February 24, 2025

S&P futures are up 0.5% after Friday’s 1.7% drop, the worst session of the year, with momentum stocks under pressure. Asian markets were mostly lower, with India lagging and Japan closed for a holiday. European markets gained, led by Germany post-election, though any debt brake reform remains uncertain. Treasuries weakened with curve flattening, while the dollar index was steady. Gold edged up 0.1%, Bitcoin futures rose 1.1%, and WTI crude added 0.3%.

The market is attempting a rebound after last week’s losses, though concerns over government funding negotiations and House GOP divisions on Trump’s legislative priorities, including the TCJA extension, remain in focus. Defensive sentiment has been attributed to weaker growth data, cautious corporate guidance, and fading retail investor interest.

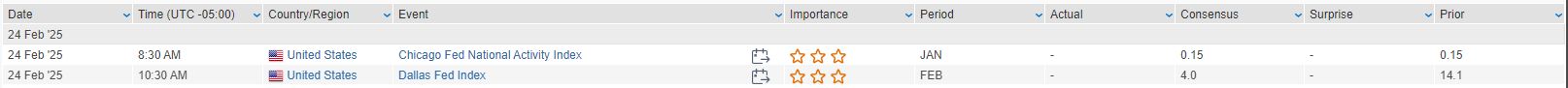

Economic Calendar:

- Today: Dallas Fed manufacturing survey, $69B 2-year Treasury auction.

- Tuesday: Consumer confidence, Richmond Fed manufacturing, home price data, $70B 5-year auction, Fed speakers Barr & Barkin.

- Wednesday: New home sales, $44B 7-year auction, Fed speakers Barkin & Bostic.

- Thursday: Q4 GDP revision, durable goods, jobless claims, pending home sales, multiple Fed speakers.

- Friday: Personal income & spending (PCE inflation), Chicago PMI, Fed’s Goolsbee speaks.

Corporate News:

- Berkshire Hathaway’s (BRK.B) operating income surged 71% year-over-year, with record $334B in cash.

- Apple (AAPL) to invest over $500B in the U.S. and hire 20K workers over four years.

- Microsoft (MSFT) is canceling a significant amount of U.S. data center leases.

- Alibaba (BABA) plans to invest at least $52B in cloud and AI over the next three years.

- Uber (UBER) CEO said Musk will not make Tesla (TSLA) robotaxis available for its rideshare platform.

- Altice USA (ATUS) and MSG Networks reached a deal to restore regional sports programming in New York.

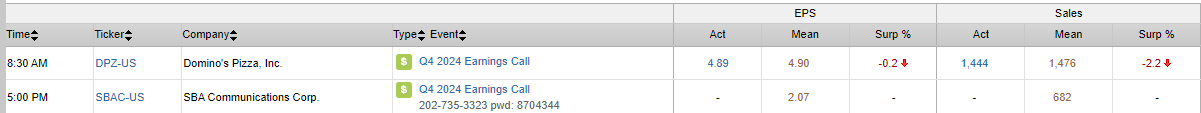

Earnings Watch:

- Nvidia (NVDA) reports Wednesday after the close, with key focus on AI demand and data center growth.

U.S. equities fell sharply on Friday, with the S&P 500 posting its worst session of the year as major indices ended the week lower. The Dow declined 1.69%, the S&P 500 dropped 1.71%, the Nasdaq fell 2.20%, and the Russell 2000 tumbled 2.94%. Big tech stocks struggled, with Nvidia and Tesla among the notable laggards. Other weak areas included managed care, hospitals, semiconductors, software, trucking, airlines, energy, regional banks, credit cards, industrial metals, chemicals, machinery, homebuilders, and small caps. Sectors that held up better included pharma/biotech, food and beverage, household products, tobacco, cosmetics, exchanges, telecom, and Chinese tech stocks.

Treasuries strengthened, with the 10-year yield falling toward 4.40% after hitting an intraday high of 4.57% earlier in the week. The dollar index gained 0.2%, gold slipped 0.1%, and Bitcoin futures fell 3.8%, closing near session lows after early strength. WTI crude dropped 2.9%, settling just above $70 per barrel.

The selloff was driven by growth concerns following weaker economic data. The flash February PMIs disappointed, with services slipping into contraction for the first time in over two years, while manufacturing remained in expansion territory, possibly due to preemptive tariff-related demand. The final University of Michigan consumer sentiment index weakened further, with a spike in one-year inflation expectations to 4.3% and an increase in five-year expectations to 3.5%. Additionally, January existing home sales fell more than expected, reflecting ongoing affordability challenges.

