Our Tactical sector report looks at price action and options market indicators to evaluate potential near-term dislocations in price. This week, we’re looking at industry level performance within the S&P 500 to identify potential new leadership trends breaking out as well as laggards that might offer an oversold opportunity.

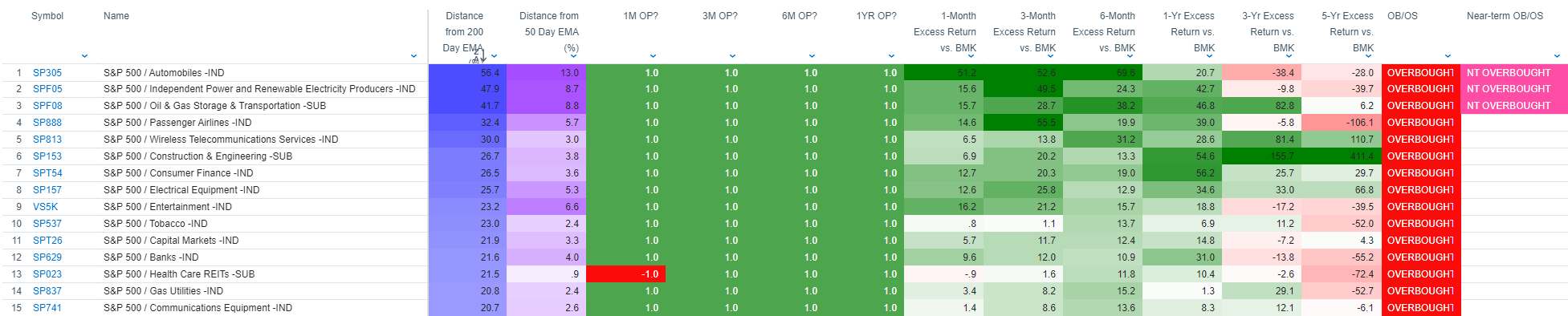

S&P 500 Industry Level: Distance from 200-day EMA

Three industries within the S&P 500 register intermediate and near-term overbought signals; Automobiles, Indy and Renewable Power and Oil & Gas Storage and Transport. The former represents a recent “Trump Trade” as positive speculation is high regarding TSLA. Power de-regulation, both for old and new technologies, is also a source of bullish speculation, but the tactical gages we follow suggest those industries have an elevated potential to consolidate near-term.

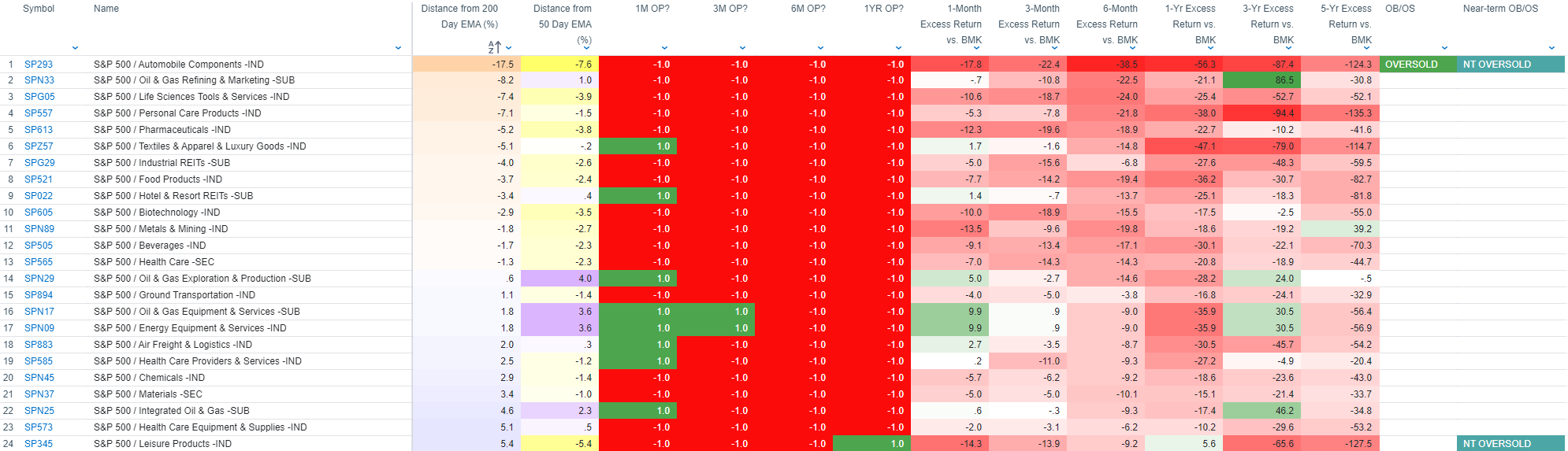

On the other side of the coin, oversold S&P 500 industries populate a diverse group of sectors. While the Automobile industry has prospered in the near-term, the Auto Components Industry is the most oversold, followed by Oil & Gas Refiners and Life Sciences & Tools companies. Commodities linked and defensive industries comprise a bulk of the oversold list.

