February 10, 2025

The S&P 500 continues in a consolidation pattern that started in early December. The index made a marginal new high on January 23rd, but the buyer couldn’t sustain above that level for longer than a day. The move sets up a negative momentum divergence in the RSI and MACD oscillators (chart below, panels 2 and 3), and with price rolling over on Friday, the index takes on a near-term bearish look heading into the week.

With consolidation at the index level stretching into its 2nd month, the pressure starts to mount on the bull. Loss of upside momentum has us anticipating a more protracted consolidation. However, interest rates have rolled over (chart below) after the US10yr Treasury Yield hit 4.8% in January. The 10yr Yield now sits just below near-term support at the 4.5% level. If rates continue moving lower, we could see a path where the housing market opens back up, lending increases and the consumer gets a second wind. If they stay sticky in the mid-4’s or move higher, we will likely want to de-risk our portfolio and add income and commodities exposure.

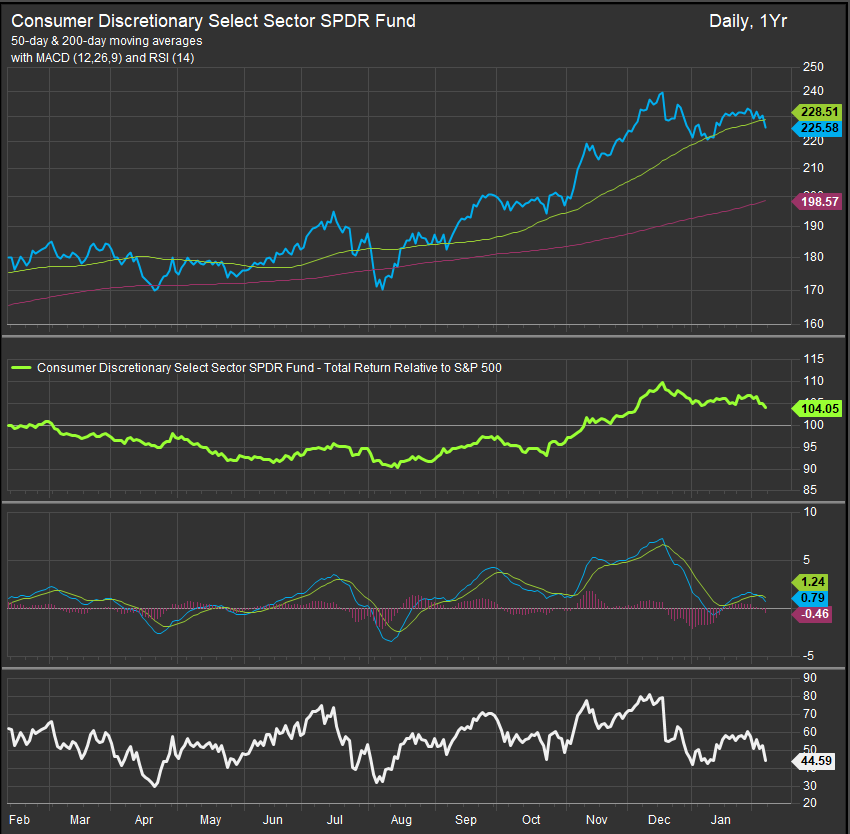

Given that price consolidations by their nature are potential pivots and we have consolidating action in both the S&P 500 price and the US 10yr Treasury Yield, we want to look to Consumer Discretionary performance to give us signal on the direction of the top-line indices.

Consumer Discretionary Sector Performance in the near-term will offer a clue

The chart of the Select Consumer Discretionary SPDR ETF (XLY) (below) shows the price in consolidation between the $220 and $240 levels. A move below $220 would confirm a bearish near-term pattern and project to a retest of support at the $200 level. This lines up with a potential retracement of all post-election optimism for the sector. The market is signaling skepticism that President Trump can deliver on all of candidate Trump’s promises. The backdrop of tariff bluster is likely not helping. We expect we will get a signal this week on whether the buyer will defend the $220 support for the Discretionary Sector or not.

