Our Tactical sector report looks at price action and options market indicators to evaluate potential near-term dislocations in price. This report covers the large cap. US Sector Fund Families from SPDR’s, iShares and Vanguard.

Equity investors have embraced the Fed’s dovish pivot on interest rates and Donald Trump’s win in the recent presidential election as bullish for stocks. The chart below shows some near-term profit-taking after the S&P 500 tested above the 6000 level for the first time. US Large Cap. stocks are near uptrend oversold levels (which are typically RSI readings in the 40-50 range) and we expect the FOMO dynamic of the bull market to carry stocks into year-end on a bullish note.

Given the context of a strong uptrend for US Equities, we expect momentum to continue to benefit stocks and sectors that are performing well in the present. Last week, we highlighted bullish developments for the Consumer Discretionary Sector. This week, Financials are registering similar signals as the Sector is on the cusp of new multi-year relative highs vs. the S&P 500.

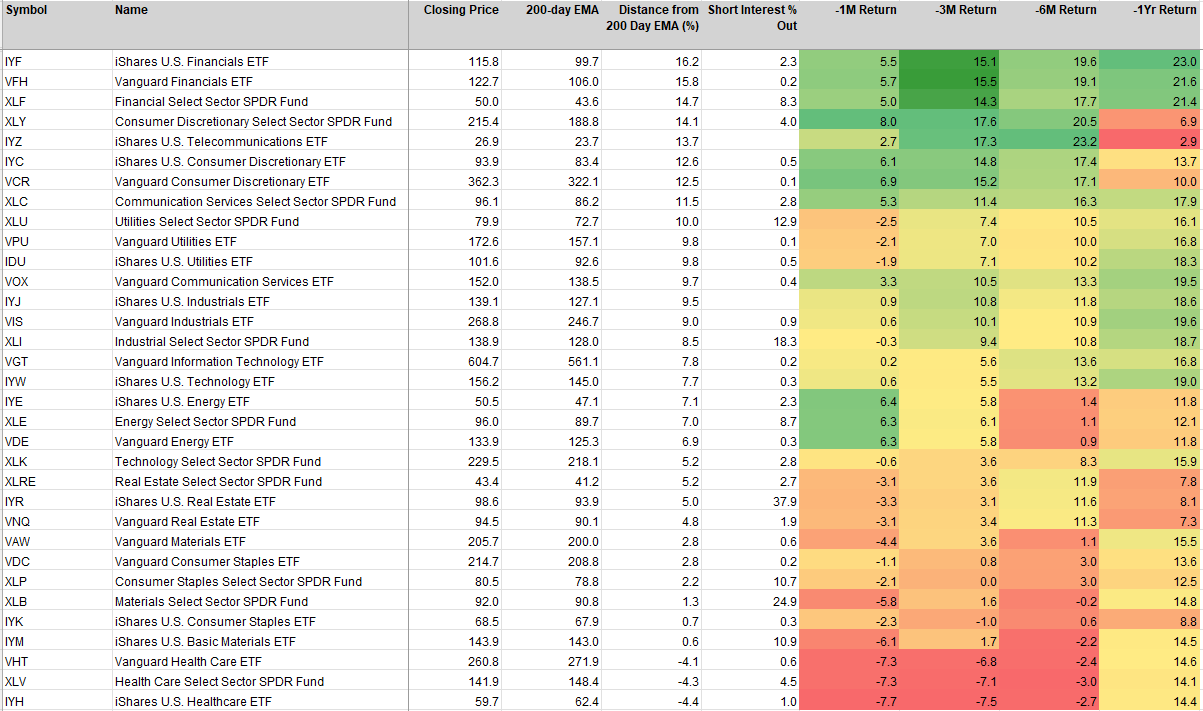

Sector Fund Families: Distance from 200-day EMA

We can see in the table below that Financials and Discretionary sector funds populate the top of the overbought/oversold column.

