March 11, 2025

The S&P 500 has broken down from support and is now in correction territory with shares down a shade less than 10% since hitting all-time highs in late February. Rotation away from Growth/Speculative areas of the market is now obvious. We are seeing moves to government bonds, quality factor ETFs, international equities, low vol. equities, 0-day options and cash.

With equities now at deeply oversold levels we are set up for a counter-trend rally. Given the steepness of the decline, we expect the first rally will fail. Given the prevalence of the 50-day and 200-day moving average in trading signals, we think that the initial rally will fail in the convergence zone between those two series. For the S&P 500, that’s between 5736 and 5966 (chart below). Using intraday highs and lows we project a slightly lower bearish objective than we published last week (5418), we see 5330-5418 as our “support zone” for the current correction.

Typically, a second low in a steep decline after an intervening rally is where positive momentum divergences form in bull markets. Referring to the chart above we can see that setup in the December 2024 price action. We want to see something similar play out in March before we can get interested in buying the dip.

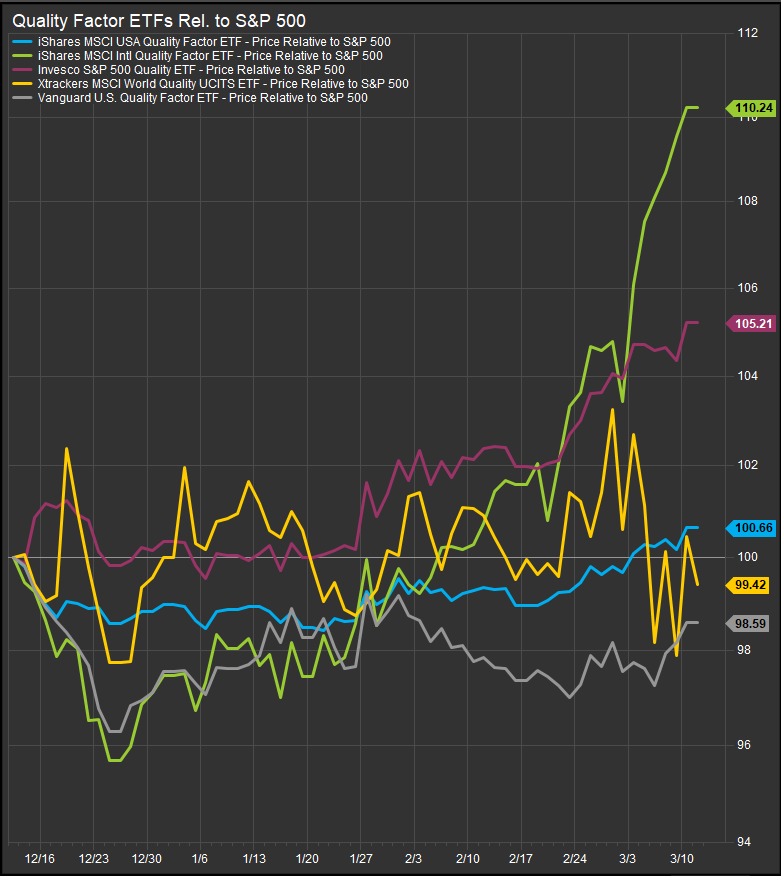

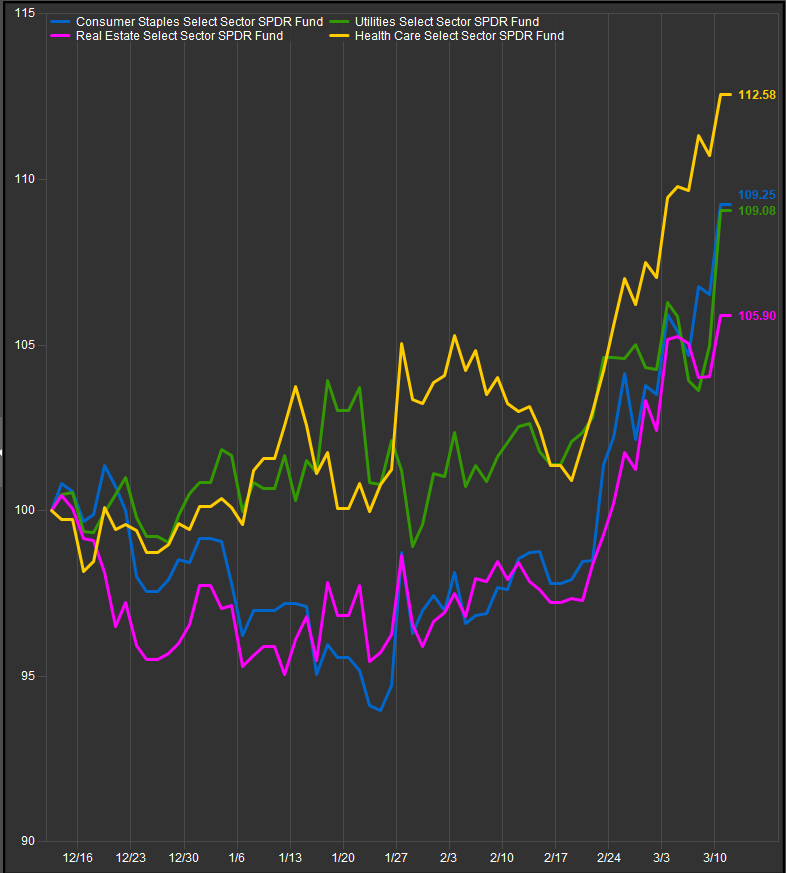

In the meantime, we think government credit, mortgage-backed securities, quality factor funds and income generating sectors of the equity market are where to hide out from the turbulence.

GOVT

MBS

Quality Factor

Defensive Sectors Relative to the S&P 500

Conclusion

Given that investors are coming to recognize the bearish setup, we think the downside scenario likely plays out in weeks not days. Those that haven’t been in a crouch may want to fade Growth exposures during the first rally and look for a subsequent low with abating downside momentum to re-enter offensive exposures.