S&P futures up 0.4% Friday morning after US equities rallied Thursday, with over 80% of S&P 500 stocks advancing and the equal-weight S&P rising more than 1%. Stocks remain on track for a mixed weekly performance following two consecutive weeks of strong gains. Asian markets mostly higher overnight, with Japan up for a third straight session, while European markets gained nearly 0.5%. Treasuries were little changed to slightly weaker, the dollar index rose 0.4%, gold was flat, Bitcoin futures fell 0.9%, and WTI crude dipped 0.2%.

Earnings remain a key focus, with AAPL’s guidance better than feared, citing iPhone strength in Apple Intelligence markets and China stimulus benefits. Visa posted a strong beat and raised guidance, noting accelerating US volumes in January. KLAC outperformed on NAND demand, while Atlassian surged after a beat and improved guidance. Intel’s results benefited from pull-ins, but guidance disappointed. HIG fell on charges, and Walgreens declined on its dividend suspension. Meanwhile, Trump’s renewed tariff threats on Mexico and Canada remain in focus, though reports suggest his aides are considering ways to soften the impact.

Today’s economic calendar includes December core PCE inflation, Q4 ECI, and the January Chicago PMI. Core PCE is expected to rise 0.2% m/m, leaving the y/y rate steady at 2.8%. Fed Governor Bowman speaks at 8:30 AM. Looking ahead, next week’s key data includes ISM surveys, JOLTS job openings, ADP private payrolls, and nonfarm payrolls, alongside increased Fedspeak, including Waller on Thursday.

US equities closed higher on Thursday, though off session highs, with the S&P 500 and Nasdaq still on track for weekly declines. Big tech was mixed, with TSLA rallying while MSFT remained a post-earnings laggard. Outperformers included casinos, life sciences, networking/IT equipment, semiconductors, payments, media, banks, A&D, credit cards, homebuilders, utilities, and real estate. Underperformers were parcels/logistics, commodity chemicals, managed care, and energy.

Treasuries firmed with curve bull flattening as the 10Y yield approached 4.50%. The dollar index dipped 0.1%, with yen strength dominating FX. Gold surged 1.9%, closing at a fresh record. Bitcoin futures rose 0.8%. WTI crude finished up 0.2%.

Earnings continued to dominate market sentiment, with META and TSLA leading gains while MSFT fell post-earnings. Despite the DeepSeek-driven AI selloff earlier in the week, sentiment remained resilient, as hyperscalers defended their capex ramp and OpenAI entered funding talks at a $340 billion valuation. The broader AI narrative continues to evolve, with market participants reassessing growth prospects in the sector.

The FOMC meeting was largely uneventful, with the policy statement leaning hawkish but Powell striking a more dovish tone in his press conference. The Fed is expected to remain on hold, with markets still pricing the first rate cut in June. While inflation has moderated, policymakers remain cautious about easing too soon, particularly given persistent strength in the labor market.

Trump 2.0 policy uncertainty remains a source of market volatility, as he reaffirmed plans to impose 25% tariffs on Canada and Mexico, set to take effect on February 1st. While the market briefly dipped on the announcement, it quickly rebounded, reinforcing the perception that Trump closely watches the S&P 500 as a key indicator of his policy impact. Beyond tariffs, other regulatory and fiscal measures remain unclear, adding to headline risk in the months ahead.

Flow dynamics continue to show retail investors buying the dip while institutions engage in de-risking. Month-end rebalancing is expected to favor bonds over stocks, reflecting concerns about stretched equity valuations and a potential slowdown in corporate earnings growth.

Economic Data

The first estimate of Q4 GDP showed the economy expanded at a 2.3% annualized rate, slightly below the 2.4% consensus forecast and down from Q3’s 3.1%. Growth was driven by strong consumer and government spending but was partially offset by weaker investment and exports. Core PCE inflation increased 2.5% in Q4, in line with expectations but up from 2.2% in the previous quarter, reinforcing concerns about persistent inflationary pressures.

Consumer spending remained robust, rising at a 4.2% annualized pace, the highest since Q1 2023, underscoring the resilience of the US consumer. Meanwhile, initial jobless claims fell to 207K, well below the 225K estimate, marking the lowest level in four weeks. Continuing claims also declined to 1.86 million from the previous week’s upwardly revised 1.90 million, signaling continued labor market strength.

In housing, December pending home sales fell 5.5% month-over-month, breaking a four-month streak of gains. The decline reflects ongoing affordability challenges, as mortgage rates remain elevated and supply constraints persist in key markets.

Company-Specific News by GICS Sector

Information Technology:

- MSFT (-6.2%): Q2 earnings and revenue beat, but Azure growth slowed, guidance disappointed, and management did not reiterate acceleration for 2H. AI-related business saw strong growth, surpassing a $13B run rate.

- IBM (+13.0%): Q4 EPS beat with in-line revenue; 2025 revenue growth outlook at ~5%. Consulting and AI-related businesses strong.

- NOW (-11.4%): Revenue in line but underwhelming billings and deferred revenue. FY25 subscription revenue guidance missed.

- LRCX (+7.4%): Beat and raised on NAND spending and AI-driven capex trends.

- CHKP (+7.4%): Earnings and revenue beat, strong Quantum Force and Infinity platform growth.

Communication Services:

- META (+1.6%): AI infrastructure investments seen as a long-term strategic advantage. Ad revenue grew 21% y/y, with strong engagement trends.

