One of the most popular categories of funds available to investors are those offering thematic exposure. This category leverages a specific theme or themes that have gained traction economically and within popular culture. Thematic ETFs range from the speculative (ARKX Space Exploration & Innovation ETF) to things we take for granted (Global X Infrastructure Development ETF). For this Thursday we reviewed the performance of popular thematic categories and offer sector related insights into drivers of performance. We look at a handful of the largest ETFs by AUM operating in each category.

Our performance charts compare funds to the S&P 500 index over the past 12 months.

Our key takeaways on thematic ETFs are as follows:

- Outperforming: Global X Millennial Consumer Fund (MILN), ARK Autonomous Technology (ARKQ), First Trust SkyBridge Crypto ETF (CRPT), ARK Next Gen. Internet (ARKW), SPDR Kensho Final Frontiers ETF (ROKT)

- Underperforming: Robo Global Robotics & Autonomous Index ETF (ROBO), iShares Biotechnology ETF (IBB), Invesco Water Resources (PHO)

- Speculative innovation themes like Space, AI & Robotics and the ARK fund family have held up well despite a broad pullback in US equities over the past weeks

- Mag7 stocks are present in many of these thematic portfolios which elevates correlation

- The best crypto related stocks are still constructive despite recent correction in the coin.

- Healthcare based themes are showing near-term strength in weak longer-term trends

- Utilities related themes like water and infrastructure continue to be the weakest performing themes

Themes (A-Z)

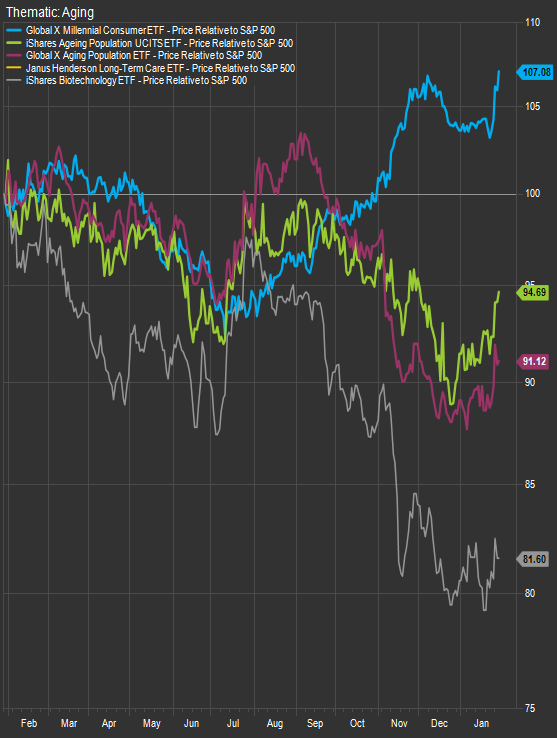

Aging

- The Global Millennial Fund (MILN) ends up being an odd bedfellow in this category, as its mainly focused on widely adopted technology solutions…a sharp bullish reversal is in the offing here…we notice fitness stocks have been behaving well in the back end of 2024

- Most “Aging” themed ETFs are focused on the Pharmaceutical, Biotech and Managed Care industries and as such have been lagging with healthcare stocks generally for much of this year…we’re seeing the latest AI turbulence offer a chance at bullish reversal

