April 18, 2025

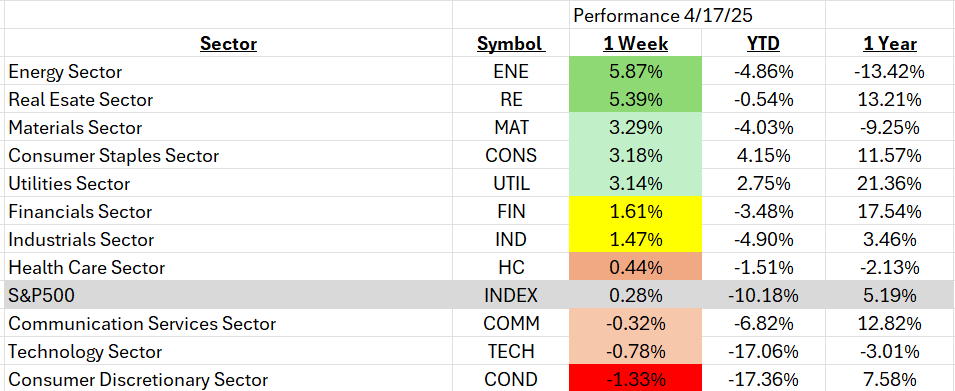

- The Energy and Real estate sector had a strong week, both up over 5%.

- The S&P500 Index had a positive showing last week +0.28% yet is still down over 10% YTD.

- The three sectors in the red this week were Communications, Technology and Consumer Discretionary.

- Consumer Staples and Utilities are both positive YTD.

- The sector leadership profile remains risk-off and tilted towards Value over Growth in the near-term

Stock/Earnings highlights:

- Technology (Semiconductors & Big Tech):

Semiconductor stocks were under pressure following new U.S. export restrictions on AI chips. NVDA fell sharply after announcing a potential $5.5B charge related to H20 chip export limits. AMD also dropped on expectations of an $800M hit from similar restrictions. Big tech underperformed, with GOOGL sliding on an antitrust ruling that raises risk of a breakup. - Healthcare (Managed Care & Biotech):

UNH dropped 22.4% after missing earnings and cutting FY guidance, citing unexpected care utilization and reimbursement headwinds. In contrast, LLY soared 14.3% on strong clinical trial results for its oral GLP-1 drug, boosting optimism around its weight-loss franchise. - Financials (Banks & Payment Services):

Regional banks like HBAN and KEY posted positive earnings surprises, driven by net interest income beats and improved guidance. However, GPN fell 17.4% after announcing a large acquisition of Worldpay, while FIS gained 8.7% as it divested assets and reaffirmed guidance. - Industrials (Transport & Aerospace):

CSX fell despite mixed results, with analysts citing operational pressures. Meanwhile, F warned it may need to raise prices on U.S. vehicles if tariffs persist and halted exports of key models to China. BA remained in focus as Chinese airlines reportedly rejected some deliveries. - Energy & Materials:

Alcoa (AA) dropped 7.0% after flagging tariff-related cost pressures ($105M per quarter), soft FCF, and uncertainty around capacity restarts. In contrast, the Energy sector outperformed last week, rising +2.3%, helped by a 3.5% rally in crude oil prices and strength in defensive positioning

Data sourced from FactSet Research Systems Inc.