March 6, 2025

S&P 500 futures are down 1% in early trading, following Wednesday’s broad market rally where all major indexes gained over 1%. Autos, industrial metals, chemicals, machinery, airlines, and builders led the advance, while energy lagged, falling ~1.5%. Overnight, Asian markets were mostly higher, with Hong Kong up 3%, while European markets slipped 0.2%. Treasuries weakened, with the yield curve bear steepening, while the dollar index dipped 0.2%. Gold fell 0.8%, Bitcoin futures rose 0.6%, and WTI crude edged up 0.2% after its sharp decline on Wednesday.

The market is struggling to sustain Wednesday’s gains, despite reports that Trump is considering agricultural tariff carveouts for Canada and Mexico. The temporary auto tariff delay, which fueled the prior session’s bounce, is still viewed as limited relief, with Canada maintaining retaliatory tariffs. Meanwhile, Trump’s rhetoric suggests no broader shift in trade policy, and Treasury Secretary Bessent’s comments reinforce concerns that the “Trump put” is further out of reach.

The AI sector remains under pressure, as seen with Marvell Technology (MRVL), which declined after offering guidance that was largely in line but failed to impress. In retail, Victoria’s Secret (VSCO) is the latest company to warn of softening consumer trends. Meanwhile, rising global bond yields remain a focus, though Germany’s increased fiscal spending is viewed as a macro positive and is driving a shift into global equities over U.S. stocks.

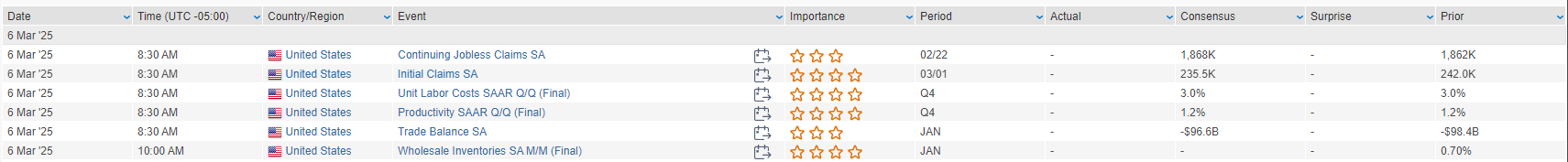

Today’s key economic releases include the trade balance, Q4 nonfarm productivity, unit labor costs, initial jobless claims, and wholesale inventories. Jobless claims will be closely watched after last week’s jump to a five-month high, with expectations at 235K vs. the prior 242K. Fed officials Harker, Waller, and Bostic are scheduled to speak, while the ECB is expected to cut rates by 25 bps, bringing total easing to 150 bps since last summer. The February jobs report is set for release Friday, with Fed Chair Powell, Williams, and Kugler also speaking.

Corporate News

- Alibaba (BABA) surged after launching a new open-source AI model.

- Marvell (MRVL) disappointed as guidance came in line with expectations, though AI commentary and Amazon (AMZN) ramp guidance were more upbeat.

- Zscaler (ZS) rallied after beating earnings and raising guidance, citing strong billings and improved sales productivity.

- Veeva Systems (VEEV) jumped on better billings, margin guidance, and a key EDC contract win.

- MongoDB (MDB) fell sharply, as a solid Q4 was overshadowed by weaker FY26 guidance, though some analysts defended the stock.

- Victoria’s Secret (VSCO) warned of weakening sales trends in late January and February, cutting Q1 and FY25 guidance.

- Sleep Number (SNBR) flagged soft demand due to reduced marketing, macro challenges, and tariff headwinds, alongside a CEO transition.

- ON Semiconductor (ON) went public with a $6.9B bid for Allegro MicroSystems (ALGM), which was rejected.

U.S. equities rebounded on Wednesday, with the S&P 500 (+1.12%), Dow (+1.14%), Nasdaq (+1.46%), and Russell 2000 (+1.02%) all posting solid gains. The rally followed Tuesday’s selloff, which erased all post-election gains. Big Tech led the rebound, while industrial metals, chemicals, airlines, builders, machinery, and transports also outperformed. Energy, regional banks, networking, and payments lagged.

Markets were buoyed by White House confirmation of a one-month tariff reprieve for automakers, easing concerns over escalating trade tensions with Canada and Mexico. Additionally, a stronger-than-expected ISM Services report helped offset earlier worries sparked by a weaker ADP private payrolls print. Sentiment was further lifted by Germany’s “whatever it takes” fiscal expansion plan, which drove European stocks higher but also pushed global bond yields upward.

Treasuries weakened, with the largest declines in the belly of the curve, as the rise in global bond yields remained a key fixed-income story. The dollar index fell 1.4%, marking its worst session since November 2023. Gold edged up 0.1%, Bitcoin futures surged 3.9%, and WTI crude dropped 2.9%, closing at its lowest level since September—a potential positive for inflation concerns.

Despite the rally, skepticism remains. Trump’s speech on Tuesday reaffirmed his aggressive tariff strategy, with no indications of backing down on trade policies targeting China, Canada, and Mexico. Stagflation risks, ongoing systematic selling from CTAs, and concerns over negative earnings revisions continue to loom over the market.

