June 3, 2025

S&P futures are down 0.5% Tuesday morning following Monday’s modest equity gains, led by energy (on oil strength), AI, Mag 7, and high short interest names. Rate-sensitive sectors lagged. Overnight, Asian markets were mixed with Hong Kong up ~1.5%, while Japan, India, and Singapore declined. Europe is trading ~0.3% lower. Treasuries are firmer with yields down 2–3 bp. The dollar index is up 0.2%, gold is off 0.4%, Bitcoin futures are up 0.1%, and WTI crude is up 0.5%.

Markets are in a holding pattern ahead of Friday’s May jobs report and a possible Trump-Xi call. Trade headlines remain mixed: the U.S. is pressing countries for offers, while China reportedly takes a harder stance. Senate Republicans are reviewing the “revenge” tax in the reconciliation bill, with concerns it could dampen foreign demand for U.S. assets. The OECD trimmed its global growth forecast, citing trade barriers and policy risk. China’s Caixin manufacturing PMI showed the sharpest contraction since Sept 2022, driven by weak export orders. Eurozone CPI cooled, falling below 2%, and Japan’s 10-year JGB auction saw strong demand.

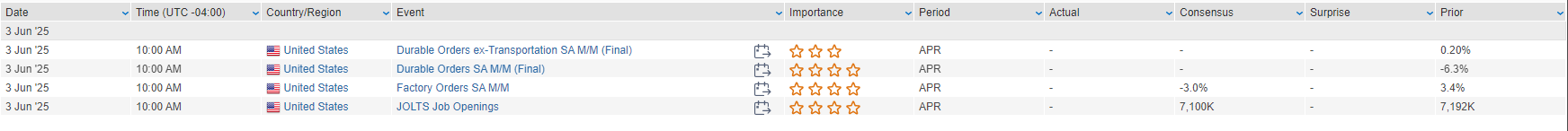

Today’s U.S. data includes factory orders and JOLTS job openings, with May auto sales due later. Fed speakers Goolsbee, Cook, and Logan are also scheduled. The week’s key data ahead includes ADP payrolls, ISM services, Beige Book (Wednesday), and the May jobs report Friday (125K NFP expected, 4.2% unemployment).

Corporate news is quiet. DG reports pre-open today. CRWD and HPE report after the close. DLTR reports Wednesday morning; FIVE and MDB report Wednesday evening. AVGO, LULU, and DOCU are among Thursday’s notable earnings.

U.S. equities ended higher on Tuesday (Dow +0.08%, S&P 500 +0.41%, Nasdaq +0.67%, Russell 2000 +0.19%), with major indices closing near session highs. The S&P 500 extended gains from its best May since 1997, while market breadth favored cyclicals and tech. The move came despite early-session weakness, driven by geopolitical concerns, soft economic data, and continued trade tensions.

Trade developments remained in focus as President Trump formally announced a plan to double tariffs on imported steel and aluminum to 50%, with implementation set for June 4. China accused the U.S. of breaching their recent agreement and threatened retaliatory action. At the same time, the Trump administration set a Wednesday deadline for countries to submit their “best offers” in ongoing trade talks. While a Trump-Xi call is expected this week, uncertainty remains high amid broader negotiations with the EU, India, and Japan. European officials warned of automatic countermeasures if no agreement is reached.

On the economic front, the May ISM Manufacturing Index missed expectations, falling to 48.5—the weakest reading since November 2024. New orders remained in contraction for a fourth consecutive month, while import and export indexes hit multiyear lows. Prices paid stayed elevated, and commentary flagged weak demand, rising costs, and uncertainty around tariffs and fiscal policy. Separately, April construction spending declined 0.4%, below expectations and revised lower for the prior month.

Fed commentary remained dovish. Governor Waller reiterated that tariff-driven inflation pressures should prove transitory and backed the potential for rate cuts in the second half of the year. Dallas Fed’s Logan said risks to the Fed’s dual mandate are balanced, and Chicago’s Goolsbee noted little economic impact from tariffs so far, adding that rates could come down over the next 12–18 months. Powell offered no remarks on the economic outlook during his appearance at a Fed conference.

Markets saw a bear steepening in the Treasury curve, with longer-dated yields rising 6–7 bps. The dollar index fell 0.6%, gold surged 2.5%, and WTI crude gained 2.8% on geopolitical risk and a smaller-than-feared OPEC+ output hike. Bitcoin futures slipped 0.3%.

S&P 500 Sector Performance:

Outperformers: Energy (+1.15%), Technology (+0.89%), Communication Services (+0.62%), Materials (+0.48%)

Underperformers: Industrials (-0.24%), Healthcare (+0.01%), Real Estate (+0.07%), Financials (+0.08%), Consumer Discretionary (+0.15%), Utilities (+0.18%), Consumer Staples (+0.19%)

Company Highlights

Energy

CLF +23.2% – Cleveland-Cliffs rallied on Trump’s announcement doubling steel and aluminum tariffs.

Technology

VERA +67.5% – Vera Therapeutics soared after its Phase 3 trial met the primary endpoint for treating IgA nephropathy, showing a 46% reduction in proteinuria.

APLD +48.5% – Applied Digital surged on news of two 15-year AI data center leases totaling 250 MW with CoreWeave.

CDW -3.1%, DELL (not listed) – Both tech firms reportedly under scrutiny as the federal government seeks to reduce technology contract costs.

Healthcare

BNTX +18.1% – BioNTech jumped after announcing a major oncology partnership with BMY, securing $1.5B in upfront payments and up to $2B more through 2028.

MRNA +1.8% – Moderna received limited FDA approval for a new COVID-19 vaccine, targeting a narrower population group.

BPMC +26.1% – Blueprint Medicines was acquired by SNY for $9.1B, a 27% premium to Friday’s close.

Communication Services

GOOGL -1.6% – Alphabet fell after a Bloomberg report that Samsung is nearing a deal to invest in Perplexity AI and integrate its search into upcoming Galaxy devices.

META (unchanged) – Reports said Meta plans to fully automate its ad creation and targeting using AI by 2026.

OMC -4.0% – Omnicom fell on fears that Meta’s move could disrupt traditional ad agency models.

FLUT, DKNG -6.0% – DraftKings dropped after Illinois proposed new taxes on sports betting, including a 25–50 cent per wager fee depending on volume.

Consumer Discretionary

TSLA -1.1% – Tesla declined after concerns surfaced about Elon Musk’s denial of a Model 2 cancellation; French vehicle deliveries dropped 67% y/y in May.

TGT (unchanged) – Target’s turnaround strategy was questioned in financial press, calling for more decisive action.

SHAK -1.1% – Shake Shack was downgraded at BTIG on execution risk tied to too many simultaneous strategic initiatives.

Roark Capital – Acquired Dave’s Hot Chicken for $1B, planning rapid expansion.

Industrials

Toyota Industries – Set to accept a $42B takeover bid by Toyota Motor Corp, according to reports.

BA (not listed) – Boeing CEO said a replacement for the 737 Max is not an immediate priority.

SAIC -13.3% – Science Applications Int’l missed on Q1 EBITDA, EPS, and FCF, weighed by fixed-price program costs. FY guidance was maintained, and book-to-bill improved to 1.3x.

Eco Data Releases | Tuesday June 3rd, 2025

S&P 500 Constituent Earnings Announcements | Tuesday June 3rd, 2025

Data sourced from FactSet Research Systems Inc.