panel 3) flipped to a tactical sell on Friday July 12th.

- XLC, 3-month, daily

- Panel 2: RSI

- Panel 3: MACD, MACD line (black) triggers sell on a downward cross of the (red) signal line, elevated potential for correction

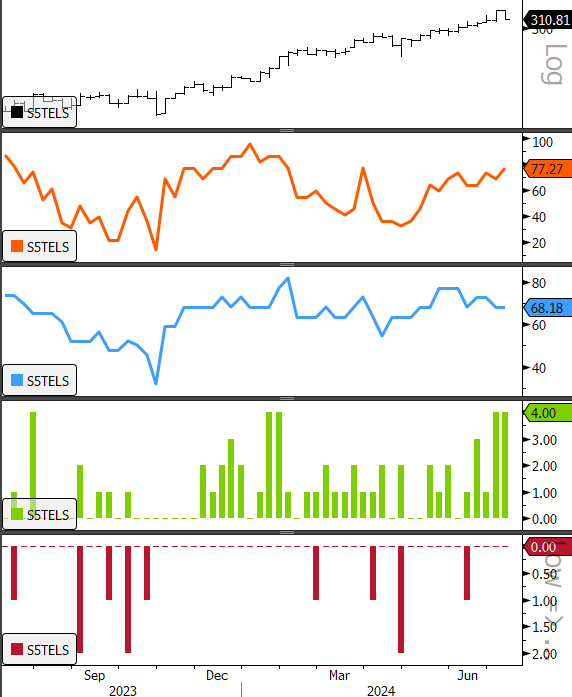

Breadth Remains in a Bullish Position

Despite lagging on the week, stock level breadth measures improved on the week with 77.27% of members in the sector above their 50-day moving average while 68% of the sector constituents remain above their 200-day moving averages of price. 52-week new highs continued to print while there hasn’t been a 52-week new low within the Sector since mid-June. The mischief in these indicators this cycle is the strength of the Mag7 which is particularly relevant to XLC with GOOG/L and META prominent in the sector.

- XLC, 1yr, daily

- % of Members ABOVE 50-day moving average

- % of Members ABOVE 200-day moving average

- 52-wk new highs | 52-wk new lows

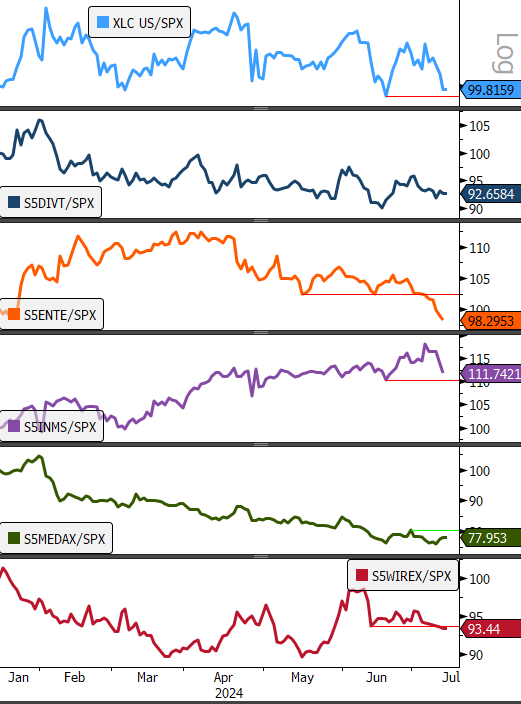

Outperformance Trends for XLC are Bending (Breaking?)

The biggest change in our trend following gage for XLC has been our relative performance inputs. We look at the SPDR vs. S&P 500 and we look at each industry within the Sector to gauge the breadth of outperformance. Those gages deteriorated last week and along with the technicals for the sector chart have us on the cusp of a tactical sell. Referencing the chart below, the top panel is the XLC relative to the S&P 500 over the past 3 months. The curve is on the cusp of making a new low. The Wireless Industry and the Entertainment Industry have already made new lows since the start of July and Interactive Media (where META and GOOG/L reside) could potentially make a new low in the coming week. That sequence of events would trigger our tactical sell where we’d take our OW allocation of +4.96% to start the month down to a neutral weight and redistribute the allocation based on the current rankings in the model.

- XLC Relative to S&P 500

- S&P 500 Diversified Telecom Industry Relative to S&P 500

- S&P 500 Entertainment Industry Relative to S&P 500

- S&P 500 Interactive Media & Services Industry Relative to S&P 500

- S&P 500 Media Industry Relative to S&P 500

- S&P 500 Wireless Industry Relative to S&P 500

Trend and Macro Inputs

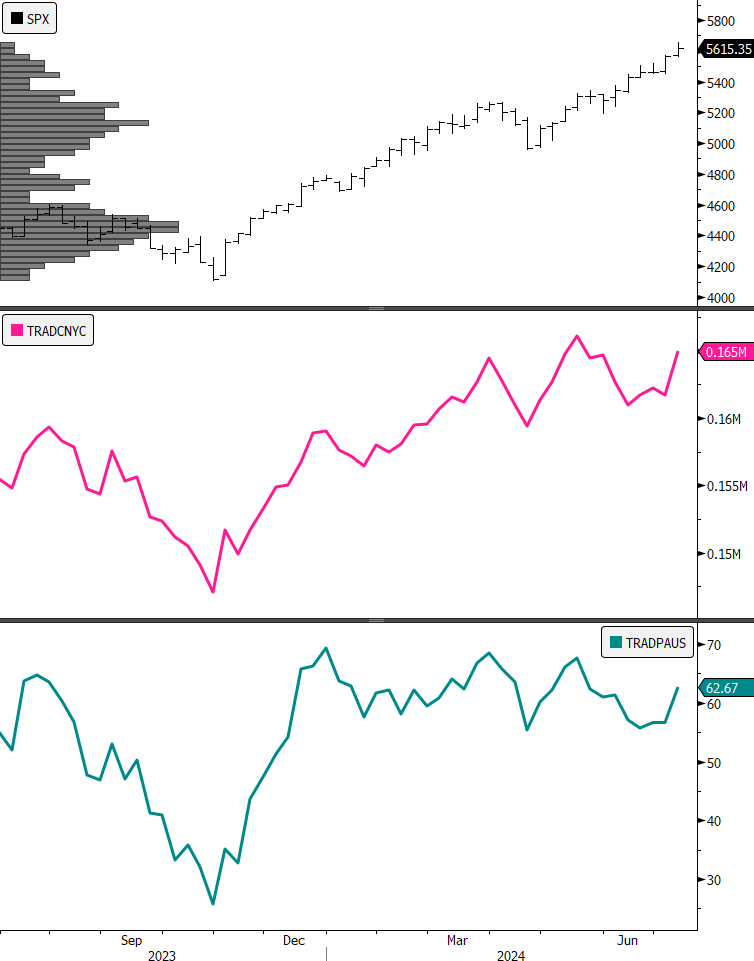

Trend and Macro inputs have not changed with regards to the XLC at this time. In fact, the strongest trend for the current XLC (since GOOG/L and META were added) has been the bull trend manifesting in the S&P 500. The market internals for US equities have improved this week with the change in leadership. This should re-invigorate the bull over the intermediate-term and should provide support for the sector unless we are on the cusp of a more durable move. Below is a look at the S&P 500 with NYSE internal breadth data. The breadth gages are strengthening with expectation of a dovish Fed. policy pivot.

- S&P 500

- Bloomberg NYSE Cumulative Advance/Decline Line

- Bloomberg % of NYSE stocks closing above their 200-day moving average

Sources: CNN, Bloomberg