Commentary:

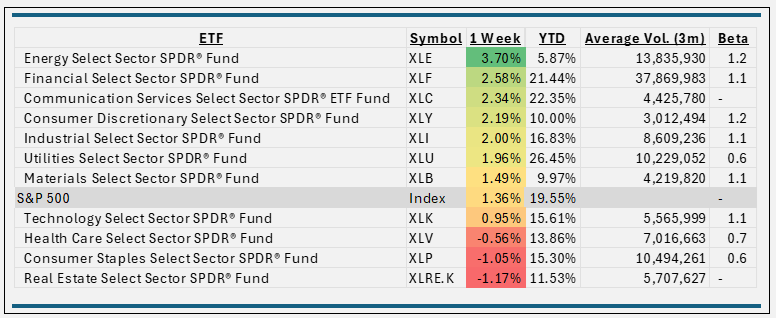

- The S&P500 jumped mid-week after the Fed announced its 50-basis point cut. The weekly gain was 1.4%, fueled by optimism of more potential rate cuts.

- Energy led the way this week, up 3.7%. Baker Hughes Co. (+7.9%), which accounts for about 3% of the ETF, and Marathon Oil Co. (+6.9%) helped push the sector onto the top spot this week.

- Financials took the second spot up 2.6%. Capital One Financial (+9.6%) and PayPal Holdings (+9.5%) were top contributors to this week’s strong sector performance.

- Utilities performance (+1.9%) was buried in the middle of the pack this week, but it’s worth mentioning Constellation Energy Co. rose 30% on the news of an exclusive agreement with Microsoft to build an AI data center at the shuttered Three Mile Island nuclear power plant.

- Three sectors ended the week in the red. Real Estate (-1.2%), Consumer Staples (-1.0%) and Health Care (-0.6%) yet all still have a string showing YTD.

ETF Tidbits:

A few new ETF this week: GammaRoad Market Navigation (GMMA) – offered by the partnership of Tidal Financial and Gamma Capital Partners. Also, Innovator US Small Cap Managed Floor (RFLR) launched by Innovators ETF. Check them out.