May 21, 2025

S&P futures are down 0.7%, following Tuesday’s pullback that ended a six-day rally for the S&P 500. Notable laggards included the “Mag 7” tech names and travel-related stocks. Treasury yields climbed 5-6 bps, with the 10-year surpassing 4.50% and the 30-year topping 5%. The dollar index declined by 0.6%, while gold rose 0.9%. Bitcoin futures slipped 0.7%, and WTI crude was up 0.8%, though off its highs amid easing geopolitical concerns.

Fiscal policy remains in focus as the House moves closer to voting on a reconciliation bill, though deficit concerns overshadow any modest stimulus impact. Global rate pressures are rising, driven by a hotter-than-expected UK CPI and a surge in Japanese yields. Geopolitical caution is elevated following reports of Israeli preparations for potential strikes on Iranian nuclear facilities. Meanwhile, trade optimism has waned with no major outcomes expected at the G7 summit and renewed threats of US tariff hikes.

Market participants are closely watching for the impact of fiscal dynamics, global rate pressures, and geopolitical tensions on broader sentiment. Retail earnings results are mixed, leaning more on company-specific factors than broader tariff or macroeconomic trends.

Corporate Highlights:

- TGT: Missed estimates, cut FY guidance but announced turnaround initiatives.

- LOW: Outperformed with better-than-expected Q1 results and reaffirmed FY guidance.

- VFC: Under pressure on softer Q1 operating income guidance.

- PANW: Fiscal Q3 and Q4 guidance mixed; concerns over weaker April trends and no key metric raises.

- TOL: Gained on strong gross margins and reaffirmed delivery guidance.

- BIDU: Rose on strong growth in AI Cloud revenue.

- UNH: Facing scrutiny over secret bonuses to nursing homes aimed at reducing hospital transfers.

- KHC: Exploring strategic transactions to unlock shareholder value.

- TTWO: Announced a $1 billion secondary offering.

- CRI: Slashed its dividend, citing tariff pressures.

- WOLF: Fell sharply on reports it may be pursuing bankruptcy.

U.S. equities were mostly lower in quiet, rangebound trading. The S&P 500 ended down 0.39%, snapping a six-day winning streak. The Dow lost 0.27%, while the Nasdaq shed 0.38%. The Russell 2000 managed to eke out a modest gain, rising 0.05%. Sector performance was mixed, with utilities, healthcare, and consumer staples outperforming, while energy, communication services, and consumer discretionary lagged.

Treasury yields were little changed, with the curve steepening slightly. The 10-year yield held just below 4.50%, while the 30-year yield remained under 5%. The dollar index fell 0.4%, extending its earlier weekly decline, while gold climbed 1.6%. Bitcoin futures gained 1.3%, continuing recent momentum, while WTI crude settled slightly lower, down 0.2%.

Fiscal Policy:

Fiscal policy remained in the spotlight as President Trump met with House Republicans in an effort to rally support for the reconciliation bill. Key sticking points include Medicaid cuts and the state and local tax (SALT) deduction limit, with reports suggesting significant divisions remain. Trump emphasized party unity publicly but privately urged legislators to back the current draft. Analysts are focused on the bill’s potential impact on economic growth and Treasury markets, particularly as deficit-financed measures come at a time of softening demand for U.S. debt.

Monetary Policy:

Federal Reserve officials continued to emphasize patience, with little movement in rate-cut expectations. Cleveland Fed’s Hammack outlined scenarios for tariff impacts and raised concerns about a potential stagflationary environment. Meanwhile, Fed Governor Musalem highlighted the negative effects of policy uncertainty on the economic outlook. Additional Fedspeak this week is unlikely to provide incremental clarity, with officials broadly maintaining a wait-and-see stance.

Trade & Tariffs:

Trade tensions remain a concern as U.S. ports warned of a potential $6.7 billion economic impact if a proposed 100% tariff on China-made cranes is implemented. At the international level, G7 finance ministers are meeting in Alberta this week to address trade issues and mitigate escalating tensions.

Sector Performance

- Outperformers: Utilities (+0.29%), Healthcare (+0.27%), Consumer Staples (+0.24%), Materials (-0.18%), Industrials (-0.37%).

- Underperformers: Energy (-0.99%), Communication Services (-0.76%), Consumer Discretionary (-0.59%), Real Estate (-0.55%), Financials (-0.55%), Technology (-0.45%).

Consumer Discretionary:

- Tesla (TSLA): Shares gained following Elon Musk’s confirmation that he intends to remain CEO and is optimistic about Tesla’s demand backdrop. Musk also reiterated plans to launch robotaxis in June.

- Home Depot (HD): Reported mixed Q1 results with sales and comps beating expectations but EPS and operating margins falling short. The company reaffirmed full-year guidance and stated it does not plan to raise prices due to tariffs, citing supply chain diversification.

- Victoria’s Secret (VSCO): Rose after adopting a shareholder rights plan in response to BBRC’s significant stake accumulation.

Consumer Staples:

- Levi Strauss (LEVI): Announced the sale of Dockers to Authentic Brands for up to $391 million. Plans to return approximately $100 million of net proceeds to shareholders through share repurchases.

Information Technology:

- Google (GOOGL): Unveiled partnerships for AI-powered glasses and launched a premium AI tier priced at $249.99 per month.

- Pegasystems (PEGA): To replace Nordstrom (JWN) in the S&P MidCap 400.

- Nutanix (NTNX): Downgraded due to valuation concerns and an uncertain IT spending outlook.

Healthcare:

- Moderna (MRNA): Shares rose after the FDA announced updated guidelines for Covid boosters, which favor vaccines for elderly and at-risk groups.

- ResMed (RMD): Fell amid competitive concerns after Apnimed reported positive trial data for an oral sleep apnea medication.

Materials:

- Eagle Materials (EXP): Shares dropped following weaker-than-expected earnings, impacted by adverse weather and increased production costs.

Industrials:

- Warby Parker (WRBY): Surged on news of a partnership with Google to develop AI-enabled glasses, with Google committing $150 million to the project.

Energy:

- Kazakhstan reported a 2% increase in oil output for May, defying OPEC+ quotas. Meanwhile, a study projected a 78% rise in global electricity demand by 2050.

Eco Data Releases | Wednesday May 21st, 2025

No major releases scheduled today

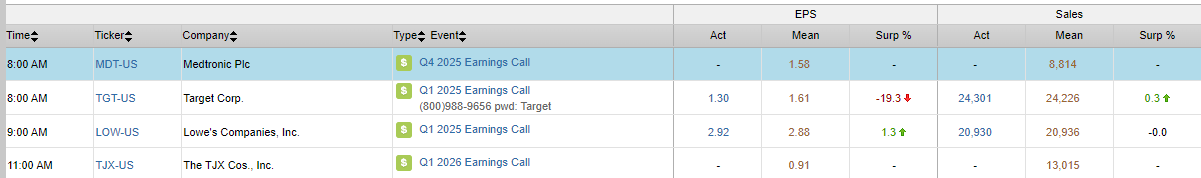

S&P 500 Constituent Earnings Announcements | Wednesday May 21st, 2025

Data sourced from FactSet Research Systems Inc.