Equities resumed their steady march higher with the major US indices all in positive territory on the day. The S&P 500 added 0.42% while the Nasdaq was up 0.57% and the Dow gained 0.14% as the laggard on the day. The Russell 2000 advanced 1.32% after lagging the large cap. benchmarks for most of the month.

At the sector level, Discretionary shares paced gains adding 1.26% while Financials were the laggard with the XLF off 0.16%. The bullish cadence continues in the near-term even as the Fed meeting minutes highlighted elevated concerns on employment. The general sentiment seems to be that those notes are stale considering the intervening data post July 31. This sentiment was buttressed by strong quarterly results from TGT and TJX as well as ADI.

Interest rates on the 2yr and 10yr Treasury Yields were slightly higher at 3.93% and 3.80% respectively while Crude and Commodities prices softened slightly with the WTI spot price settling at $73.16 and the Bloomberg Commodities Index dipping to the 95 level.

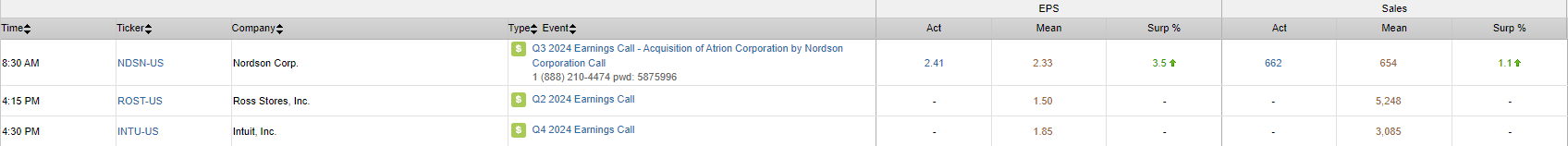

Initial and Continuing Jobless Claims, Existing Home Sales and Flash PMIs are on the economic slate for Thursday. On the earnings calendar, NDSN, INTU and ROST are set to report quarterly results.

Eco Data Releases | Thursday August 22nd, 2024

S&P 500 Constituent Earnings Announcements by GICS Sector | Thursday August 22nd, 2024

Intuit is at a key juncture on the chart entering earnings season. There is clear overhead resistance at the $670 level where the stock price currently resides. An upside break-out projects a longer-term price target of $790.

- INTU 1yr, daily (200-day m.a. | Relative to S&P 500| MACD)

- MACD is on a buy signal while the relative curve is nearing the threshold to signal bullish reversal vs. the S&P 500

Data sourced from FactSet Data Systems