ETF Insights| October 1, 2024

XLV had the 2nd lowest score in our Elev8 model entering October and is one of our zero weight sectors this month.

Price Action & Performance

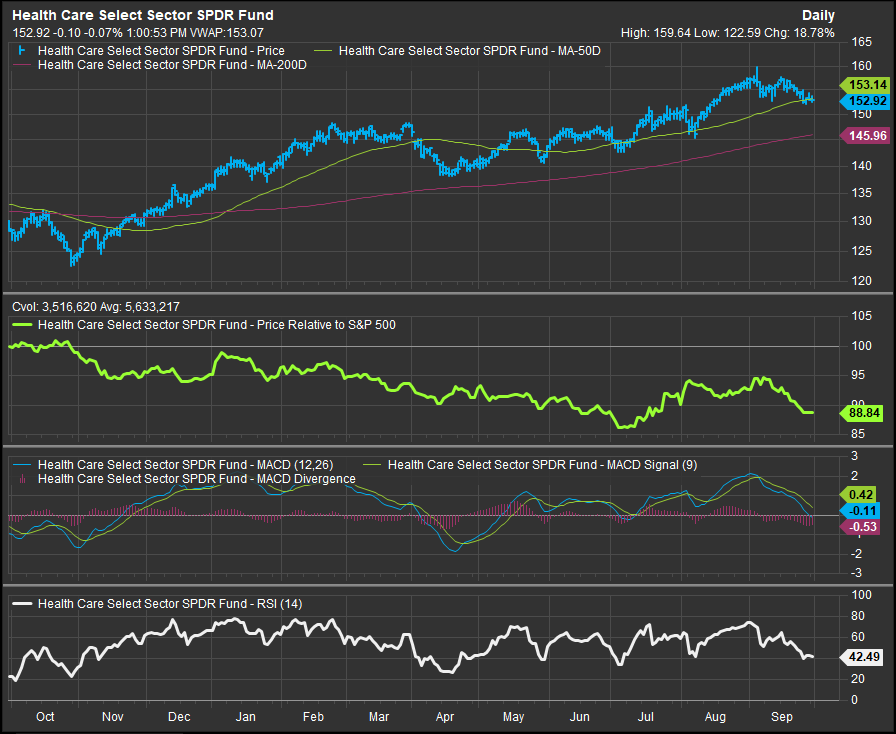

In absolute terms, XLV finishes September near oversold levels with price pulling back to the 50-day moving average. With the S&P 500 hitting new highs, this means XLV is dueling with XLE as the worst performing Sector for the month of September. Oscillator work is near oversold levels, but we aren’t seeing any positive divergence at present.