- CMCSA (-11.0%): Q4 EBITDA miss despite better revenue and FCF. Weak broadband net adds and soft advertising weighed on sentiment.

Consumer Discretionary:

- TSLA (+2.8%): EPS missed, but FCF beat, and unit costs declined. Reiterated 2025 new model timeline, upcoming Robotaxi launch, and FSD expansion.

- LVS (+11.1%): Macau weaker, but analysts dismissed it as one-off due to renovations and Xi’s visit. Singapore strong. Dividend raised.

- PHM (+4.9%): EPS and revenue beat, ASPs held up, but Q1 and FY25 delivery guidance light.

- WHR (-16.5%): Weak Q4 EBIT and soft 2025 guidance. Retail destocking still a headwind.

- TSCO (-5.0%): Q4 revenue and EPS missed, with weak comp sales. FY25 EPS guidance also soft

Industrials:

- UPS (-14.1%): Weak revenue, lowered guidance, and confirmed a 50%+ volume cut from AMZN by 2H 2026.

- CAT (-4.6%): Missed on dealer destocking, with soft 2025 guidance. Positive commentary on order backlogs.

- URI (-5.0%): In line Q4, but 2025 EBITDA and FCF guidance weak.

- CHRW (-6.9%): EPS beat, but freight activity still muted.

- TTEK (-2.9%): Earnings beat, but noted delays in government projects under the new administration.

Financials:

- MA (+3.1%): Revenue and EPS beat, with strong US volume acceleration.

- CLS (+13.6%): AI-driven demand tailwinds for data center hardware, potential OpenAI program wins.

Healthcare:

- CI (-6.7%): EPS missed on higher medical costs. 2025 guidance weak. Stop-loss business flagged as a key area of concern.

- TMO (+6.8%): Strong Q4 driven by instrumentation and LPS. FY25 revenue guide slightly below consensus, but EPS outlook ahead.

Materials:

- DOW (-6.1%): Q4 revenue missed, cost-cutting announced, and 2025 guidance light. Lower performance coatings demand.

- IP (-1.6%): NA box/containerboard pricing improved, but weaker volumes offset gains.

Eco Data Releases | Friday January 31, 2025

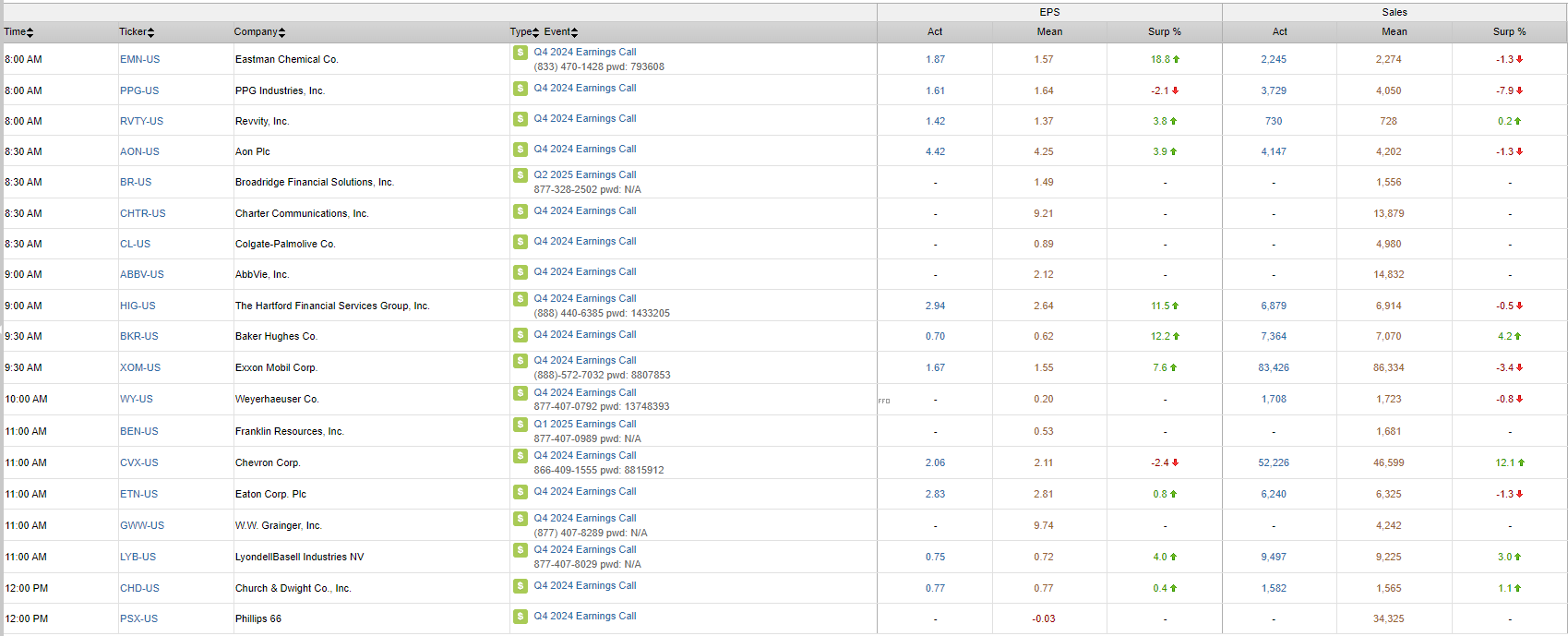

S&P 500 Constituent Earnings Announcements | Friday January 31, 2025

Data sourced from FactSet Research Systems Inc.