S&P Futures are up 0.1% in Wednesday morning trading after a mostly flat session on Tuesday. The S&P 500 briefly hit a new all-time high before giving up most of its gains in the afternoon. Small caps, cyclicals, and crowded shorts were among the top performers. In other markets, Treasuries weakened across the curve, Gold rose 0.4%, the Dollar Index fell 0.2%, Bitcoin futures dropped 0.5%, and WTI crude declined 1.4%, while Copper climbed 0.7%.

Fed Easing Cycle and Market Sentiment

The FOMC meeting today is expected to kick off the Fed’s easing cycle, with ongoing uncertainty about whether the rate cut will be 25 or 50 basis points. The debate centers on the Fed’s shift toward supporting growth rather than solely focusing on inflation. Market expectations lean toward a 60% probability of a 50 bp cut, though most analysts favor a 25 bp move. The market is pricing in about 75 bp worth of cuts for 2024, less than the 100 bp+ cuts that traders had anticipated. Powell is expected to echo dovish messaging from Jackson Hole, reinforcing the Fed’s reluctance to allow further labor market cooling.

Information Technology

Microsoft (MSFT-US) and BlackRock (BLK-US) are reportedly planning a $30B AI investment fund, highlighting continued enthusiasm around AI as a driver of growth. The AI sector remains a focal point, with investment and innovation expected to fuel future market performance.

Industrials

US Steel (X-US) rose after reports that Nippon Steel’s takeover proposal will be extended for a security review. This boosts the potential for further consolidation in the steel industry. However, Casella Waste Systems (CWST-US) was a laggard, down on news of a $400M equity offering.

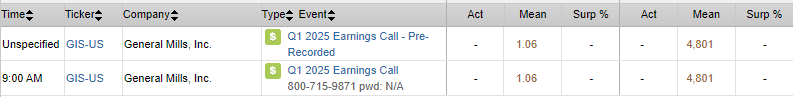

Consumer Staples

General Mills (GIS-US) reported revenue ahead of expectations and slightly better-than-anticipated EPS. Despite this, organic growth remained negative, continuing a sluggish trend noted in its fiscal Q4 results. The company reaffirmed its FY25 guidance for flat to 1% organic sales growth.

Health Care

23andMe (ME-US) shares fell after independent directors resigned, citing the CEO’s failure to provide a fully financed buyout proposal after five months of negotiations. This reflects ongoing instability and uncertainty within the company’s leadership.

Energy

The decline in WTI crude prices contributes to broader disinflationary trends, with gasoline prices down 16% year-over-year. Lower energy prices are expected to boost discretionary spending and offer a tailwind for consumer-oriented sectors.

Real Estate

The latest data on housing starts and building permits for August will be released on Wednesday, providing further insight into the strength of the US housing market. These indicators are closely watched as the Fed evaluates the overall economic landscape ahead of its rate decision.

Retail & Freight Earnings

General Mills reaffirmed its FY25 targets and highlighted challenges in driving organic sales growth. On Thursday, Darden Restaurants will report earnings, with analysts expecting continued softness at Olive Garden but crediting the company’s cost control efforts. FedEx will report fiscal Q1 results later that day, with attention focused on its cost-cutting efforts and the potential spin-off of its Freight business. Lennar will also report Q3 results, with the stock facing pressure on concerns about a Q4 margin ramp, despite strong year-to-date performance.

Positioning and September Headwinds

Market positioning continues to lean defensive, even after last week’s rally left the S&P 500 just below its mid-July all-time high. Deutsche Bank noted that equity positioning fell last week, now just above neutral. Investors have pulled back from growth stocks, particularly in tech, while defensive sectors like Utilities are seeing higher allocations due to their AI-driven infrastructure exposure. Goldman Sachs also highlighted that its sentiment indicator is at levels not seen since October 2023, reflecting cautious positioning amidst fading buyback bids and an uptick in supply.

Seasonality and Market Dynamics

Negative seasonality in the second half of September remains a significant headwind, with Goldman Sachs pointing out that historically, the last two weeks of September have been the weakest trading period of the year. Corporate buyback blackouts, which began in mid-September, are contributing to reduced equity demand, with buyback volumes expected to drop by 35% during the closed window. However, JPMorgan estimates that month- and quarter-end rebalancing could generate up to $125B of equity demand over the next two weeks.

Big Tech Earnings Outlook

As the market looks ahead to Q3 earnings, big tech is expected to continue to provide support, though its outperformance is narrowing. FactSet forecasts S&P 500 earnings to rise 4.9% year-over-year in Q3, down from the 7.8% projected earlier. Tech, Healthcare, and Communications Services are expected to post double-digit earnings growth, while Energy faces a double-digit contraction. However, strategists are cautioning that big tech’s earnings growth may converge with the broader market in Q4, reducing its historical outperformance.

Eco Data Releases | Wednesday September 18th, 2024

S&P 500 Constituent Earnings Announcements | Wednesday September 18th, 2024

Data sourced from FactSet Data Systems