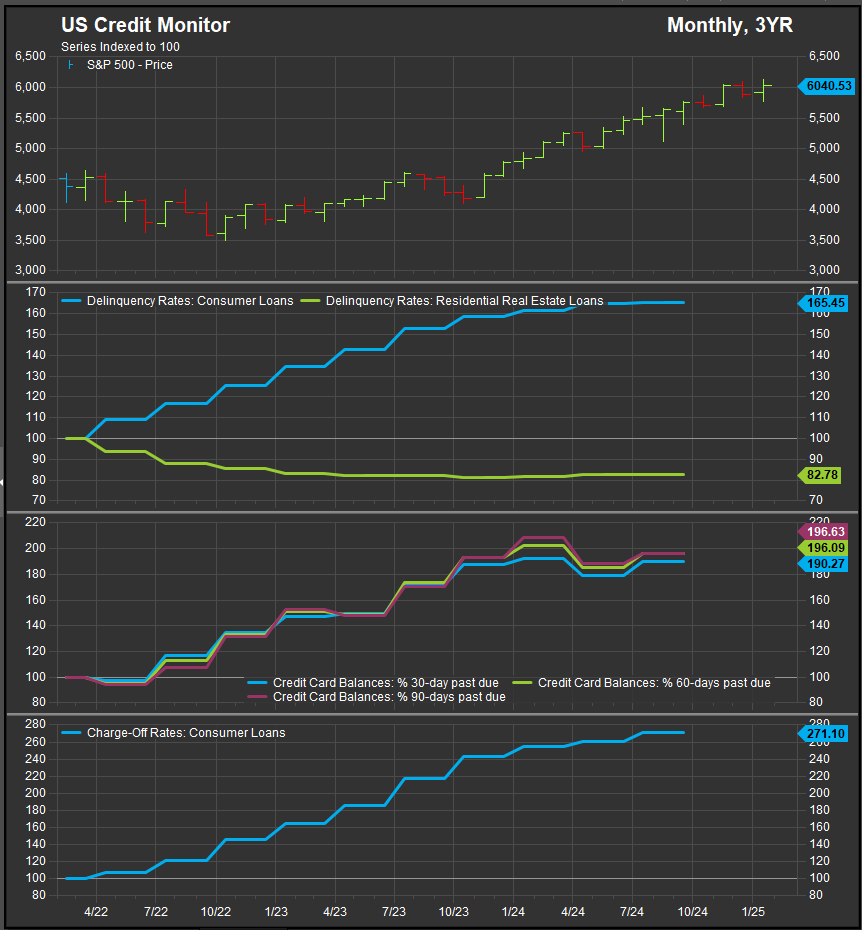

We would expect a buy signal to come with falling rates. The Discretionary sector has strong projected forward earnings, but that projected growth relies on continued spending power. Consumer loan delinquencies, credit card delinquencies and consumer loan charge-off rates are all moving higher through 2024. The data lags, but absent some softer prints for the intervening periods, the trend away from the Residential loans is clear. Consumers on the margins are starting to stretch their credit to continue with the pace of purchases. The chart below shows the pace of delinquencies doubling and consumer loan charge-off rates almost tripling since mid-2022.

Is the good news priced in for AMZN and TSLA?

