Risk to the bull trend emerged this week after the FOMC disappointed consensus expectations for 2025 by issuing cautious guidance on easing the policy rate. The short and sweet distillation is the FOMC laid out expectations for 3 cuts to the target rate in 2025 while consensus was for 4 cuts. The VIX has spiked in reaction and near-term selling has hit the tape.

We note the S&P 500 daily price chart (below) is already showing oversold conditions on the RSI gage as the MACD tactical gage corrects to a level where accumulation has occurred in the past. With Today’s futures pointing to a soft open, we want to see accumulation into the close as evidence that the bull is still in control of the tape.

10yr US Treasury Yields have pivoted higher since December 9 and recently made a new near-term high. A sustained rise in rates would be a bearish development for the equity market advance. If equities move lower from conventional oversold and rates keep going higher, we will be looking to lower the risk profile of our Sector portfolio, likely by adding to Utilities and Staples sectors. The chart below shows the 50-day moving average of the 10yr US Treasury Yield crossing above the 200-day, while the RSI study is near overbought territory. Trend change is about extremes, and we are on the threshold of extremes. Price action from Thursday to Friday morning has been restrained after fast market action on Wednesday.

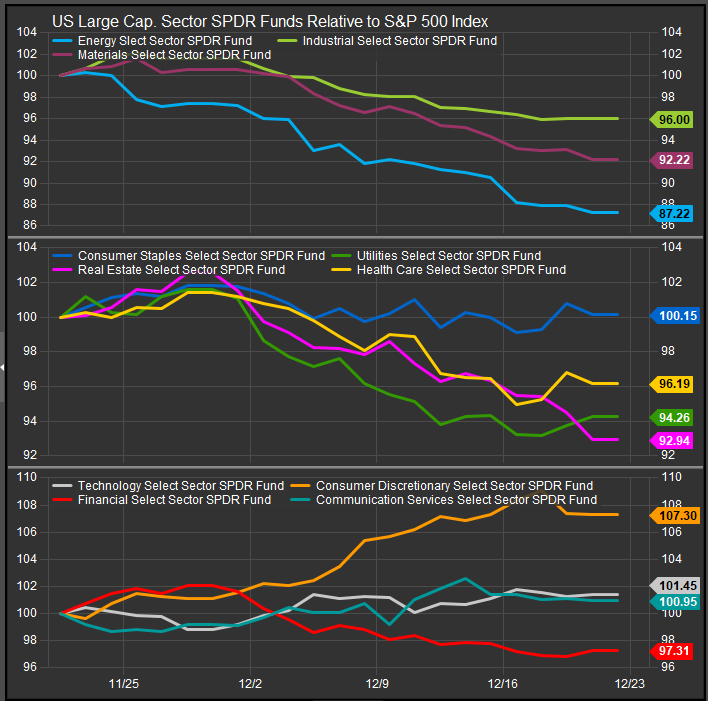

Sectors

Sector performance has shown an expected near-term tilt towards Defensive Sectors while the Consumer Discretionary sector has seen the heaviest selling around the FOMC’s announcement. We are not seeing a clear sell signal for the sector yet as the sector was at an overbought condition and remains in a strong uptrend in both absolute and relative terms.

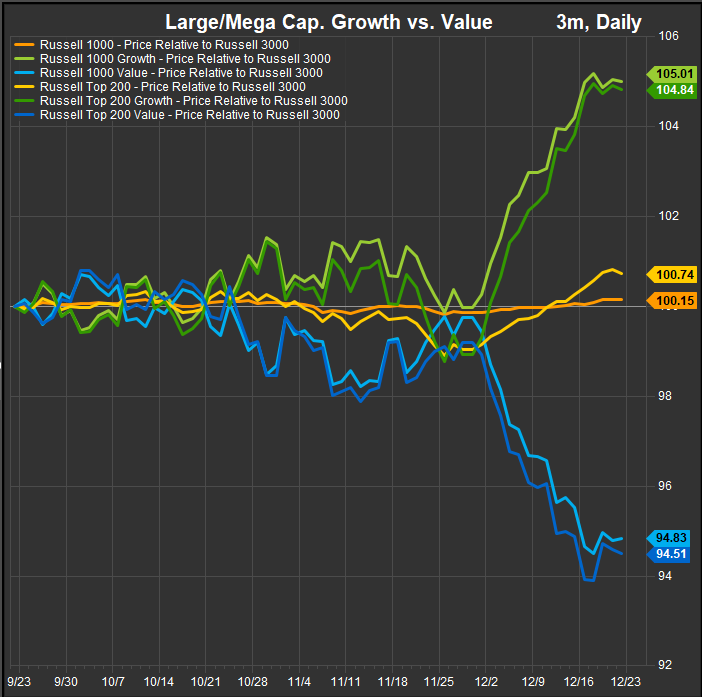

Large/Mega Cap: Growth stretched near-term, likely to give back gains if rates keep rising

After a few months near parity, Growth factor performance broke out to the upside in December as rates rolled over. Now, with inputs from the Fed. and stronger economic prints in Q4, rates have pused up toward highs for the year. Growth performance hasn’t rolled over yet, but continued upwards pressure on rates would make that a likely scenario.

