XLP had one of the weakest scores in our Elev8 Sector selection models and we start September with a short position.

Price Action & Performance

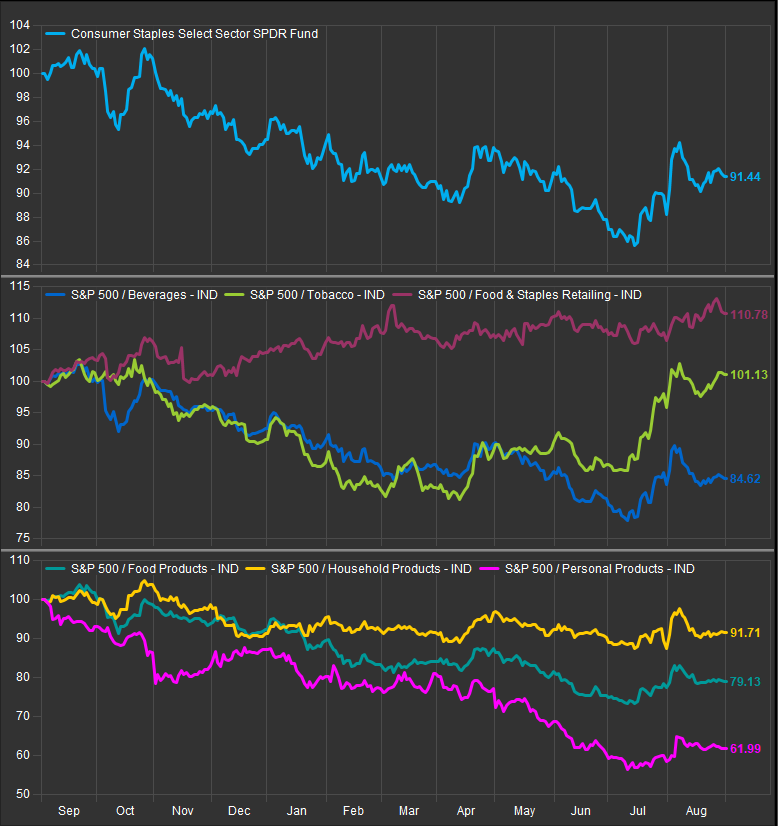

XLP underperformed the S&P 500 in August. Staples remains a YTD laggard sector, trailing the S&P 500 by >8% in nominal terms. The sector enters September with the RSI oscillator at a near-term overbought condition.

At the industry level, the Staples Distribution (formerly Food & Staples Retailing) Industry is a source of alpha vs. the S&P 500 while the tobacco industry has improved since April, to post positive performance over the trailing 12-month period. Beverages, Food Products and Personal Products all have lagged the benchmark by double digits over the past 12 months. Lower rates in the near term have delivered a small boost to performance.

At the stock level we like WMT, COST and CL and we note that the former two are the only material drivers of outperformance for the Sector as they account for 3% of the Sector market cap. If there are any missteps between the big two, we worry what that would mean for the sector.

Economic and Policy Drivers

Consensus has firmed around dovish policy expectations for the 2nd half of 2024. Rates have responded by moving lower with 2yr and 10yr Yields below 4% in August. Staples stocks historically benefit from falling interest rates, but that typically occurs when equity prices are also falling. This cycle has seen a positive correlation between bond and stock returns.

Staples co.’s typically operate lower margin businesses with a broad array of essential products. The product categories are typically associated with value-oriented marketing. This has caused consumers to balk at some of the higher prices showing up on store shelves for established brand names. As we’ve heard from the Financial commentariat class, one of the reasons inflation is cooling is because Consumers have begun refusing higher prices. The present behavioral trend is exacerbated by increased competition from private label entrants into the traditional staples categories. The big reach for margin that was sparked by pandemic shortages is now getting pushback from the consumer who is still under pressure despite promises of lower rates ahead.

ESG policies also add a layer of cost that is particularly difficult for the Staples sector. Increased R&D and costs associated with recyclable and reusable packaging is a strain on lower margin businesses that market low price points.

While expectations of dovish interest rate policy animate a near-term bid into laggards, we don’t see a clear catalyst for long-term outperformance in the XLP at present. Rather, the dynamics outlined above remain in force.

In Conclusion

Weaker inflation and a bullish earnings season from the Tech. Sector have put the XLP in the back seat on performance while it also starts off September registering overbought conditions. This isn’t an attractive setup. Our Elev8 Sector Rotation Model Portfolio is out of XLP for September and starts the month short the sector -6.02% vs. the benchmark S&P 500

Chart | XLP Technicals

- XLP 12-month, daily price (200-day m.a. | Relative to S&P 500 |RSI |MACD)

- Some improvement in the past 2 months, but it remains short of convincing us to go long for the month

XLP Relative Performance | Industry Level Relative Performance | 1yr

Data sourced from FactSet