April 7, 2025

S&P futures -1.7%, Nasdaq -2.6% in Monday morning trading, both off worst overnight levels. VIX >45. Follows last week’s sharp equity selloff, with the S&P 500 down over 9% and Nasdaq off 10%—worst two-day decline since March 2020. Index is now down 17% from February highs. Treasuries firmer with curve bull steepening. Dollar index -0.2%. Gold -0.3%. Bitcoin futures -3.5%. WTI crude -2.8%.

Risk-off sentiment persists as Trump and administration officials doubled down on tariffs over the weekend, showing little willingness to negotiate. This overshadowed reports of global interest in talks. Recession risks are rising alongside valuation concerns, record YTD equity inflows, and poor policy sequencing. Despite a brief pricing-in of 125 bp in Fed cuts today, recent Fedspeak—especially Powell’s—remains cautious due to resilient growth and sticky inflation.

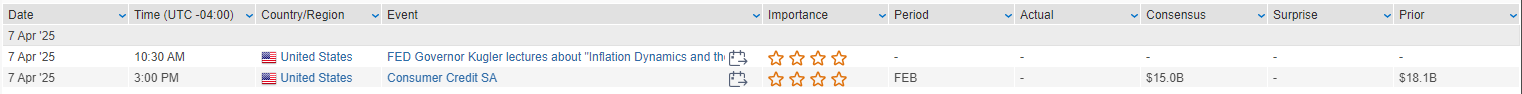

No major data on the calendar today, though Fed Governor Kugler speaks at 10:30. Focus this week includes CPI (Thursday), PPI (Friday), and multiple Fed speakers including Daly (Tuesday), Barkin (Wednesday), and Powell’s colleagues throughout Thursday and Friday. FOMC minutes also due Wednesday.

Corporate Highlights:

- META launched its Llama 4 AI model amid growing Chinese competition.

- TSLA featured in NYT on booming used EV market.

- CPRI reportedly nearing sale of Versace to Prada at ~€1B (1/3 lower than initial expectations).

- SBUX to slow expansion in India.

- WBD boosted by a $150M+ opening weekend for Minecraft.

- QGEN raised Q1 and FY guidance.

- APO, BX, CG, KKR mentioned in FT piece on institutional investors seeking exits from private equity stakes.

Markets ended sharply lower Friday (Dow -5.50%, S&P 500 -5.97%, Nasdaq -5.82%, Russell 2000 -4.37%) as global trade fears intensified following China’s announcement of a 34% tariff on all U.S. imports, effective April 10. This retaliation matches the Trump administration’s reciprocal tariffs and compounds earlier hikes, bringing effective rates to 54% on Chinese imports. The S&P 500 closed out its worst two-day performance since March 2020, down 17.4% from its February peak, while the Nasdaq entered bear market territory.

Risk aversion remained elevated amid uncertainty around Trump’s willingness to negotiate, with the president doubling down on his policies but also referencing a “productive” call with Vietnam. These mixed signals are compounding fears that tariffs are not just a negotiating tool but a core structural pillar of Trump 2.0 policy—potentially used to fund fiscal promises like the TCJA extension.

The Fed remains in wait-and-see mode, with Chair Powell warning that tariffs could create persistent inflation pressures and weigh on growth. He reiterated the Fed is not in a hurry to cut rates and described the outlook as “highly uncertain,” despite markets increasingly betting on a June cut. Meanwhile, fiscal policy is also in flux, with Republicans reportedly considering raising the top tax rate and eliminating corporate SALT deductions as part of reconciliation efforts—potentially dampening hopes of a strong counter-cyclical stimulus.

Economic Data:

- March Nonfarm Payrolls: +228K vs. ~140K expected.

- Unemployment Rate: Rose to 4.2%, in line with estimates.

- Average Hourly Earnings: +0.3% m/m; +3.8% y/y.

- Gains seen in health care, transportation/warehousing, and social assistance.

- DOGE-related government layoffs not yet visible in payroll data.

- Some hiring may have been accelerated due to pre-tariff import efforts.

GICS Sector Highlights:

Consumer Discretionary (-4.50%)

- NKE (+3.0%): Rebounded after Trump highlighted a “very productive” call with Vietnam’s leader, suggesting potential tariff relief. Vietnam is reportedly seeking to eliminate tariffs as part of a broader deal.

Healthcare (-5.50%)

- GEHC (-16.0%): Hit by China’s anti-dumping investigation into U.S.- and India-made CT scan components; China also restricting rare-earth exports used in medical imaging.

- SHC (-3.6%): Subsidiary Sterigenics reached a $30.9M settlement to resolve 97 ethylene oxide claims.

Materials (-6.29%)

- DD (-12.8%): Under pressure following a new antitrust probe launched by Chinese regulators targeting DuPont China.

- DOW (-10.4%): Downgraded at JPMorgan (alongside LYB) on tariff concerns; noted vulnerability in polyethylene exports and narrowing margins.

Energy (-8.70%)

- No notable gainers.

- WTI crude plunged 7.4%, building on Thursday’s ~7% drop, amid growth concerns and a surprise OPEC+ production increase.

- XOM 8-K suggested Q1 EPS upside due to upstream performance but was overshadowed by broader energy weakness.

Financials (-7.39%)

- Banks, insurers, credit cards, and asset managers all sharply lower.

- Sentiment hit by increased recession risk and the potential impact of tariffs on earnings, lending, and credit markets.

Technology (-6.33%)

- TSLA led losses in big tech (decliner not quoted in this session).

- Trump extended TikTok deal deadline by 75 days, suggesting possible de-escalation, though headlines mixed.

- GEHC and DD news added to tech supply chain uncertainty, especially around China-exposed hardware components.

Industrials (-6.29%)

- Sentiment pressured by trade tensions, higher input costs, and risk of retaliatory action from key trade partners.

- Market watching whether China targets aviation and capital goods next.

Utilities (-5.58%), Consumer Staples (-4.55%), and Real Estate (-4.62%)

- These sectors held up better as defensives benefitted from Treasury rally and rotation away from cyclicals.

- Gold (-2.8%) gave up Thursday’s gains as traders reallocated to Treasuries.

Eco Data Releases | Monday April 7th, 2025

S&P 500 Constituent Earnings Announcements | Monday April 7th, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.