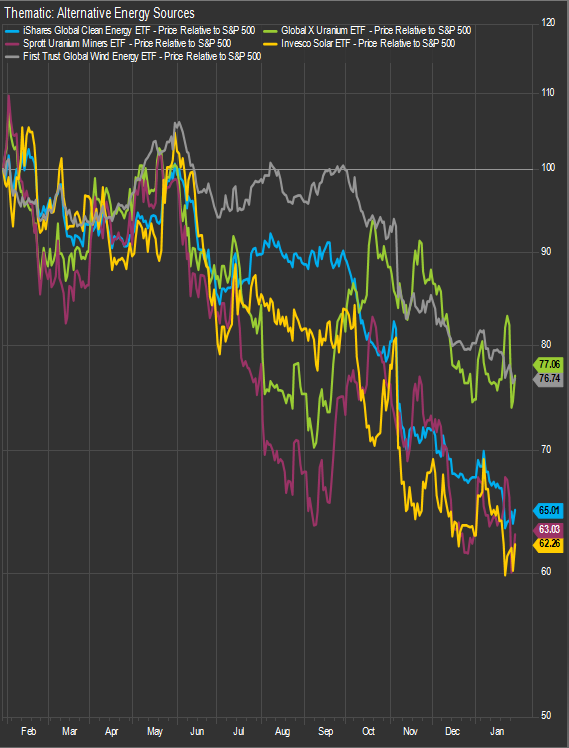

Alternative Energy

- Energy prices have firmed in the near-term and the Alt. Energy space has seen some improvement as well.

- Clean Energy is lagging through this potential upside reversal

- We would expect Solar and Uranium in particular to stay bid as long as Growth areas of the equity market remain under pressure

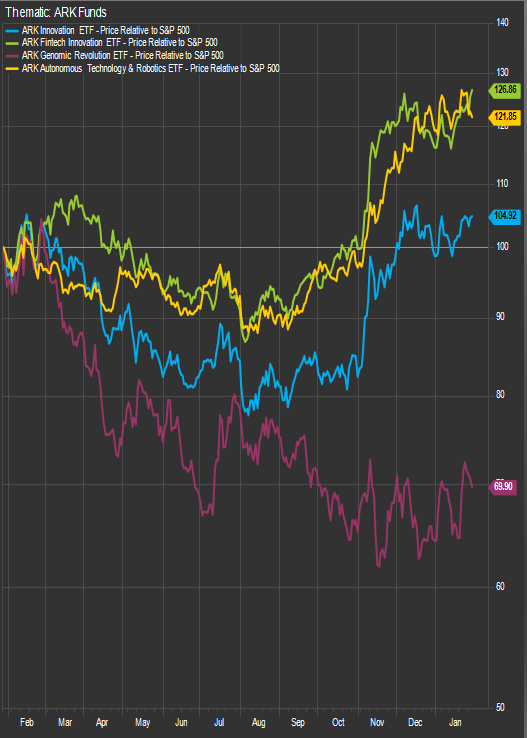

ARK Funds

- The ARK Fintech and ARK Autonomous Robotics funds has led in the 2nd half of 2024 while the Innovation and Robotics funds are also showing constructive bullish reversals

- We have buy ratings on top holdings NVDA, AMZN, TSLA, META, PLTR, SHOP, COIN, TTD, RBLX, XYZ and ACHR

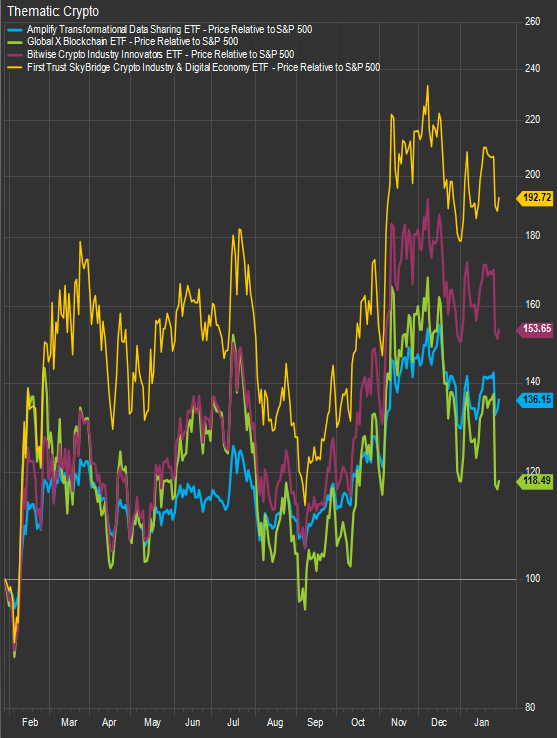

Crypto

- Crypto as an asset class functions as a levered risk-on play.

