Last week the US 10yr Yield broke out above highs from April/May of 2024, a technical development that projects an upside move to above 5.7% over the longer-term (chart below). The move has catalyzed near-term rotation into defensive and commodity linked sectors and away from Growth, Technology, Discretionary and Comm. Services Stocks that have led for much of the bull market cycle. Major US Indices were down >1% in Friday trading. We expect more weakness to come over the near-term and have pared risk in our Elev8 Sector Rotation Portfolio selling out of our position in the Consumer Discretionary Sector and going long Healthcare, Utilities, Staples and Energy Sectors.

Persistent strength in economic data, highlighted on Friday morning by a strong than expected employment report, has investors betting that the Fed will be sidelined in 2025 after 2024 ended with dovish expectations. In the very near-term commodities prices have popped to the upside which sets the table for further rotation and continued speculation on inflationary outcomes. A move above the 103 level on the Bloomberg Commodities Index (chart below) would strengthen conviction in an upside inflation scenario supported by rising commodities prices.

Defensive sectors are ripe for near-term outperformance as they have been out of favor for several months and typically start periods of outperformance from oversold conditions. The Healthcare Sector price chart (below) is emblematic of this condition.

When evaluating the S&P 500’s bullish trend channel since 2023 we can expect a further 10% drawdown while maintaining belief in the long-term uptrend scenario. The chart below illustrates the channel. Also of note, the previous low in October/November of 2023 was a breadth was out with less than 10% of S&P 500 constituents above their respective 50-day moving averages. A similar condition is in effect at present, though not quite as extreme.

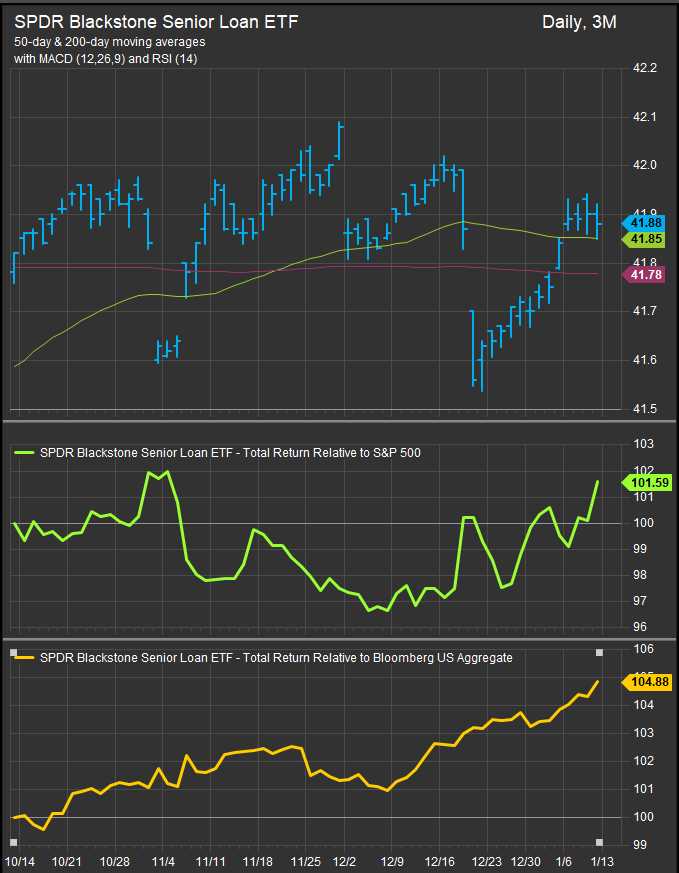

For the time being we expect a shake-out in the equity market. We are not yet ready to declare the bull market over, but after back to back 20% gains on the S&P 500 a year of consolidation is in the cards, and a sour start to 2025 reinforces that notion. We will be looking for positive momentum divergences to form before calling an accumulation opportunity, but we would expect rates and commodities prices would need to soften before investors feel comfortable moving back into Growth exposures. In the meantime we want to add some safety to our portfolio and we expect investors will find shorter duration and floating rate investments attractive. The SPDR Senior Bank Loan ETF (SRLN) is a good example of an instrument that has some tailwinds from the uncertainty around inflation and the direction of rates. The chart below shows outperformance vs. Stocks and Bonds over the past 3-months.

Senior Loans also outperformed in 2022 when the S&P 500 suffered through a peak-to-trough decline of >27%.

For the time being, we expect near-term outperformance in low vol. and commodities linked equity sectors, short duration bonds and floating rate securities like corporate bank loans to continue.

Patrick Torbert, Editor & Chief Strategist, ETFSector.com

Data sourced from FactSet Research Systems Inc.