S&P futures are up 0.4% Tuesday morning, following a mostly higher close for US equities on Monday as value and cyclicals outperformed while big tech, semis, airlines, and retail lagged. Treasuries were stable, the dollar fell 0.3%, gold was flat, Bitcoin futures rose 2.7%, and WTI crude dipped 0.7%.

Key drivers include reports of a gradual implementation of Trump tariffs and easing EU regulatory pressure on US tech companies. M&A activity remains robust, particularly in the rental equipment sector, while small business optimism hit a six-year high. Internationally, China’s new loans and aggregate financing exceeded expectations, and the BoJ is signaling potential rate hikes at its next policy meeting.

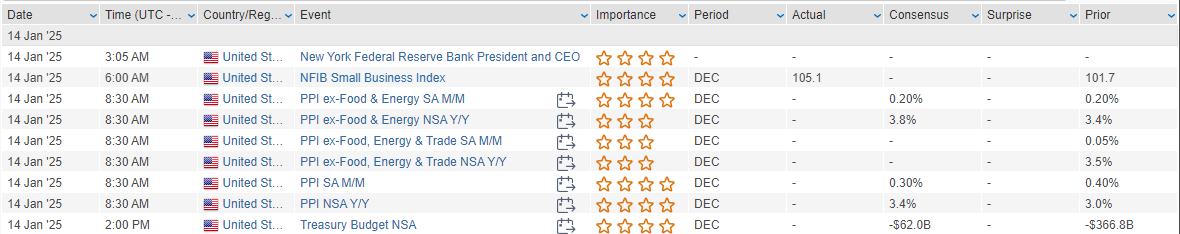

December PPI, expected at 08:30 ET, anticipates a 0.4% m/m increase, with core PPI forecast at +0.3%. The NFIB small business optimism index reached a six-year high. Fed speakers today include Kansas City Fed President Schmid at 10:00 ET and NY Fed President Williams at 15:05 ET. Upcoming data highlights include CPI, housing, and retail sales later this week.

In corporate news:

- Tech: EU reassessing probes into AAPL, GOOGL, and META; AMZN reportedly revamping Alexa as an AI agent.

- Healthcare: DHR guided Q4 revenue flat y/y; PFE CEO downplayed activist dispute.

- Energy: SLB under pressure to exit Russia amid new sanctions.

- Industrials: URI to acquire HEES for $4.8B EV.

- Consumer Discretionary: KBH beat on orders and FY25 guidance; SIG fell on a weak holiday sales update.

- Media: Reports suggest Chinese officials are exploring options for TikTok, including a potential sale to Elon Musk.

US equities closed mostly higher on Monday, with the Dow gaining +0.86%, the S&P 500 up +0.16%, while the Nasdaq fell -0.38%, and the Russell 2000 added +0.24%. The equal-weight S&P 500 outperformed the cap-weighted index by over 60 basis points, reflecting positive breadth. Energy, materials, and financials led gains, while big tech and semis lagged.

Treasuries weakened slightly, with curve flattening as the 30-year yield approached 5%. The dollar index rose 0.2%, while gold declined 1.3%. Bitcoin futures fell 1.7%, recovering from deeper intraday losses. WTI crude climbed 2.9%, extending last week’s 3.5% gain amid tight supply concerns and geopolitical factors.

Key Macro Themes

The higher interest rate backdrop continues to weigh on market sentiment, with focus on fiscal deficit dynamics, sticky inflation, and tariff uncertainty under the Trump 2.0 administration. Reports of potential gradual implementation of tariffs to mitigate inflation concerns provided limited relief. Meanwhile, AI momentum waned on reports of technical issues with NVIDIA’s Blackwell chips and new export restrictions on AI chips. The Q4 earnings season kicks off with a high bar for expectations and scrutiny on stretched valuations and market concentration.

Economic Data Highlights

The NY Fed’s inflation expectations survey showed mixed results:

- 1-Year: Unchanged at 3%.

- 3-Year: Rose 0.4pp to 3%.

- 5-Year: Declined 0.2pp to 2.7%.

Wage growth expectations fell, and perceived job security weakened to the lowest levels since April 2021. A busy macroeconomic calendar includes PPI and NFIB Small Business Optimism on Tuesday, CPI and the Fed Beige Book on Wednesday, and retail sales and industrial production later in the week.

Company-Specific News by GICS Sector

Information Technology

- NVIDIA (NVDA): Fell 2% following reports of overheating and glitches in Blackwell chip racks, prompting some customers to cut orders. The Biden administration announced new AI-related chip export restrictions.

- Micron Technology (MU): Down 4.3% after the announcement of a 120-day comment period on AI chip export rules, potentially impacting datacenter construction and gaming chip markets.

Healthcare

- Intra-Cellular Therapies (ITCI): Soared +34.1% on news Johnson & Johnson (JNJ) will acquire the company for $132/share, a 39% premium.

- Moderna (MRNA): Dropped -16.8% after cutting FY24 sales guidance by ~6% and providing FY25 guidance below Street estimates.

- Gilead Sciences (GILD): Entered a strategic partnership with LEO Pharma for inflammatory disease treatments.

Consumer Discretionary

- Macy’s (M): Fell -8.1% after guiding Q4 revenue slightly below the low end of prior guidance and reporting flat comparable sales versus expectations for growth.

- Shake Shack (SHAK): Gained on a Q4 preannouncement highlighting revenue and margin outperformance.

- Abercrombie & Fitch (ANF): Down -15.7% despite raising FY revenue growth guidance; investor expectations were elevated after recent strong stock performance.

- Sonos (SONO): Fell after the announcement of a CEO transition, with little immediate clarity on future growth strategies.

Financials

- Howard Hughes Holdings (HHH): Rose +9.5% on news of a buyout proposal from Bill Ackman’s Pershing Square, offering $85/share in cash or stock.

- Cintas (CTAS): Received positive mentions after raising revenue guidance.

Industrials

- United States Steel (X): Up +6.1% after the Biden administration extended Nippon Steel’s deadline to abandon its acquisition bid, with reports of a potential joint bid from Cleveland-Cliffs (CLF) and Nucor (NUE).

Energy

- Exxon Mobil (XOM): Flat on the day as discussions of long-term refining and upstream challenges continued to weigh on sentiment.

Consumer Staples

- Hershey (HSY): Confirmed CEO Michel Buck will retire in 2026, with succession planning underway.

Materials

- Steel and Chemicals: Benefited from broader commodity rotations and strong pricing momentum, led by outperformers like U.S. Steel.

Eco Data Releases | Tuesday January 14, 2025

S&P 500 Constituent Earnings Announcements | Tuesday January 14, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.