ETF Insights| December 1, 2024

Price Action & Performance

Price broke out to new all-time highs for XLY after the Presidential Election. The technical bullish reversal that began for the sector in September followed through to new price and relative highs in November. Oscillator work has indicated potential for longer-term bullish trend change as the weekly RSI gage has moved above the 70 level which confirms momentum has been strong enough to bet on a sustained uptrend moving forward. Our technical methodology projects XLY upside to $300 over the next 2-years from a current price of $222.30. We think this target is dependent on interest rates staying range bound below the 4.5% level, and we will gain conviction on our call if rates move lower in the near-term.

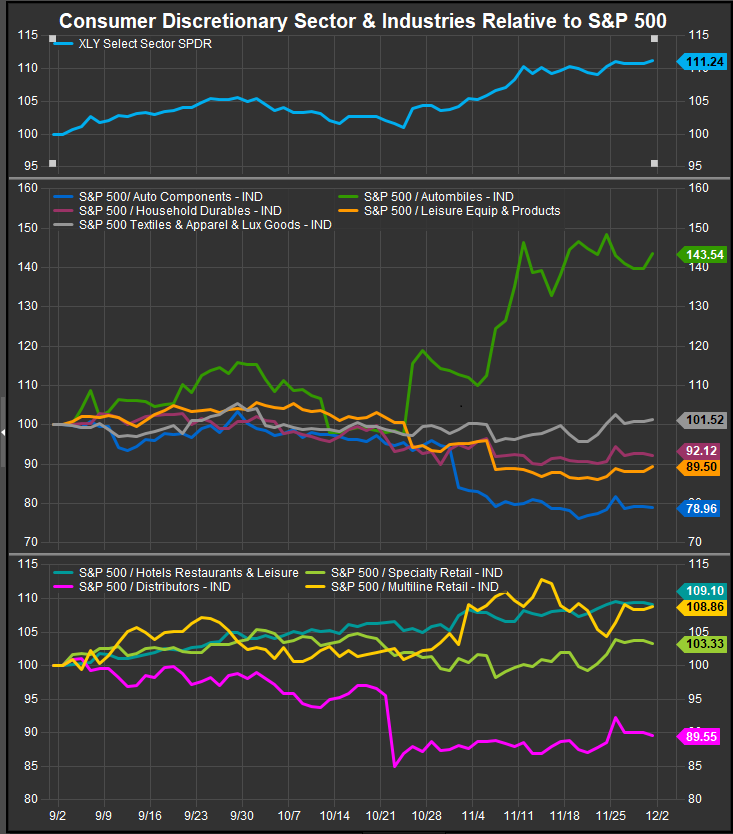

At the Industry, it’s been Mega Cap. dominated areas of the sector that have driven positive performance. Multi-line Retail (AMZN) and Automobiles (TSLA) have outperformed. Hotel Restaurant and Leisure stocks have also been positive while Auto Components, Household Durables, Leisure Equipment and Distributors have continued to correct lower. Specialty Retail stocks have also improved over the trailing 3-months.

At the stock level we are seeing clear improvement, particularly in travel and entertainment stocks. Cruise lines have been unexpectedly strong with CCL, RCL and NCLH all buy-rated in our work along with BKNG and EXPE. Hotels and Airlines have also been strong near—term. Automotive Retail continues to fade along with Auto Components, and homebuilders are getting sold as interest rates back up. We continue to have a positive outlook on homebuilders over the longer-term, but we believe they need interest rates to resolve lower heading into 2024. We are constructive on Mag7 members AMZN and TSLA and we expect they will continue to work if the bull market can sustain.

Economic and Policy Drivers

In November 2024, the U.S. Consumer Discretionary sector experienced strong performance, driven by robust consumer confidence and spending, alongside favorable economic and policy developments. The Conference Board’s Consumer Confidence Index reached a 16-month high, reflecting optimism about the labor market and declining inflation expectations. Personal consumption expenditures grew at a healthy pace, supported by rising incomes and a resilient labor market. Holiday shopping trends also contributed to the sector’s strength, with Black Friday and Thanksgiving Day sales seeing significant year-over-year increases. Online shopping and mobile transactions surged, further amplified by the growing popularity of Buy Now, Pay Later (BNPL) services. Despite concerns about global trade tensions and inflationary pressures, consumer resilience remained a key growth driver.

Policy developments also played a pivotal role in boosting sentiment. The election of Donald Trump, coupled with expectations of pro-business policies such as tax cuts and deregulation, spurred optimism. However, potential tariffs on imports from China, Mexico, and Canada raised concerns about supply chain disruptions and consumer prices. While the macroeconomic backdrop was robust, marked by steady disinflation and a 2.8% GDP growth rate in Q3, the market remained cautious about uncertainties in trade policy and global economic conditions. The combination of positive seasonality, resilient consumer behavior, and strong earnings growth positioned the Consumer Discretionary sector for continued gains heading into December, despite lingering trade and geopolitical risks.

In Conclusion

XLY has started to benefit from the change in Fed policy and outlook. It has shown material technical improvement over the previous 3 months, and we have seen our buy signals triggered. We start December with an OVERWEIGHT position of +1.73% in XLY vs. the S&P 500 weight in our Elev8 Sector Portfolio.

Chart | XLY Technicals

- XLY 12-month, daily price (200-day m.a. | Relative to S&P 500 |MACD|RSI)

- XLY is in a clear bullish reversal and has a long-term upside price target of $300 based on the recent break-out to all-time highs

XLY Relative Performance | Industry Level Relative Performance | 3m

Data sourced from FactSet Research Systems Inc.