COMMENTARY:

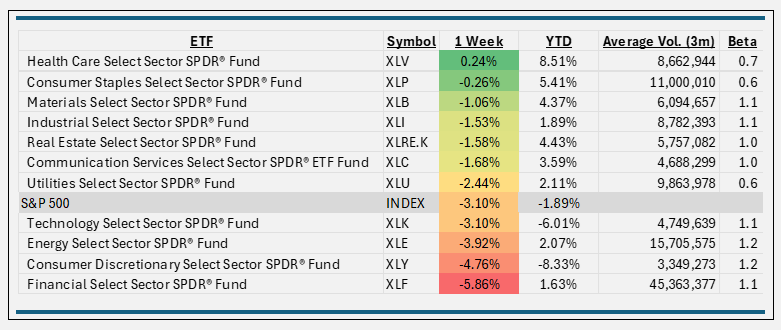

- The S&P500 index had a rough week, falling 3.1%, and swung into negative territory YTD for the first time in 2025. The index logged its sixth consecutive session with a move greater than 1%, on Thursday, marking its longest such streak since November 2020, and is on pace for its worst week since September. Thursday’s sharp selloff marked the S&P’s biggest pullback of the year for the second time this week.

- Only one of the eleven S&P sectors had gains; Health Care rose slightly, up 0.2% this week. Moderna (+15.0%), Molina Healthcare (+8.7%), and HCA Healthcare (+7.8%) contributed to the gain.

- Financials were hit the hardest, with a 5.9% decline. A reported record US trade deficit in January, Stagflation fear, and interest rate uncertainty were on investors’ minds this week. Constituents in the index that fell the most included KKR & Co, (-15%), Discover Financial Services (-14.1%), and Capital One (-13.7%).

- Consumer Discretionary was hit hard as well, falling 4.8%. Concerns persist over Trump’s aggressive trade policies, sticky inflation, and negative earnings revisions. Tesla, which represents 13% of the index exposure, fell 10.4%. A handful of smaller stocks had double-digit negative returns for the week. Caesars Entertainment (-14.3%) and Ralph Lauren (-14.2%) were examples of those.

- The last two weeks have seen two sectors falling into negative territory year-to-date. Consumer Discretionary is down about 8%, and Technology had fell about 6%. The other nine sectors continue to hold in the green since the end of 2024 with HealthCare in the lead u 8.5%.

ETF TIDBITS:

State Street Global Advisors continues to innovate. This week, it expanded its lineup to include a global multi-asset allocation ETF. Preeminent hedge fund Bridgewater Associates actively managing the fund makes it special. The SPDR Bridgewater All Weather ETF (ALLW) provides access to two strong asset management brands in a liquid, accessible ETFs wrapper.

As index-based products see continued demand, index methodology—alongside cost, performance, and brand—is becoming crucial to financial advisers, Cerulli Associates says. Accordingly, asset and wealth managers consider index construction as a means to differentiate their products, according to new research sponsored by S&P Dow Jones Indices. According to the new research, financial advisers with at least 10 per cent of their client assets invested in ETFs expect to allocate 49 per cent of total assets to index-based strategies in the next two years, up from 46 per cent in 2024. Advisers consider the quality of index design (82 per cent), brand (56 per cent), and index data resources (52 per cent) as the top three factors when reviewing an index for an ETF product. Beverly Chandler 3/6/25