TSLA will be a key driver of the Automobile Industry moving forward

TSLA has registered a “good overbought” condition recently. We think any profit-taking in the near-term will likely be an accumulation opportunity as the chart pattern represents a longer-term bullish reversal for the stock. A move above $400 would confirm the long-term upside break-out. The long-term pattern objective for the stock on a break-out above $400 would be $700.

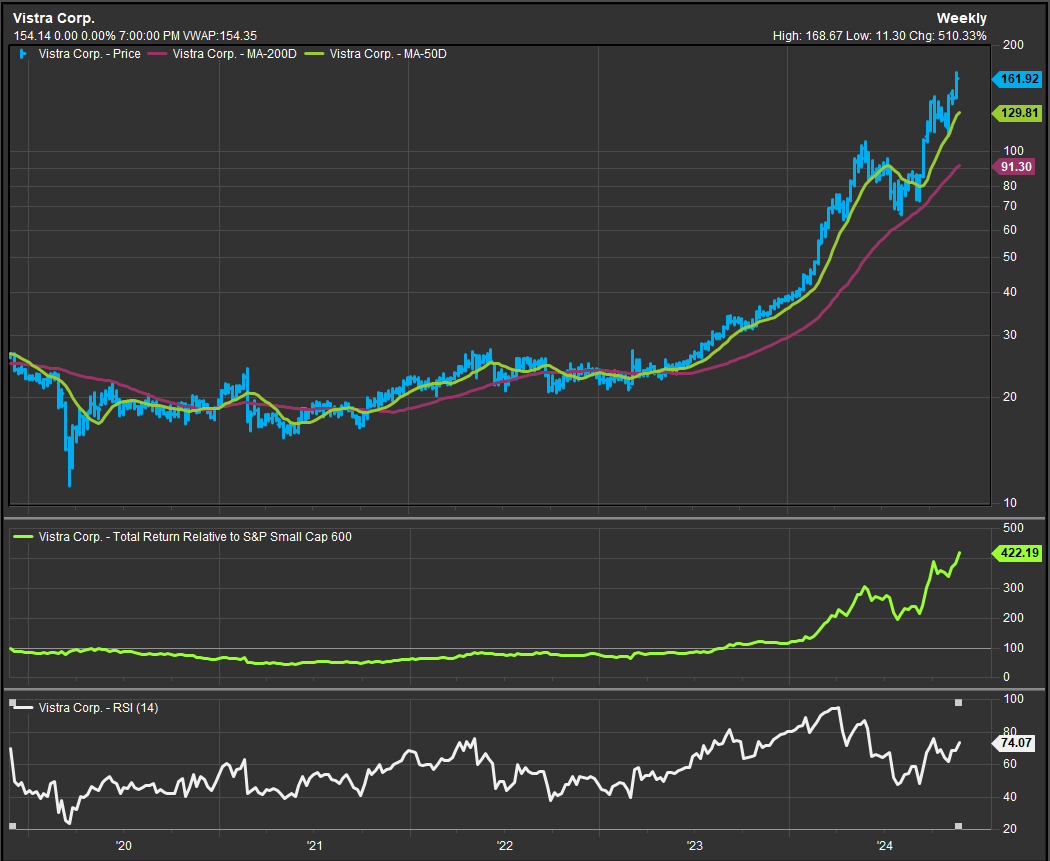

VST/Indy Utes are Extended to the Upside

In contrast to TSLA, which is breaking out of a multi-year consolidation, Vistra Corp. is getting extended to the upside. We would expect eventual retracement and would look for a better entry point to participate.

Conclusion

When riding high momentum trends, longer-term price structure is an important context for selection. TSLA is a potential big-base break-out that project’s significant upside above the $400 level. VST is extended in the near-term and has an elevated potential to retrace gains. On the flip side, rotation into legacy defensive sectors is the likely shift if negative news starts hitting the tape as several areas of the Healthcare and Consumer Staples Sector are deeply oversold over the intermediate term.

Data sourced from FactSet Research Systems Inc.