Small/Mid Stocks: Trading as a block again regardless of style

We noted in previous reports that small/mid Growth and Value cohorts were back to trading as a block in December. Here we see performance curves ticking higher in the near-term regardless of size and style. This is a good reminder that Mega Cap. Growth is likely to take the brunt of rotation away from Growth if it occurs.

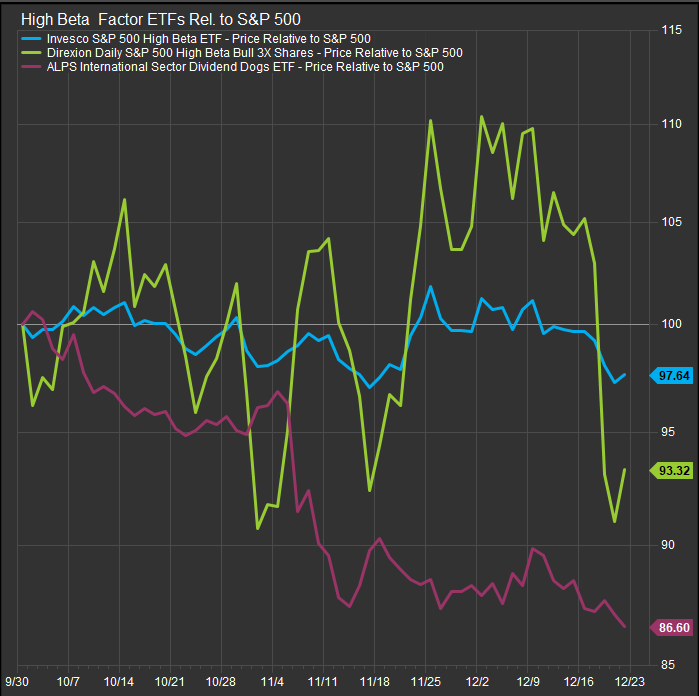

High Beta Underperforming

High beta performance has weakened in the near-term. While the Invesco High Beta ETF performance is within 2% of the S&P 500 benchmark return, Levered High Beta and International High Beta have seen bigger declines over the past two weeks. We expect at the least that some consolidation is ahead for the equity market.

Low Vol. also underperforming

The conundrum for us with regard to positioning changes is that low vol. equities are also underperforming and haven’t seen a notable bump in response to Wednesdays draw-down. This is surprising to us.

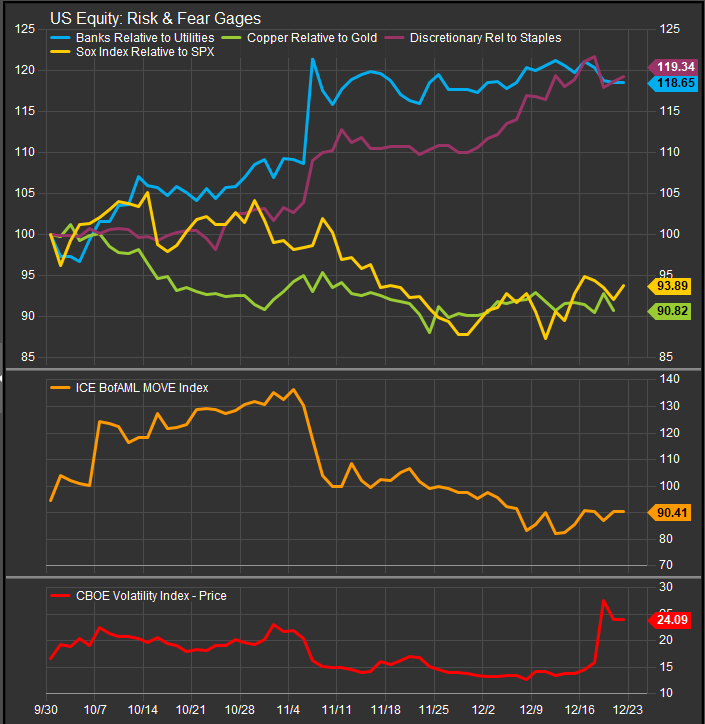

Risk On/Risk Off: Vol. Remains Low, Risk Appetite Gages Firm

It should be noted that near-term selling around spikes in the VIX is expected as the volatility index is a direct input into many risk-parity funds which can hold more equities when the VIX is lower and are mandated to lower their beta profiles when the VIX moves higher. These types of strategies are part of the market structure that leads to near term dislocations and forced selling when “complacency” conditions prevail.

Bond market vol., as measured by the MOVE index hasn’t spiked with the VIX, and we’ve actually seen Semiconductor performance firm vs. broad equities in the very near-term. We will stay patient for now and look for more evidence of trend change before we come off our bullish stance.

In Conclusion

Growth still in the leadership postion, but rising rates and acknowledgement from the Fed that inflation is still a concern has the potential to change the picture. For now, we are maintaining our Sector allocations from the beginning of the month which include long exposures to Technology, Discretionary, Industrials, Financials and Comm. Services. We will stay patient for now and look for more evidence of trend change before we come off our bullish stance.

Data sourced from FactSet Research Systems Inc.