Market sentiment was also weighed down by dampened retail buying, stretched positioning, and uncertainty around tariffs, taxes, and geopolitics. Big options expiry likely added to volatility, while earnings guidance trends remain a concern despite a strong Q4 reporting season. Fed Vice Chair Jefferson spoke Friday, but his comments focused on central bank communication rather than monetary policy.

Company News by Sector

Consumer Staples

- Celsius Holdings rose 27.8% after a Q4 beat on EPS and revenue, with gross margins ahead of expectations. The company announced a $1.8B acquisition of Alani Nu, which is expected to close in Q2 and be accretive to EPS in its first full year.

- Sprouts Farmers Market fell 15.6% despite a Q4 earnings, revenue, and comps beat, as FY25 guidance midpoints only slightly exceeded consensus. The stock had gained 34% year-to-date before the report.

- BJ’s Restaurants gained 6.5% after Q4 results and FY25 guidance came in ahead of expectations, with traffic improvement, margin expansion, and buybacks supporting the stock.

Consumer Discretionary

- Floor & Décor added 1.5% following a Q4 earnings, EBITDA, and revenue beat, with comp declines less severe than feared. Analysts upgraded the stock, citing potential demand recovery.

- Hims & Hers Health dropped 25.8% after the FDA reported that semaglutide shortages had been resolved, raising concerns about future demand for weight-loss prescriptions.

- Rivian declined 4.7% after a Q4 revenue beat but EPS miss, despite reporting its first positive gross margin quarter. However, FY25 guidance for adjusted EBITDA and production fell short of expectations.

- Texas Roadhouse was under pressure despite a Q4 earnings beat, as the company flagged softer year-to-date demand and commodity price pressures.

Energy

- The sector struggled, falling 1.95%, as crude oil prices dropped 2.9% and WTI settled just above $70 per barrel.

Financials

- Coinbase rose on reports that the SEC may dismiss an enforcement case against the company.

- Block fell 17.7% after a Q4 adjusted EBITDA beat but revenue miss, with Q1 and FY25 gross profit guidance coming in below expectations. Analysts were cautious about the company’s reliance on second-half improvements.

- CarGurus slid 17.1% after a Q4 earnings and margin beat, but revenue and Q1 guidance fell short. Analysts were positive on Marketplace growth but cautious on CarOffer trends.

Industrials

- Saia and Old Dominion Freight Lines both fell sharply as concerns grew that Amazon may be expanding its internal LTL capacity. TFI International’s CEO also warned about an unclear first-half outlook, adding to sector pressure.

Information Technology

- Solaris Energy Infrastructure surged 22.6% despite Q4 earnings coming in light, as revenue exceeded expectations. The company announced new power solutions contracts and data center-related orders.

- Akamai fell 21.7% after Q4 revenue met expectations but Q1 and FY25 guidance disappointed. Analysts flagged legacy migration issues, FX headwinds, and slowing core business. Multiple firms downgraded the stock.

- Dropbox dropped 16.2% despite a Q4 revenue, earnings, and margin beat, as management warned of churn risks. FY25 guidance was underwhelming even after factoring in headwinds from the FormSwift acquisition.

- RingCentral declined 5.9% after Q4 revenue and AEBITDA slightly exceeded expectations, but FY25 revenue guidance came in lower. Slowing ARR growth was a concern for analysts.

Healthcare

- UnitedHealth Group fell 7.2% after reports that the Department of Justice is investigating billing practices tied to Medicare Advantage payments. The company denied the allegations, calling them “outrageous and false.”

- Glaukos slid 20.0% despite a Q4 revenue beat, as 2025 revenue guidance only met consensus. The stock had been priced for a stronger outlook, and iDose product sales fell short of high expectations.

- Insulet declined 1.9% despite Q4 earnings and revenue exceeding expectations, as investors focused on the company’s conservative U.S. Omnipod revenue guidance.

- Travere Therapeutics fell 6.8% following a Q4 earnings miss, though revenue slightly exceeded estimates. Analysts were disappointed by the lack of FY25 Filspari guidance.

Real Estate

- Ryan Specialty Holdings declined 4.7% after reporting Q4 EPS in line with estimates, but organic growth slowed due to property rate pressure. FY25 EBITDAC margin guidance also missed consensus.

Communication Services

- The RealReal fell 18.8% despite reporting Q4 revenue and EBITDA at the high end of guidance. Analysts were positive on growth trends and AI initiatives, but the stock had gained 443% in 2024, making expectations difficult to exceed.

Materials

- Industrial metals and chemicals stocks underperformed, declining 1.80% amid macroeconomic uncertainty.

Eco Data Releases | Monday February 24th, 2025

S&P 500 Constituent Earnings Announcements | Monday February 24th, 2025

Data sourced from FactSet Research Systems Inc.