COMMENTARY:

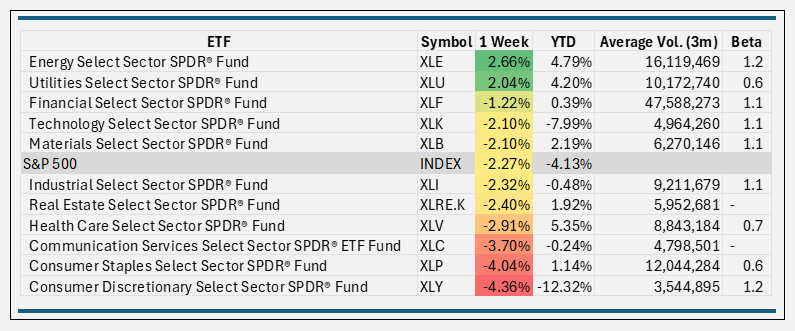

- The S&P 500 index added to its YTD decline, falling 2.3% this week. The Index is off by 4.1% since the end of December. Heightened uncertainty regarding trade policy and tariffs plus moderating economic activity on job growth and GDP growth also played a role. The 10-year bond yield fell to 4.3%, signaling a flight to safety.

- Only two of the S&P sectors had positive returns for the week. Energy (+2.7%) and Utilities (+2.0%). Data Centers and AI: Accelerating demand for electricity to power data centers (driven by AI growth) and clean-tech manufacturing boosted utilities. ConocoPhillips (+9.2%) was the best performer in the Energy sector, and AES Corp. gained 9.2% and sat atop the Utilities stocks.

- The sectors hit hardest this week were Consumer Discretionary (-4.4%) and Consumer Staples (-4.4%). Declines in consumer sentiment, inflation pressure throughout the economy, and uncertainty about trade policy were all factors that drove the negative returns. Expedia Group fell 12.0%, and Estee Lauder was down 9.3%. These two stocks were the worst individual performers in each of the two sectors.

- While most of the eleven sectors remain in positive territory year to date, four have swung into negative territory, with Consumer Discretionary off 12.3% and Technology down 8.0%.

ETF TIDBITS:

ETF giants had different experiences this week:

Vanguard funds received $1.4 billion in flows this week, raising its year-to-date net flows to just over $75 billion, while Invesco saw $629 million exit its funds, bringing its 2025 net flows to $14 billion. Also, BlackRock takes in $2 Billion, while State Street Waves $1.1Billion Goodbye, according to etf.com data.