Key Economic & Policy Developments

- February ADP Private Payrolls: 77K, well below the 150K consensus and down from 186K in January, signaling labor market softening.

- February ISM Services: 53.5, above the 53.0 estimate and January’s 52.8. New orders and employment rose, but prices index held above 60 for the third straight month, raising inflation concerns.

- Fed’s Beige Book: Reported slightly higher economic activity since mid-January but noted softer consumer spending, rising price sensitivity, and concerns over tariffs driving price increases. Employment remained steady, with labor availability improving.

- Tariff Developments:

- White House confirmed a one-month tariff delay for autos, after Commerce Secretary Lutnick suggested some sectors might be spared from a 25% tariff.

- Trump’s comments on tariffs suggested no major reversals, with further trade disruptions expected.

- China warned it is prepared for a trade war with the U.S. (Axios).

Sector Performance & Notable Company News

Technology (+1.39%)

- Alphabet (GOOGL): Urging the DOJ to drop its push to break up the company, citing national security risks.

- Box (BOX, -3.2%): Q4 earnings in line, but guidance for Q1 and FY26 below expectations. Analysts noted margin headwinds from investments, though AI monetization remains a long-term positive.

- Credo Technology (CRDO, -14%): January quarter beat estimates, but scrutiny remains over 86% of revenue coming from Amazon.

Communication Services (+1.50%)

- Flutter (FLUT): Issued FY25 guidance in line with consensus, seen as a positive in an uncertain macro environment.

- Criteo (CRTO): Beat earnings and guided above expectations, though concerns persist over revenue concentration with its biggest customer.

Healthcare (+1.01%)

- Moderna (MRNA, +15.9%): CEO Stephane Bancel bought 160K shares, signaling confidence in the company.

- Novo Nordisk (NVO): Cut Wegovy prices to $499 per month, a move aimed at expanding accessibility.

- Chimerix (CMRX, +70.6%): To be acquired by Jazz Pharmaceuticals (JAZZ) for $935M, a 72% premium to its prior close.

Consumer Discretionary (+1.75%)

- Tesla (TSLA): German registrations dropped over 75% YoY, reflecting weak demand in Europe.

- Ford (F, +7.2%) & General Motors (GM, +7.2%): Rallied after confirmation of a one-month delay in auto tariffs on Canada and Mexico.

- Ross Stores (ROST): Q4 earnings beat expectations, but FY guidance was light, citing macro and geopolitical volatility.

- Foot Locker (FL, +5.1%): Q4 comps and revenue beat, though FY guidance disappointed due to consumer uncertainty.

Consumer Staples (+0.43%)

- Brown-Forman (BF.B, +10.1%): Q3 EPS beat, but revenue and operating income missed. Analysts noted the bar was low, but broader market trends remain a concern.

- Campbell Soup (CPB, -2.9%): Lowered full-year guidance, citing weakness in snack sales.

- Albertsons (ACI, +5.3%): To be added to the S&P MidCap 400 index, replacing AZPN, which is set to be acquired.

Industrials (+1.59%)

- Huntington Ingalls (HII, +12.4%): Rallied after Trump announced plans for a new White House Office of Shipbuilding.

- Thor Industries (THO, -14.5%): Missed Q2 earnings estimates and cut FY25 guidance, citing continued margin pressure.

- AeroVironment (AVAV, -4.4%): Missed earnings and lowered guidance, blaming California wildfires and high winds.

Materials (+2.63%)

- Carrier Global (CARR, +4.5%): Upgraded to Overweight at JPMorgan, which cited conservative guidance and an attractive valuation post-tariff-related pullback.

Energy (-1.51%)

- WTI crude fell 2.9%, hitting its lowest close since September, weighing on the sector.

- Oil traders grappling with tariff uncertainty, with prices swinging based on Trump administration comments.

Financials (+0.63%)

- Fifth Third (FITB, -2.8%): Lowered Q1 EPS expectations, citing weaker fees, reserve build, and tariff risks impacting capital markets.

- Bankers losing hope for M&A rebound, with uncertainty weighing on deal-making activity.

Real Estate (+1.01%)

Eco Data Releases | Thursday March 6th, 2025

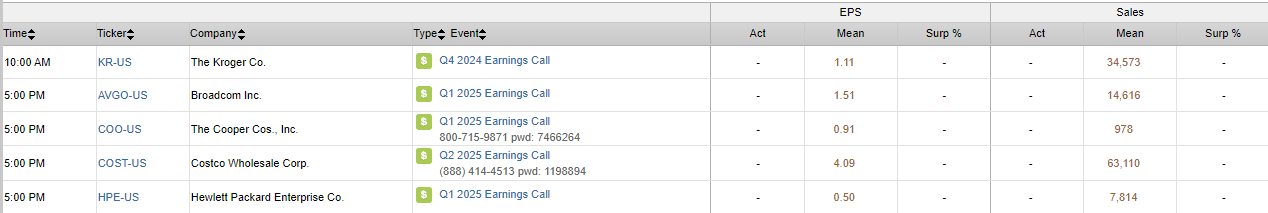

S&P 500 Constituent Earnings Announcements | Thursday March 6th, 2025

Data sourced from FactSet Research Systems Inc.