COMMENTARY:

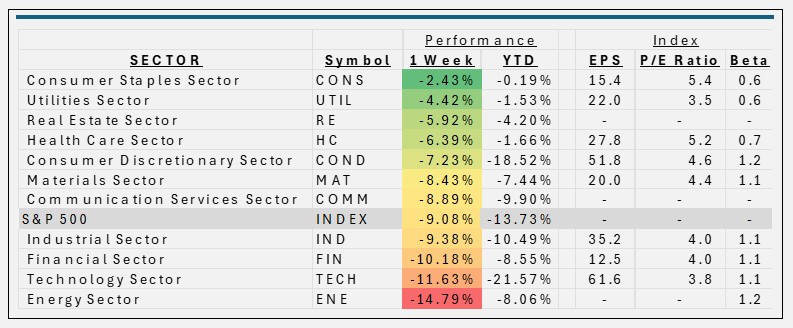

- Bloomberg screens this week should have had background music playing UB40’s song Red, Red, Wine. The primary driver of this week’s sell-off was the start of a tariff war that the administration believes will level the import/export playing field in the future. Investors clearly don’t like uncertainty, as the S&P500 fell 9.0%, bringing every sector along for the ride. The index is now down 13.7% YTD.

- All eleven sectors had declines this week. Consumer Staples fell the least, (-2.4%). Only seven of the 38 constituents had positive returns. Lamb Weston Holdings (+9.2%) and Dollar General (+7.6%) gained the most. The bottom two laggards were Estee Lauder (-19.0%) and Archer-Daniels-Midland (-9.5%).

- Energy was hit the hardest, down 14.8% for the period. Each and every one of the 23 sector holdings was in the red. These five names all decline in excess of 20%: APA Corp., Diamondback Energy, Valero Energy, Halliburton, and Devon Energy. Drivers included an 8% drop in oil prices, anticipation of how China will react to the tariffs, and an increasing assumption of a near-term recession.

- The Tech sector was also hit hard, falling 11.6%. Only ONE stock in the index gained; First Solar was up 1.0%. Six of the smaller constituents all had losses of over 20%. Micron Technology, Western Digital, and Dell Technologies, to name a few. However, it was the loss of $1.8 trillion of market value of the combined “Mag-7” stocks that was the primary driver.

- As Friday came to a close, and some investors’ eyes may have been bloodshot, it may have been a good time to open that bottle of red….

ETF Tidbits:

ETFs experienced significant outflow this week as investors sought safe haven, while market uncertainty shakes out:

Asset Class Key Movement Notable ETFs

Equity ETFs $10.85B outflows Tech (-$1.69B), Consumer Discretionary (-$1.18B)

Money Market Funds $22B inflows Ultrashort Bonds (+$14B in March)

Gold ETFs $7.4B inflows (March) SPDR Gold Shares (GLD, +19.2% Q1)

Bitcoin ETFs $99.8M outflows (April 3) GBTC (-$60M), FBTC (-$23M)