COMMENTARY:

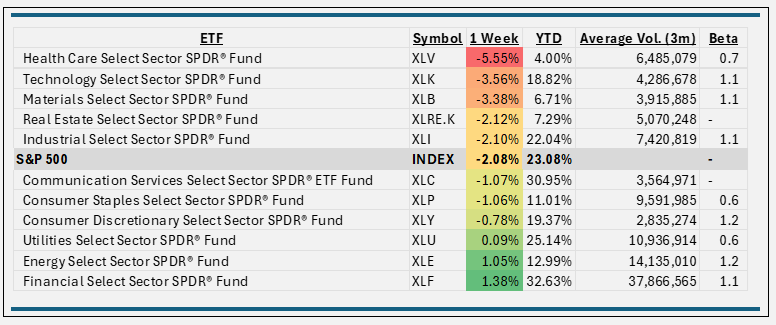

- The S&P500 Index gave back some post-election gains from the prior week, dropping 2.08% over the week ending November 15th. The market seemed to refocus on earnings and other fundamentals rather than election headlines.

- The Health Care sector experienced the most significant decline, dropping 5.6% for the week. This downturn has positioned Health Care as the worst-performing sector year-to-date, with a modest gain of 4%. Moderna saw its stock price plummet 21.3% following its announcement of a 20% reduction in R&D spending. Vaccine manufacturers now face potential headwinds because of uncertainty surrounding healthcare policies in the upcoming administration transition.

- Technology fell 3.6% for the period. The stocks that lagged the most included Monolithic Power Systems (-24.7%) and Super Micro Computer (-24.2%)

- Only three of the eight sectors were in positive territory this week. The top performing this week was Financials, gaining 1.4%. Individual driver pushing the return up included Charles Schwab (+9.1%) and Wells Fargo (+6.1%).

ETF Tidbits:

Bitwise Asset Management has announced Bitwise 10 Crypto Index Fund (BITW) as an ETP, joining a growing trend of crypto asset managers seeking to convert investment vehicles into exchange-traded structures.

Industry disruptors and creative wealth creators have been getting creative with new ETP ideas, as listed on ETF.com. To mention a few:

Roundhill brought us the shuttered Subversive Metaverse ETF (PUNK), which chased the idea of real estate, gaming and other virtual things in the so-called metaverse which may or may not still exist.

Tuttle, among the more creative shops, launched and later closed funds based on picks by CNBC’s Jim Cramer: Tuttle Long Cramer Tracker ETF (LJIM) and Tuttle Short Cramer Tracker ETF (SJIM).

Truflation’s latest idea is DEAD, the Deadlift index, based on the idea “that CEOs who lift weights outperform those who don’t on the S&P 500,” according to its website. The index, which is not yet tracked by an ETF, “merges fitness, trends, finance, and corporate performance,” the website said. “DEAD ETF” is generating big social media interest.