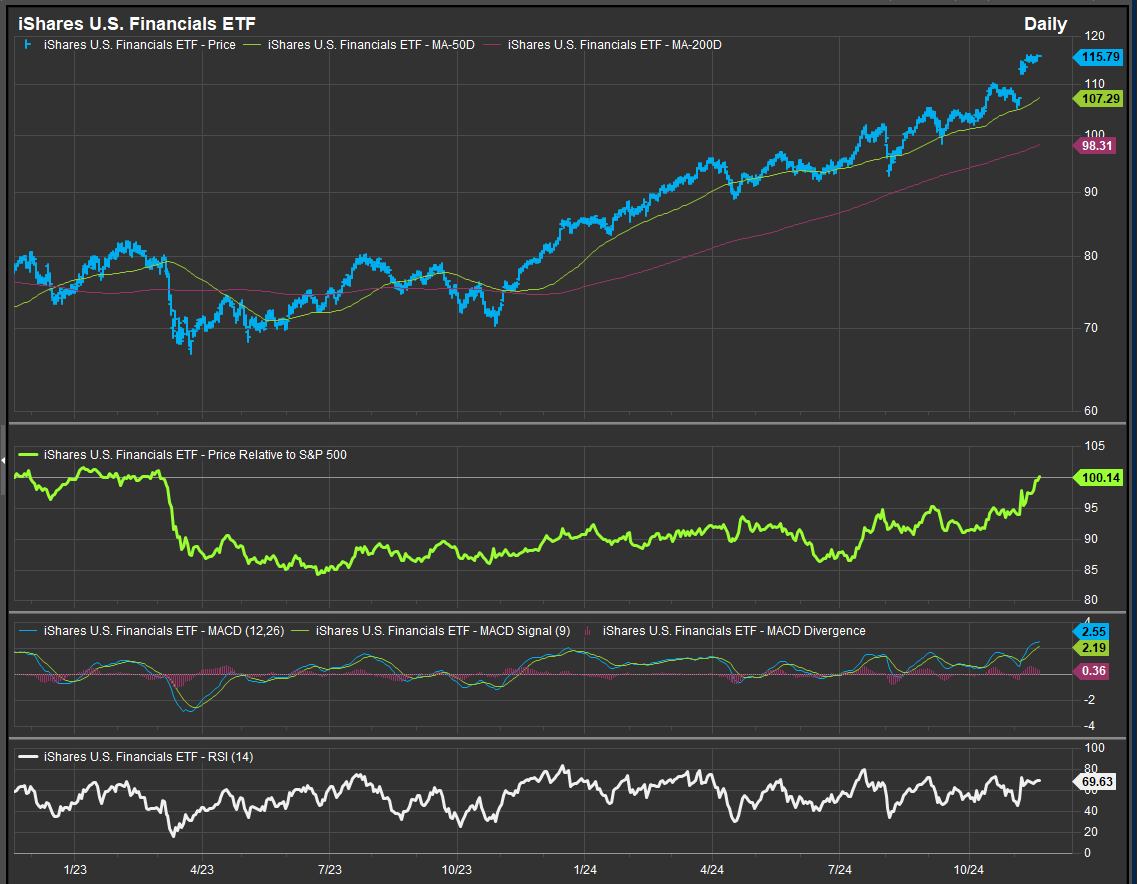

Financial Sector Registers a Long-term Bullish Signal

Last week we highlighted Discretionary Sector Funds as an opportunity since they had very poor 12M performance with the most recent 6-months showing enough sustained upside momentum to call its move an early-stage bullish reversal and project longer-term upside. We are now seeing Financial Sector ETF’s IYF, XLF and VFH on the cusp of generating multi-year relative-high signals. The chart below shows IYF’s relative curve (panel 2) recently took out 52-week relative highs formed in August and September. The curve now sits a few upside ticks away from taking out Q1 2023 highs which would put the bank-run fully in the rearview mirror.

Relative-high buy signals are typically driven by momentum as recognition of bullish trend change along with near-term fundamental drivers (in this case the prospective Trump Administrations deregulatory bent) to drive outperformance over longer time frames after a group of stocks has been lagging for a significant period. Financial stocks were held captive by the early 2023 bank runs. Investors are finally re-rating the sector positively after balance sheet concerns lingered into 2024.

Conclusion

While we generally view tactical signals as near-term oversold opportunities, bull market investing is about aligning with the strongest uptrends and riding momentum to generate alpha. This is of course a different approach than with sideways or down-trending patterns at the index level. We typically ride these upside trends until we see evidence of negative momentum divergence in our oscillator work. That typically shows up as higher highs on the price of the security coincident with lower highs on an oscillator like the RSI, Stochastics, Rate of Change or others that quantify momentum. Right now, Financials, Discretionary and Comm. Services Sectors have positive momentum and relative performance, and we continue to advocate for investors to go long those sectors.

Data sourced from FactSet Research Systems Inc.