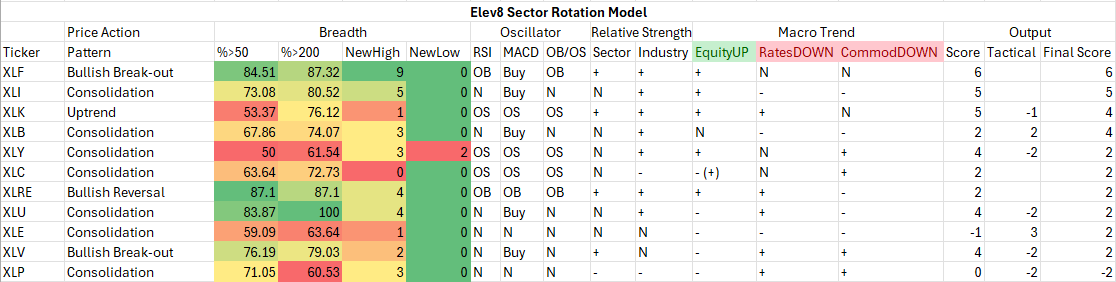

We introduced the Elev8 Sector Rotation Model in June. Here’s a look under the hood at the inputs we use to score the 11 GICS Sectors for August. Under ideal circumstances the model has up to 18 inputs that can affect the score. Currently the USD component of the model is not throwing off a signal one way or another as the DXY Index has been range-bound. Otherwise, our scores are a mixture of price action, momentum, breadth, relative strength and macro trend coincident performance.

The table below shows the model’s scores for August. Financials and Industrials and Technology Sectors score the highest in our model for August. The two former sectors are tracing out bullish reversals and the latter is oversold in a strong longer-term uptrend.

Under the “Output” section we have a “Tactical” column that adjusts certain sector scores for dislocations we perceive will affect the market in the near-term. There are two tactical considerations for August. The one is negative seasonality which we think could affect XLK and XLY negatively if it manifests this year. The other tactical adjustment is extreme oversold conditions in commodities prices which we think are overdone. We expect XLE and XLB to get a tailwind this month from positive reversion.

Model Inputs: August

Key: Pattern = L/T (1yr+) Price Pattern of the Sector ETF, %>50 = # of constituents with price ABOVE its 50-day moving average, %>200 = # of constituents with price ABOVE its 200-day moving average, NewHigh = # of constituents making new 52-wk highs in the past month, NewLow = # of constituents making nw 52-wk lows in the past month

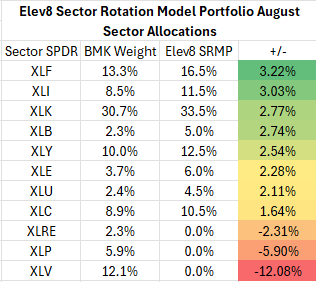

Elev8 Sector Rotation Model Portfolio: August Positioning

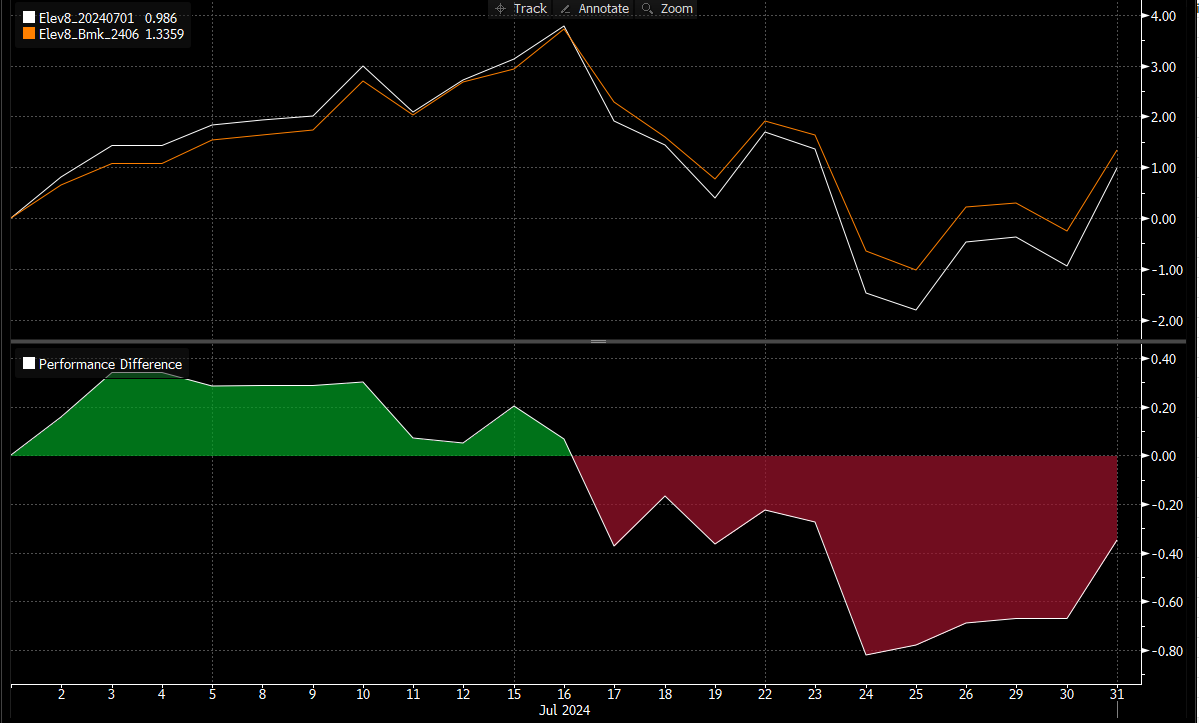

Elev8 SRMP: July 2024 Performance (-33bps)

It was a tough end to the inaugural month for the Elev8 model. We started the month-long leadership sectors XLC and XLK, and took a hit when equities corrected AND rotated mid-month. As the profit/loss curve shows, we ended the month on the upswing, and we expect the decline in July may have pulled forward some of the correction that typically comes in August. Our biggest allocations are in economically sensitive cyclical sectors, but we note the Tech. Sector enters the month oversold, along with the Discretionary Sector and we think the prospect of lower rates in the 2nd half will be bullish for both sectors.

Conclusion

We knew there would be violent rotations given the bifurcation of the market since early 2023. Our strategy broadly has been to allocate for a broad bull market in alignment with the prevailing trends. Our tactical strategy is to miss small until we hit big. Mega Cap. Tech has posted strong earnings so far this season. The coming election offers a period of some uncertainty and volatility, but the Fed is no longer a headwind, and we expect the bull market cycle to continue.