S&P futures are down 0.1% in Wednesday premarket trading, following Tuesday’s rally where the S&P 500 rose ~1%, led by big tech while energy lagged on an oil selloff. Asian equities were mixed, with China’s Hang Seng extending Tuesday’s selloff. European equities are mostly higher. Treasuries remain steady, and the dollar index is up 0.1%, with the kiwi seeing the most movement after a rate cut. Gold is flat, and Bitcoin futures are down 0.1%. WTI crude is slightly up 0.2%.

The market remains quiet with no significant overnight developments. Tuesday’s rebound followed Monday’s declines, supported by rate stabilization and optimism around a soft landing. There’s guarded optimism ahead of Q3 earnings, despite downward revisions, and consumer spending surveys suggest resilience into the holiday season. On the bearish side, concerns persist around hawkish Fed repricing, cautious corporate updates, oil prices, geopolitical tensions, and election uncertainty.

Fed speakers today include Logan, Goolsbee, Barkin, and Daly, following recent comments from Vice Chair Jefferson and Atlanta’s Bostic about cooling labor markets and inflation concerns. DoJ is considering a Google breakup in its antitrust case. Other corporate updates include Pfizer’s CEO meeting with Starboard Value, TSMC reporting a 40% jump in Q3 revenue, and GM projecting flat EBIT for 2025

US equities higher: Dow +0.30%, S&P 500 +0.97%, Nasdaq +1.45%, Russell 2000 +0.09%

US equities finished higher in Tuesday trading, reversing Monday’s weakness. Gains were driven by strength in big tech, with NVDA standing out as a notable gainer. Other outperformers included cruise lines, airlines, exchanges, trucking, semiconductors, software, networking/communications, waste, payments, and entertainment. P&C insurers recovered some ground after Monday’s decline due to hurricane concerns. Laggards included energy (crude), chemicals, industrial metals, machinery, cosmetics, casinos, and credit cards. China tech gave back recent gains on stimulus disappointment. Treasuries were firmer, with some curve steepening after four straight days of yield increases. The 3Y Treasury auction tailed with weaker demand. The dollar index was flat, gold finished down 1.2%, Bitcoin futures fell 1.8%, and WTI crude dropped 4.6% despite tensions in the Middle East and Israel considering striking Iranian energy targets.

The overall market narrative hasn’t shifted much: Monday’s post-NFP rise in yields pressured equities, reflecting a hawkish Fed outlook, while there’s cautious optimism ahead of Q3 earnings season, with the big banks starting to report on Friday. There are also concerns about Middle East tensions and the US presidential election, at a time when positioning and sentiment indicators remain stretched. Fedspeak remains prominent, with Atlanta’s Bostic and NY’s Williams emphasizing the need for patience in the easing cycle. Governor Kugler supported the 50bp cut and reiterated the need to focus on inflation. Overnight, St. Louis’s Musalem stressed concerns about easing too much too soon.

Macro and Treasury Market Updates:

Yields have backed up significantly following last week’s strong nonfarm payroll report, fueling a hawkish Fed outlook. The 3Y Treasury auction tailed with weak demand. Markets are also watching developments in the Middle East, with Israel contemplating retaliatory strikes against Iranian energy targets after recent missile attacks. Hurricane Milton, expected to hit central Florida, is another area of concern.

Stock Big Gainers/Decliners by Sector

Health Care

- +16.5% PTCT-US (PTC Therapeutics): Announced positive updates from long-term treatment studies of vatiquinone for Friedreich ataxia; said the company recently aligned with FDA on key aspects of the planned NDA submission for vatiquinone.

- +2.9% HUM-US (Humana): Upgraded to outperform from market perform at Bernstein; cited an attractive entry point after a steep drop in share price; also noted improved operating outlook for Medicare Advantage and reduced uncertainty on risks such as STARS ratings and repricing execution.

- +2.6% WAT-US (Waters): Upgraded to buy from hold at Jefferies; cited increased confidence that the LC/MS replacement cycle has begun following checks.

Information Technology

- +6.6% AFRM-US (Affirm Holdings): Upgraded to buy from neutral at BTIG; company on a path to GAAP profitability, increasing share of point-of-sale finance; also sees opportunities to increase merchant engagement amid a pullback of traditional point-of-sale providers.

- +6.6% DOCU-US (DocuSign): Will join S&P MidCap 400 on Oct-11.

- +5.1% PANW-US (Palo Alto Networks): Positive commentary from Goldman Sachs on prospects for growth boost from upgrading attached subscriptions; also initiated at outperform at BNP Paribas Exane on market share and growth acceleration potential.

- +4% NVDA-US (NVIDIA): Media reports Foxconn is building a massive factory in Mexico in response to “crazy” demand for NVDA’s GB200 Blackwell AI servers.

- -2.1% RBLX-US (Roblox): Hindenburg Research issued a short report claiming the company inflated key metrics and in-game research revealed the platform is dangerous for children.

Industrials

- +1.8% HON-US (Honeywell International): Announced plan to spin off advanced materials business into an independent, U.S. publicly traded company, which is targeted to be completed by the end of 2025 or early 2026; spin transaction will not impact FY24 guidance.

- -2.8% OTIS-US (Otis Worldwide): Downgraded to peer perform from outperform at Wolfe Research; cited valuation after a rally on China stimulus; sees some risk of margin compression in New Equipment.

Consumer Discretionary

- -6.7% BABA-US (Alibaba Group): Trading lower, along with other China and China-reliant stocks, after the latest stimulus update from China’s state planner disappointed with no new large stimulus announced.

Communication Services

- -2.8% SPHR-US (Sphere Entertainment): Announced CFO Byrnes leaving the company but will continue to serve through the search process.

Financials

- -1.7% AXP-US (American Express): Multiple downgrades, citing factors including deteriorating trends in areas such as billed business, revenue growth, NII, credit trends, and a further decline in Gen Z growth; difficulty meeting the 10% revenue growth target in a weaker macro backdrop.

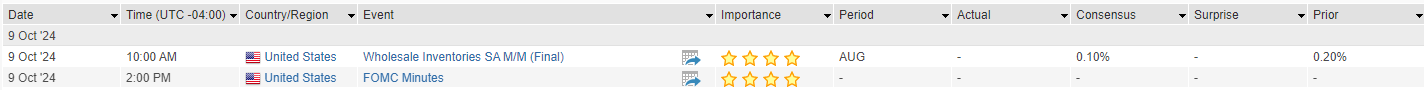

Eco Data Releases | Monday October 9th, 2024

S&P 500 Constituent Earnings Announcements | Monday October 9th, 2024

No S&P 500 Constituents Report Today

Data sourced from FactSet Research Systems Inc.