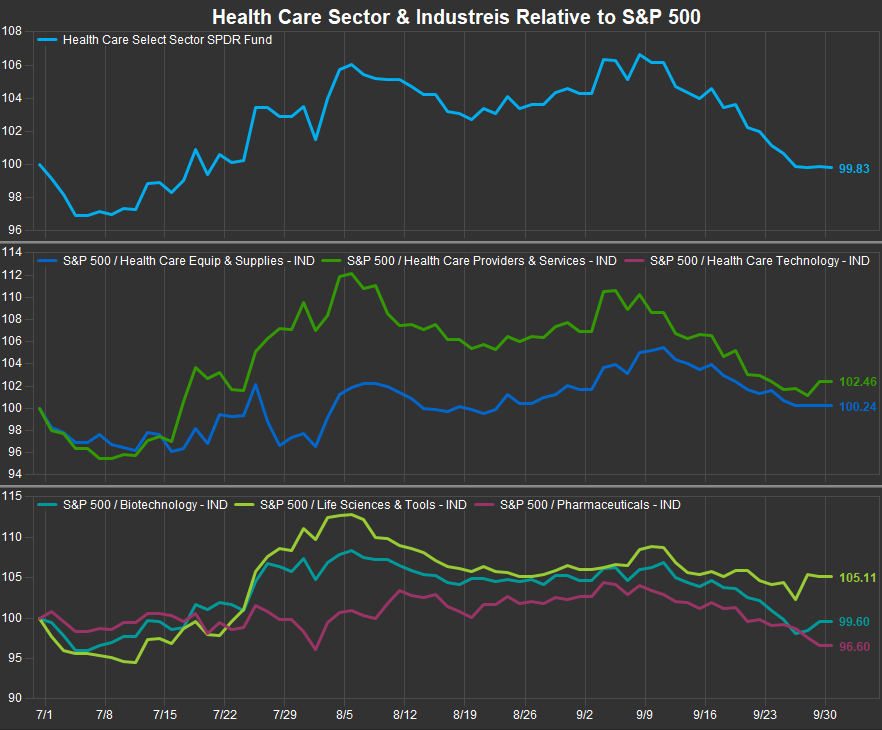

Healthcare Sector and Industry level performance vs. the S&P 500 has failed to sustain momentum from its near-term peak in early August. As the broad equity market has pivoted higher in response to the Fed, XLV has been a funding source for more offensive exposures. At the Industry level, 3 of 5 Industries have pulled back to market perform or weaker over the past 3 months. The sector in aggregate is flat as well. The Life Sciences & Tools Industry, historically the most offensive exposure in the sector has been leadership over the trailing 3-month period while defensive Pharmaceuticals have lagged.

Unsurprisingly, the correction in prices at the sector level has been accompanied by deteriorating stock level technical. REGN, for example, broke lower on a poor quarter after entering the month as one of the strongest charts in the sector. Our favorites heading into October are BSX, ISRG, HCA, and VRTX. We are also constructive on REGN, ABBV, LLY, DHR and TMO.

Economic and Policy Drivers

The emergence of GLP1 drugs has had a profound impact on the Healthcare sector. However, after 2+ years of dominance by manufacturers like LLY, there has been a shift in performance driven by expectations of interest rate policy easing. That has come to pass, however it was a “buy the rumor, sell the news” dynamic for the Healthcare Sector. It remains to be seen how the XLV will react to the upcoming election. Historically there have been components of both party’s platforms that have been seen as tailwinds to the industry, whether Democratic candidates mandating universal coverage, or Republicans proposing to boost efficiency by allowing insurance companies prerogative over who they cover. That said, the sector is likely to continue its historical role of being a decent haven when the tape corrects and a likely a potential laggard if the bull market retains its current trajectory.

In Conclusion

We went from near market weight to a tactical short on the XLV in September after the Fed came in heavy with a 50bp cut to the policy rate. We enter October with the XLV as one of our three zero-weight sectors. Our Elev8 Sector Model is UNDERWEIGHT XLV with a -11.57% allocation vs. our benchmark S&P 500

Chart | XLV Technicals

- XLV 12-month, daily price (200-day m.a. | Relative to S&P 500 | MACD | RSI)

- Bullish reversal from July is on life support in the ICU. There are better charts to buy than XLV at present

XLV Relative Performance | XLV Industry Level Relative Performance | 3m

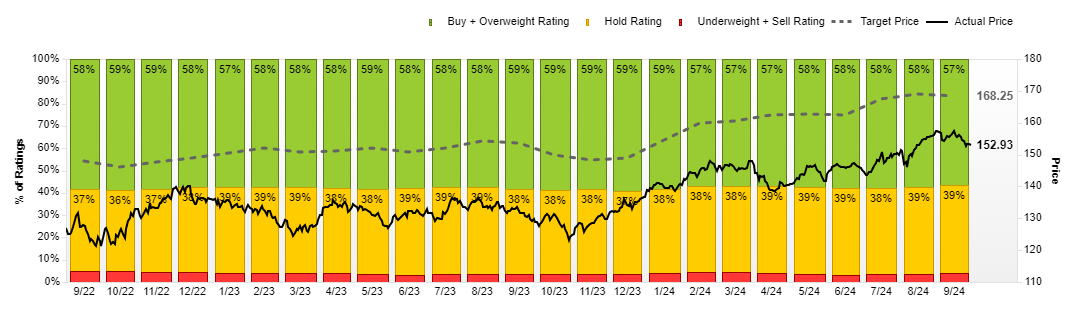

XLV Street Analyst Ratings and Price Targets:

Data sourced from FactSet