With a nod to the backdrop of election season, this week brings sharp focus on the polarized nature of sector performance. A combination of mild inflation data, better than expected earnings reports, and tepid economic prints have set the table for investors to start discounting a Fed. pivot to lower rates. Easing, in turn, would allow hope for cyclicals to thread the needle and potentially flourish in a much hyped “soft-landing” scenario for the economy. That hope has manifested in a sharp near-term change sector level performance.

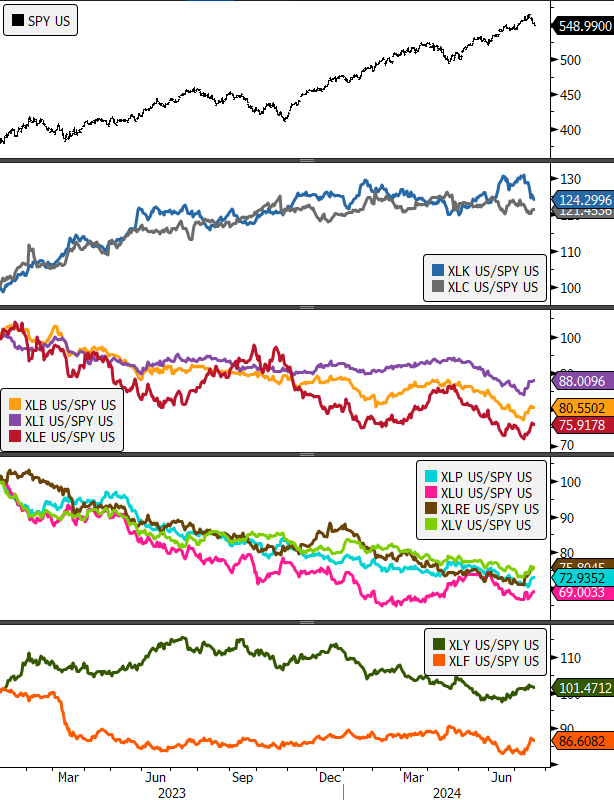

Since January 1, of 2023, almost all the long-term alpha produced at the sector level accrued to the “Terrible Two,” XLC (+21.4%) and XLK (+24.3%) as seen in the chart below). Of the other 9 GICS Sectors, only XLY has kept up with the benchmark SPY over the time frame. Each has lagged materially in 2024 until the last two weeks. I led off this note talking about the business cycle and some improvement in the outlook for cyclicals, but as big a piece of the dynamic is the prospects for the “Terrible Two” themselves. Semiconductors are correcting as a group and dragging the XLK into correction as a Sector (MSFT and CRWD are not helping with their outage shenanigans). To add some spice, August through October is the most negative stretch of the calendar for seasonality historically. Point being, the correction in XLC and XLK could continue in the near-term, but it could eventually be seen through the lens of opportunity, especially if an economic reacceleration is in the offing. Read on as we look back on the 2016 election to see how big a pop we can expect.

In the near term, there is likely some upside to the cyclical sectors. They trade at a discount to the market and have been out of favor since the end of 2022. However, we should keep in mind that observable trends in financial market prices are actual manifestations of underreactions. We perceive value incrementally because we do not have foresight. We take profit as a function of behavior and because of structural forces in capitalism that compel us to do so. Those are two broad factors that lend themselves to trending. Given the momentum already exhibited by the AI theme, we expect FOMO at least will lead to another bullish pivot in the trade.

–Patrick Torbert, CMT | Chief Strategist, ETFsector.com

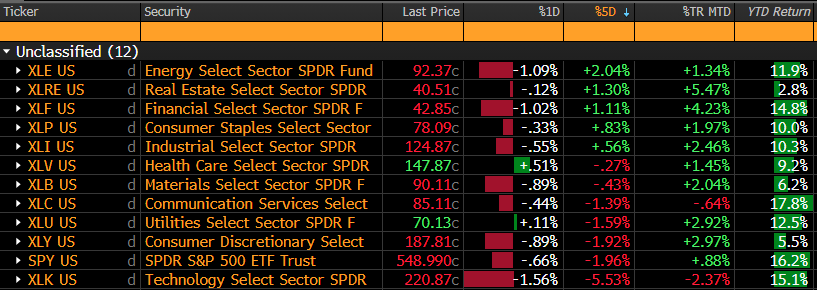

ETF’s/The Week in Review

What’s Hot!

Sectors

This was a script flipped week for sector performance with the XLK the sole underperformer vs. the SPY and the other 10 Sectors coming in ahead. The Elev8 Sector rotation model took its XLC allocation to neutral this week on relative trends switching to intermediate-term negative in our model. We also took some of our XLK long off the table with a similar short-term sell triggered in the sector relative strength work there. As we pointed out in our weekly letter a few weeks ago (Narrations of a Sector ETF Operator | Weekly Market Letter, July 7, 2024 – ETF Sector) the XLK accounts for a lion’s share of SPX earnings and that share is growing. Valuations are high, but commensurate and we do think the sector’s outperformance trend will revive at some point in this cycle.