- Correlation remains high among coins

- CIFR, BTDR, WULF and RUM are new upstarts to go along with “old heads” COIN, XYZ and MSTR

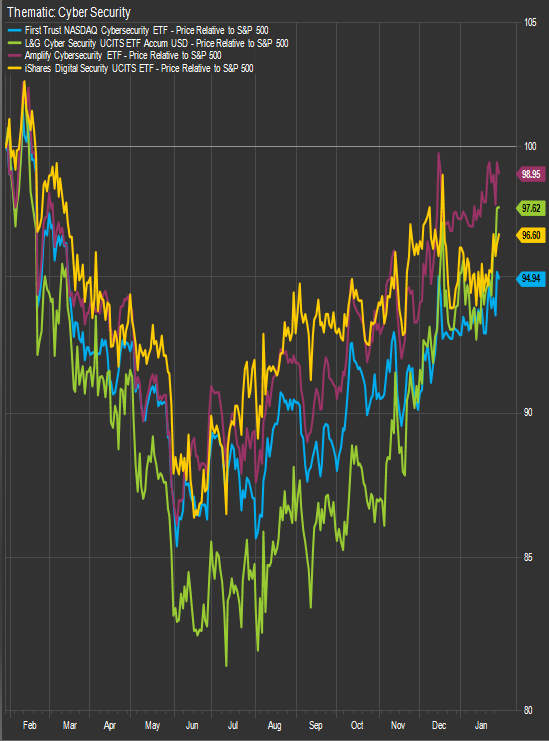

Cyber Security

- The Cyber Security theme has executed a sharp pivot in performance vs. the S&P 500 since mid-year

- Fixtures like AVGO, CRWD, FTNT and PANW remain notable buy rated stocks in our work

- We also note sharp bullish reversals in QLYS and FSLY that are worth looking into

- GEN and FFIV are other buy rated names we like in Cyber

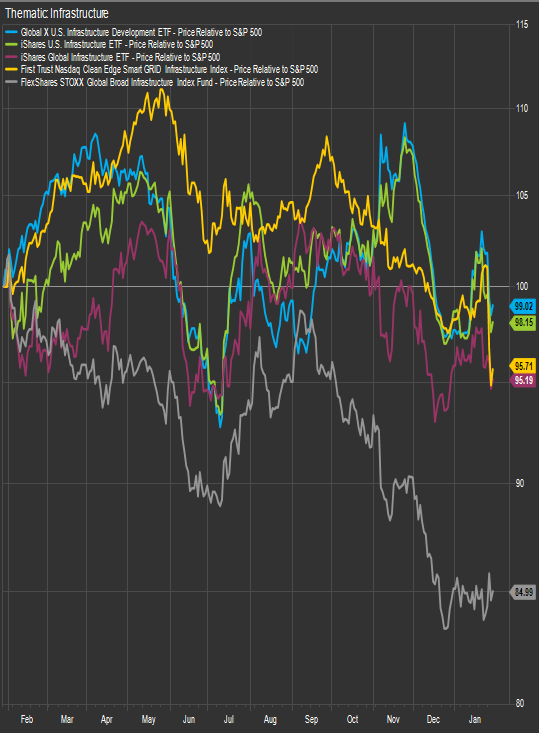

Infrastructure

- Infrastructure has faced headwinds to performance in 2024

- A mix of utilities, airport and highway operators, transports, MLP’s and energy storage and data centers and cellular service providers, infrastructure is typically a quality and income play which does best when equities are stable, but performance is subdued

- Utilities have been an unexpected drag in the near-term as they’ve been caught up in the turbulence of the AI trade

- In a year when the S&P 500 has posted a 28% gain, these funds struggle to keep up.

