COMMENTARY:

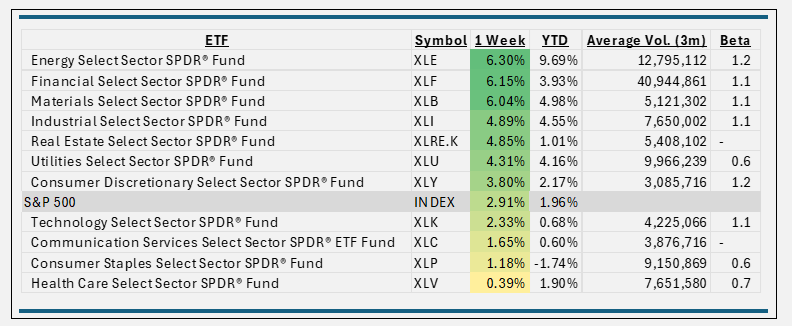

- The S&P500 got back into the green this week, up 2.91%. Wednesday the 15th was the best-performing day since November, driven by a tame inflation report, and a positive start of fourth-quarter earnings reports.

- Energy carried on from last week’s gains, up 6.3%, and continues to be the highest-performing sector so far this year. Predictions of extended cold weather across the country and moderation in natural gas prices were headlines that helped the sector. Schlumberger was up 12.8% on the announcement of dividend increases and share buyback.

- Two other sectors returned over 6% this week, Financials and Materials. Citigroup gained 12.0% and KKR added 11.8% taking the top two spots in that sector. Albemarle (+12.7%) and Celanese (+11.7) helped within Materials.

- All eleven GICS sectors within the S&P were winners this week. Although Health Care was up 40 basis points, it was the lowest-performing sector this week.

- Next week the new administration takes over in Washington. Investors should get a clearer picture of upcoming policy changes. Hold Tight!

ETF TIDBITS:

Competing S&P500 ETFs – SPY (State Street) & VOO (Vanguard), reported differing inflow patterns for Q4’24. SPY took in $21 Billion with an AUM of over $600 Billion, while VOO took in $1.3 Trillion. Both are industry leading giants.

Lazard Asset Management has filed with the Securities and Exchange Commission to introduce its first exchange-traded funds. The list of opportunities are the Lazard Emerging Markets Opportunities ETF, the Lazard Equity Megatrends ETF, the Lazard International Dynamic Equity ETF, the Lazard Japanese Equity ETF, and the Lazard Next Gen Technologies ETF. The ETFs are expected to launch later this year.