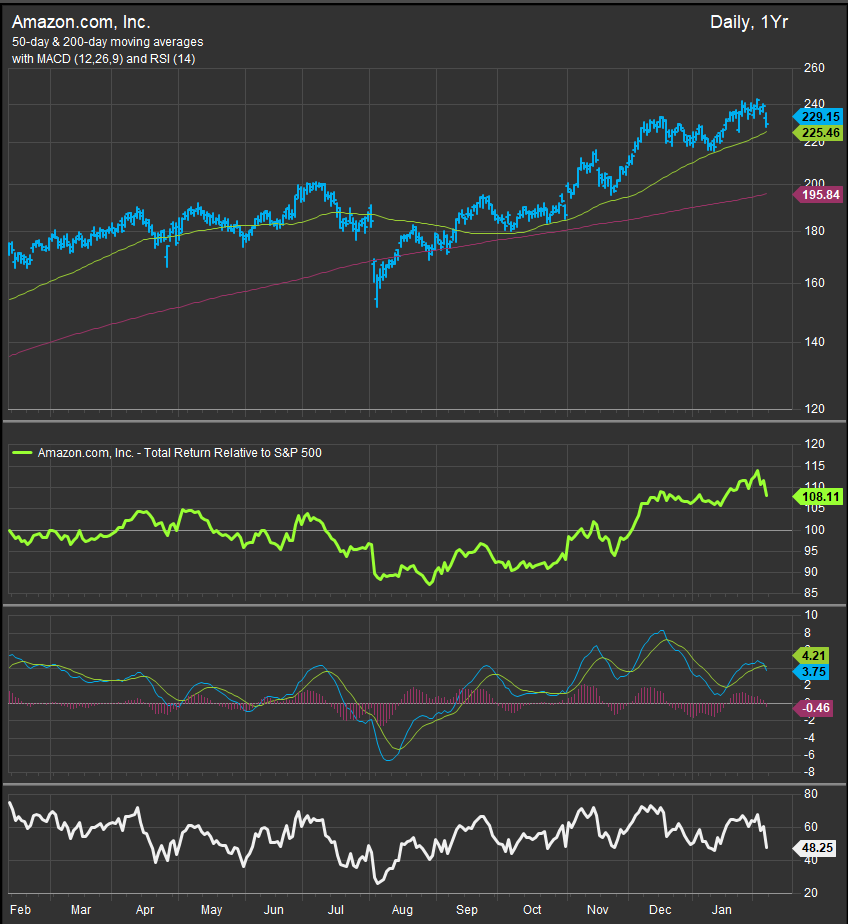

AMZN and TSLA have both been key drivers of outperformance for the discretionary sector. Each has delivered strong earnings Growth at high valuations. However, we are getting to a point where the valuations are looking expensive relative to consensus earnings. This increases the leverage interest rates are likely to exert on earnings growth. Both of these companies need consumer balance sheets to improve. Both have operations that are levered to interest rates in one way or another. TSLA buyers are exposed through car loan rates while AMZN buyers are exposed through revolving credit rates. As we showed earlier, delinquencies are on the rise, which is typically an upwards pressure on the cost of credit.

When factoring in headwinds to the consumer we should also consider that both companies are richly valued relative to the broad market. Amazon is 1.5x more expensive than the S&P 500 on consensus NTM earnings while TSLA is >5x more expensive by that metric. TSLA, by these consensus metrics, offers 1.5x the earnings growth of the S&P 500’s aggregate pace. AMZN is growing earnings at half the pace of the S&P over the next 12 months.

The TSLA stock chart (below) has retraced to near-term support. A major test for the post-election buyer of the stock is in the offing.

The AMZN chart (below) hasn’t had the same level of enthusiastic buying, but the buyer gets a chance to show their hand at the $220 level. A violation for either chart would be hard for the sector to overcome given their prominent weights.

The companies in the sector that boast discounts to their earnings and strong forward projections are NCLH, EXPE, RCL and CCL. BKNG also shows discounted earnings. What’s interesting to us when considering the fundamentals more deeply is the woeful stock charts of companies like BWA and GM. Both project to grow earnings at a better clip than the S&P 500 over the next 12-months at a discounted valuation, but both have persistently underperformed.

BWA went nowhere in 2024 despite equities in a bull trend for the year. We only point this out because Borg Warner screens as growing earnings 6.6x faster than the S&P 500 over the next 12 months at 30% of the price of the S&P 500’s earnings.

Conclusion

While the S&P 500 remains in consolidation, we look to the behavior of economic bellwether sectors to get a clue as to whether investors are accumulating or distributing shares. The Discretionary sector has consolidated towards clear near-term support levels along with cornerstone stocks AMZN and TSLA. We are looking for clues to the broad market’s direction based on the near-term price action in these charts.

We’ve started February with an overweight position in Discretionary stocks in our Elev8 sector model. We continue to give the benefit of the doubt to the prevailing bull trend. The growth stories for AMZN and TSLA are at a key pivot point in the near-term and those two stocks will exert a heavy influence on the sector’s aggregate performance. Those stocks are nearing uptrend support, and despite their lofty valuations, the buyer has shown up to accumulate shares persistently.

We may also see some signal if a laggard with strong near-term earnings growth projections like BWA gets picked up, but till then, keep that in your pocket for when the efficient market enthusiast gets turned up too high at the next conference.

Patrick Torbert, Editor & Chief Strategist, ETFSector.com

Data sourced from FactSet Research Systems Inc.