S&P futures are little changed Thursday morning after US equities closed higher Wednesday, with the S&P, Dow, and Nasdaq all at record highs. Tech outperformance continued, supported by earnings and AI-related momentum. Asian markets were mixed overnight, while European indices rose 0.6%. Treasuries weakened, the dollar index fell 0.1%, and Bitcoin surged 5.2% to surpass $100K. WTI crude gained 0.4%, and gold dipped 0.1%.

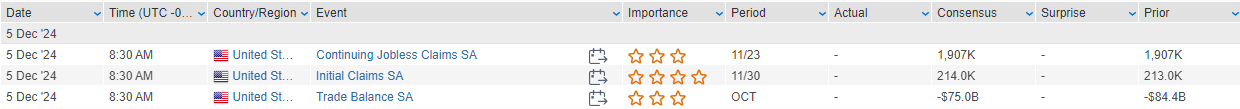

Markets are in a holding pattern ahead of Friday’s November nonfarm payrolls. Key drivers include tech strength, favorable December seasonality, strong inflow trends, and limited spillover from overseas political turmoil. Initial jobless claims today are expected at 215K, while markets price a 75% probability of a 25bp rate cut at December’s FOMC meeting.

Stock Highlights:

- COST-US: November comparable sales decelerated due to calendar shifts, but core comps remained strong.

- SNPS-US: Provided light guidance, citing market bifurcation, macro uncertainties, and preparations for its Ansys acquisition.

- S-US: Declined despite slightly better ARR and net adds, as results missed elevated expectations.

- AVAV-US: Missed EBITDA estimates.

- PVH-US: Delivered a Q3 beat, but soft Q4 guidance and incremental FX headwinds weighed on FY24 EPS outlook.

- FIVE-US: Beat earnings expectations, raised guidance, and noted a strong start to the holiday shopping season.

- AEO-US: Fell on softer guidance, flagging potential sales volatility during non-peak periods.

- ASO-US: Announced an increase in its share buyback authorization.

- VRNT-US: Jumped on a Q3 beat and positive AI-driven momentum commentary.

US equities advanced on Wednesday, with the S&P 500, Dow, and Nasdaq all closing at fresh record highs. The S&P 500 logged its 11th gain in the past 12 sessions, supported by strong performance in big tech and AI-related stocks, despite broader market breadth remaining mixed. Key outperforming sectors included semiconductors, software, biotech, and consumer discretionary, while underperformers included homebuilders, chemicals, trucking, and pet products. Treasuries firmed across the curve, reversing earlier weakness, while the dollar index remained flat. Gold edged up 0.3%, Bitcoin futures surged 3.7% past $100K, and WTI crude fell 2.0% after gains earlier in the week.

Market sentiment reflected a waiting mode ahead of Friday’s November NFP report, with dovish-leaning Fedspeak, including comments from Richmond’s Barkin and St. Louis Fed’s Musalem, contributing to easing rate expectations. Data releases were mixed: ADP private payrolls came in slightly below consensus, ISM services data missed expectations, and the Fed’s Beige Book pointed to slight economic activity growth in most districts. Political developments overseas, such as the fall of the French government and South Korea’s brief martial law declaration, had limited spillover effects.

Sector News

Information Technology

- Marvell Technology (MRVL): +23.2%. Q3 results and Q4 guidance surpassed expectations, driven by meaningful volume ramp of AI custom ASICs and strong data center performance (+100% y/y growth).

- Pure Storage (PSTG): +22.1%. Surged on a better-than-expected Q3, upwardly revised Q4 guidance, and a significant design win with a top-4 hyperscaler.

- Okta (OKTA): +5.4%. Posted a Q3 beat and raised its FY25 guidance; new product momentum accounted for 15% of bookings.

- Box (BOX): -7.7%. Despite a Q3 beat, deferred revenue and billings came in light. Management cited macro headwinds and challenging y/y comps.

- Microchip Technology (MCHP): -5.7%. Reportedly paused its application for US semiconductor subsidies due to inventory concerns.

Consumer Discretionary

- Chipotle Mexican Grill (CMG): +4.8%. Announced a ~2% price increase at select stores, signaling a broader system-wide rollout.

- Mattel (MAT): +5.6%. Highlighted strong Black Friday sales and Q4 growth momentum during a Morgan Stanley conference.

- Foot Locker (FL): -9%. Q3 results missed on earnings, revenue, and margins; weaker-than-expected comps and promotional challenges weighed on the stock.

Health Care

- Eli Lilly (LLY): +2%. Released a study showing its Zepbound treatment outperformed Novo Nordisk’s Wegovy, achieving better weight loss results in obesity treatment.

- Edwards Lifesciences (EW): +5.7%. Reaffirmed 2024 sales guidance ahead of an investor day, with 2025 TMTT sales outlook slightly ahead of expectations.

Industrials

- JetBlue Airways (JBLU): +8.3%. Raised Q4 revenue and ASM guidance; highlighted better on-time performance and improved demand over the Thanksgiving holiday.

- Thor Industries (THO): -3.2%. Reported a surprise FQ1 loss, citing a challenging sales environment in the North American Towable and Motorized segments.

- GXO Logistics (GXO): -13.8%. Fell after Bloomberg reported the company declined acquisition offers, opting to remain independent. CEO announced retirement plans for 2025.

Consumer Staples

- Campbell Soup (CPB): -6.2%. Fiscal Q1 sales missed expectations due to weak organic growth in Meals & Beverages and Snacks segments. Announced CEO transition effective January.

- Hormel Foods (HRL): Declined on weaker-than-expected Q4 results and a soft FY25 guide.

Communication Services

- Roku (ROKU): +9.6%. Needham projected the company could be acquired within 12 months, citing strong installed base and pricing power.

Materials

- Coherent (COHR): +5.1%. Initiated at “Buy” by Jefferies on valuation and management’s optimization efforts.

Eco Data Releases | Wednesday December 5th, 2024

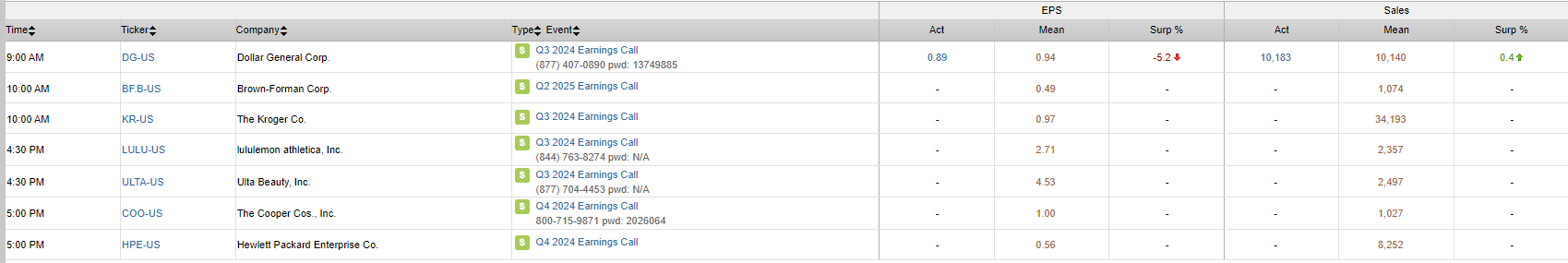

S&P 500 Constituent Earnings Announcements | Wednesday December 5th, 2024

Data sourced from FactSet Research Systems Inc.