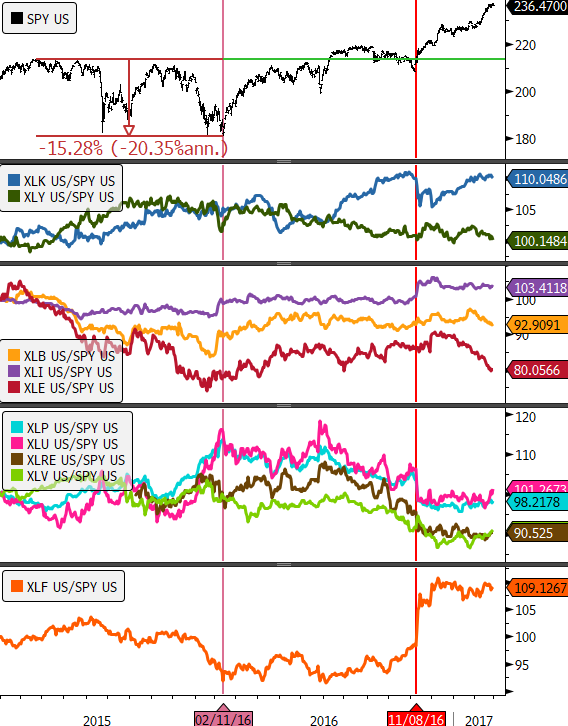

2024 Election: A Similar Setup to 2016

The chart below shows the S&P 500 with the (then)10 Sector SPDR Relative Performance curves from 2015-2017. A 15% downside correction played out in the S&P 500 from mid-2015 through February 2016 on a big momentum trade unwind domestically and the unraveling of an “echo-bubble” in the Shanghai Composite Index. Most cyclicals responded adroitly to the low of 2/11/2016 except for Financials which scuffled. In hindsight, there was a “coiling of the spring” for the XLF from February to late October 2016 (chart, bottom panel), and the Sector broke out on election day outperforming the S&P 500 by >10% over the next week and >15% over the next month. This was the type of “pop” where the bet had to be on in advance as the alpha opportunity was short in duration and front loaded. The XLF triggered a fresh 6-month relative-high vs. S&P 500 in the weeks before the election, a strong bullish reversal signal. Investors should keep an eye on the relative performance of cyclical sectors ahead of election day. If we do see former President Trump carry his current momentum to victory, US equities have historically started off new administrations with a material upside move in the first 6-months. With cyclical sectors having lagged serially since the beginning of 2023, the setup for continued outperformance is on the table.

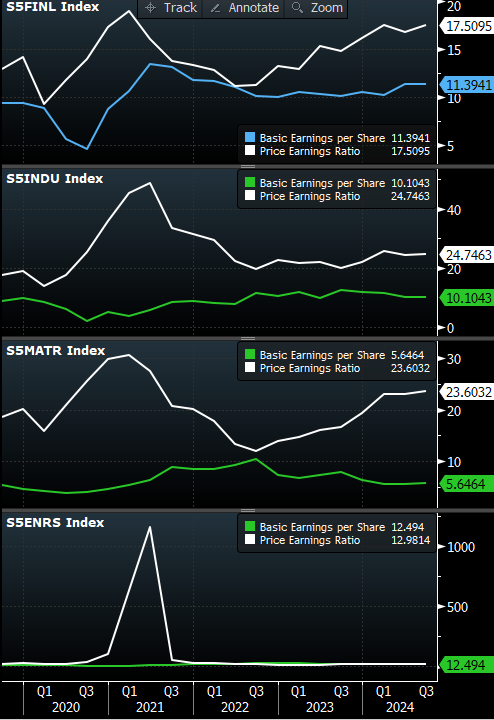

Taking the case of the XLF in 2016 further, The S&P 500 of today commands an almost 20% valuation premium to 2016 (26x vs. 22x), while the Financial Sector heading into this election is valued at 17.7x vs. 16x in mid-2016. Importantly, the S&P 500 Financial Sector is currently the 2nd cheapest sector (Energy Sector is valued around 13x). It was deeply discounted in Q1 of 2023 due to the SVB and SBNY bank runs and could be set up for a pop. The inputs in our ETFSector.com Elev8 Sector Rotation Model for XLF have been improving over the past 3 months.

If the election does spur a more sustained move into cyclicals into 2024, the S&P 500 GICS the chart below shows the Financial Sector has seen a recent uptick in quarterly aggregate earnings per share and is less generously valued than Industrial Sector or Materials Sector shares heading into the election. With downwards pressure on rates a tailwind to bank balance sheets there may finally be a case to own the sector for a sustained period. On the flip side, even with the banks and the financial sector more broadly taking off after the 2016 election, the XLK lagged from October 25 that year to December 5th, just 41 days before buyers stepped in and made it the best performing sector of 2017. So, just remember to keep a plan for the intermediate-term as well as the longer-term as election season hype begins to sway the markets and the sectors.

Source: Bloomberg