With equities consolidating post-election gains in the near-term, we’ve found ourselves primarily concerned with the behavior of interest rates in the wake of a new Trump Administration. Much ink has rightly been spilled on the potential for Tariffs to negatively impact the economy and cause inflation. This will primarily be expressed through higher prices, but the economic impact will be felt through deterioration of consumer balance sheets and ultimately contraction in the availability of credit.

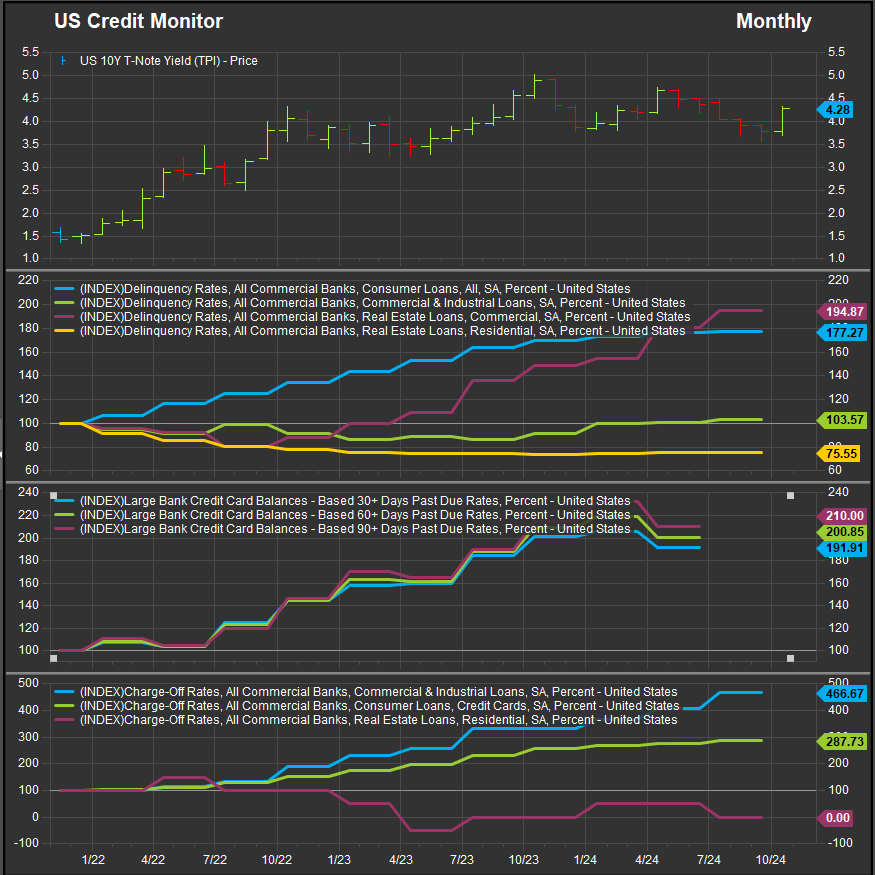

Our Elev8 Sector Rotation Model is currently long both the Consumer Discretionary Sector and the Consumer Staples Sector, but rising rates are a negative input to both. The chart below illustrates the issue well. Below the US 10yr Yield (Top Panel) we show loan delinquency rates (Panel 2), past due balances on credit card balances (Panel 3) and Bank Loan Charge-off Rates (Panel 4).

We can see from the chart that Consumer Loans and Commercial Real Estate Loan delinquency rates have been climbing for the past 3 years. We’re seeing 30, 60 and 90 days past due rates have doubled over the past 3 years, with corresponding increases in charge-offs for Commercial and Consumer loans. The one area that hasn’t been affected in the near-term has been Residential Real Estate lending. We interpret the strength of residential credit as representing two things, structural demand for housing and a lack of affordability that is side-lining buyers in lower and middle-income tiers. Those are likely the buyers that need housing the most but have the least insulation in their finances from rising interest rates.

Rising credit delinquency and default is a problem on its own, but when considered in conjunction with planned Tariffs and other inflationary foreign policy measures, there is potential for another deleterious circumstance to emerge. The Trump Administration implemented Tariffs during his last Presidency against a backdrop of much lower interest rates and a stronger consumer. This allowed the cost of those Tariffs to be diffused by producers, consumers and retailers. If prices are expected to rise again with a new round of proposed Tariffs, the Consumer is in a much weaker position than it was previously. Corporations likely won’t have the ability to pass cost on to the consumer without damaging credit. Hence, we expect any implementation of new Tariffs to have the potential to compress margins in sectors and industries where the variability of input costs is a major determinant of profit margin.

When we further consider the emergence of the “White Collar Recession” in 2024, we start to see a picture that differs from the “Soft Landing” talk that has fueled the bull market trend YTD in the US.

The term “white-collar recession” has been increasingly discussed in 2024, reflecting concerns about the economic challenges facing professional sectors. Below is a table summarizing the number of news articles mentioning “white-collar recession” each month in 2024. This trend indicates a growing focus on the impact of economic conditions on white-collar employment throughout the year.

| Month | Number of Mentions |

| January | 5 |

| February | 8 |

| March | 12 |

| April | 15 |

| May | 20 |

| June | 25 |

| July | 30 |

| August | 35 |

| September | 40 |

| October | 45 |

| November | 50 |

Sources:

- Fox Business – https://www.foxbusiness.com

- CBS News – https://www.cbsnews.com

- Bloomberg – https://www.bloomberg.com

- CNBC – https://www.cnbc.com

- Reuters – https://www.reuters.com

- The Wall Street Journal (WSJ) – https://www.wsj.com

- The Financial Times (FT) – https://www.ft.com

- Yahoo Finance – https://www.finance.yahoo.com

- Bureau of Labor Statistics (BLS) – https://www.bls.gov

- LinkedIn News – https://www.linkedin.com/news

Conclusion

While the S&P 500 persists in its bullish trend, we are starting to see stress points emerge that could derail investor exuberance. Whenever prices run up, they generally reflect elevated bullish expectations for forward fundamental and economic data releases. Rising Rates in the near-term present a potential fly in the ointment for the Fed and could set the table for consolidation as investors start looking towards 2025.

At ETFsector.com, we take our cues from the market itself. We would interpret the US 10yr Yield moving over resistance at 4.6% to be a bearish tell for the market and we would look to trim higher beta exposures if that transpired.

Data sourced from FactSet Research Systems Inc.