- Our favorite ideas within these holding profiles are OKE, VST, TRGP and DTM

Internet

- Domestic internet funds are outperforming due to big Tech exposure and a mixture of Small and MidCap software names that have generally been outperformers in the cycle

- Chinese shares can’t seem to get out of their own way in 2024 with a big spike in performance around government interventions in September/October showing no upside follow-through

- We like TTD, XYZ, DDOG, MELI, SHOP, NET, HOOD, PSTG, ROKU

Robotics & AI

- Performance of Robotics and AI ETF’s is all over the map this year

- The best performing funds are anchored by core holdings AAPL, MSFT, NVDA, GOOGL, META, ORCL, BAC and CRM but names like AUR, OKLO and LUNR show patterns worth looking into

- All of the above are buy rated in our stock level work with the exception of MSFT

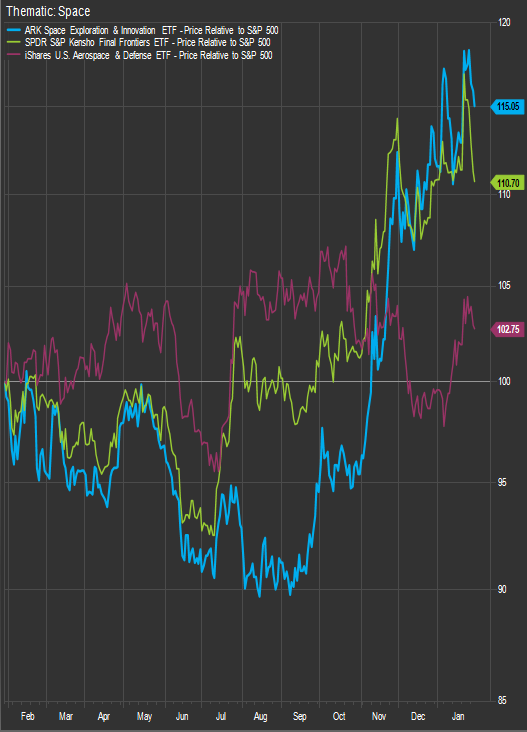

Space

- Space focused funds have a broad mix of satellite, Aero/Defense, and Small/Mid Software and industrial co.’s

- AMZN is also in the space business

- RKLB, COHR, FTI and Elbit Systems are names that we recommend

- Space themed funds holding smaller innovation-based companies are significantly outperforming the legacy Aerospace & Defense ETF

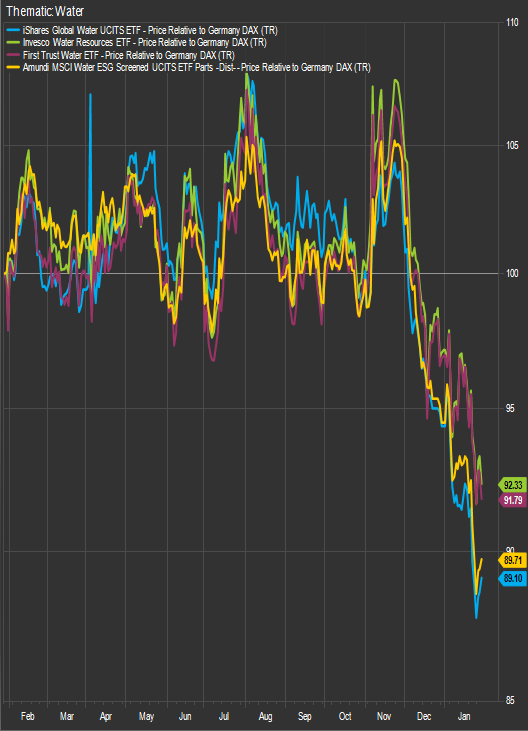

Water

- Water funds have gone in the tank over the past 3-months

- Most of the largest holdings in the First Trust Water ETF have been correcting in 2024. The best stock charts are found in the small/mid space

- We like domestic names like PNR, ACM, PRMB, MLI and BMI

Data sourced from FactSet Research Systems Inc.