June 10, 2025

S&P 500 futures are little changed following modest gains across major indexes on Monday, with small-caps, high short interest names, and Tesla leading. Defensive sectors and financials lagged. Asian markets were mixed—Taiwan, South Korea, and Japan outperformed, while Greater China lagged. European markets are down ~0.3%. Treasuries are firmer with long-end yields down 4–5 bp. The dollar index is up 0.1%, gold is down 0.1%, Bitcoin futures are up 0.4%, and WTI crude is up 0.5%.

Markets remain quiet ahead of key events, including day two of U.S.-China trade talks in London. Expectations center on mutual easing of export controls—China on rare earths and the U.S. on tech. Focus also remains on Wednesday’s May CPI report and Thursday’s 30-year bond auction. There’s no major monetary or fiscal policy news following Trump’s recent Fed comments and possible Senate reconciliation bill delays past July 4.

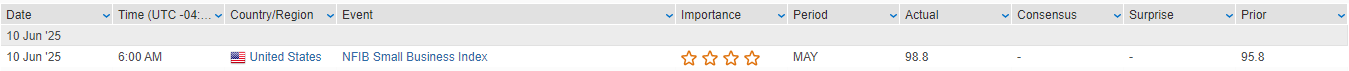

On the data front, the NFIB Small Business Optimism Index rose to 98.8 in May from 95.8, ahead of expectations and ending a four-month slide. Today’s $58B 3-year Treasury auction is secondary to Thursday’s longer-dated supply. CPI is expected to show headline +0.2% m/m, pushing y/y to 2.5%, and core CPI +0.3% m/m, lifting y/y to 2.9%, with possible tariff effects on core goods.

Corporate Highlights

- Apple (AAPL): WWDC takeaways underwhelmed; little perceived progress on Apple Intelligence.

- Meta (META): CEO Zuckerberg reportedly frustrated with Llama 4; now leading AGI talent push.

- TSMC (TSM): May sales surged 40% amid chip stockpiling tied to tariff concerns.

- Novo Nordisk (NVO): Shares rose on report that Parvus Asset Management has built a stake.

- Disney (DIS): Will pay Comcast (CMCSA) an additional ~$440M for Hulu stake.

- AT&T (T): Reiterated 2025 guidance, noted continued strength and competitiveness in wireless.

U.S. equities ended Monday mostly higher in a quiet session, with the S&P 500 up 0.09%, Nasdaq +0.31%, Russell 2000 +0.57%, and the Dow flat. Major indexes closed off intraday highs but extended last week’s rally, which pushed the S&P 20% above its post-Liberation Day low. Bitcoin futures rose 4.2%, gold gained 0.3%, and WTI crude climbed 1.1%. Treasury yields fell ~2 bp across the curve, leading to modest steepening, while the dollar index slipped 0.2%.

Markets saw limited direction from day one of U.S.-China trade talks in London, though press reports suggested some early signs of softening. China may be easing rare-earth export restrictions, and Trump has reportedly authorized U.S. negotiators to discuss rolling back certain tech export bans. Talks are set to continue Tuesday.

In Washington, Trump said a decision on a replacement for Fed Chair Powell would be announced “very soon,” increasing speculation around a more politically aligned Fed. Former Fed Governor Kevin Warsh is considered the leading candidate. The Senate is expected to release its version of the GOP reconciliation bill this week, with debate intensifying over the proposed Section 899 “revenge tax,” which has drawn corporate opposition.

The only U.S. economic release of note was the NY Fed’s Consumer Expectations Survey, which showed declines in inflation expectations across all horizons (1Y: 3.2%, down 0.4pp). Expectations for earnings and household income rose modestly, and job-loss probability declined. Tuesday brings the NFIB Small Business Optimism Index, followed by CPI on Wednesday, PPI and jobless claims on Thursday, and University of Michigan sentiment on Friday. The Fed remains in its pre-FOMC blackout period, and the Treasury begins ~$120B in coupon auctions with a $58B 3-year note sale Tuesday.

Sector performance on Monday was mixed, with Consumer Discretionary leading the way, gaining 1.08%, supported by strength in Tesla and select retail names. Materials also outperformed, rising 0.62%, while Technology added 0.25%, helped by Synopsys and continued AI enthusiasm. Energy and Communication Services posted modest gains of 0.22% and 0.13%, respectively. On the downside, Utilities were the worst performer, falling 0.66%, followed by Financials (-0.55%), Consumer Staples (-0.24%), and Healthcare (-0.16%). Industrials and Real Estate lagged as well, down 0.09% and 0.07%, respectively.

Company-Specific News by Sector

Information Technology

- Apple (AAPL): WWDC unveiled OS redesigns and “Apple Intelligence” AI tools, though analysts viewed the announcements as modest.

- Qualcomm (QCOM): Confirmed acquisition of UK-based Alphawave IP Group for ~$2.4B.

- Synopsys (SNPS) +2.0%: Rose on reports China restored some access to EDA tools after Trump-Xi call.

- IonQ (IONQ) +2.7%: Acquiring Oxford Ionics for $1.075B in cash and stock.

- AppLovin (APP) -2.0%: Declined after being excluded from the S&P 500 index rebalancing.

Consumer Discretionary

- Tesla (TSLA) +4.6%: Rebounded after Trump expressed support for Tesla and Starlink.

- Topgolf Callaway (MODG) +14.9%: Spiked after Director Adebayo Ogunlesi disclosed a large insider buy.

- Chewy (CHWY) -3.5%: Downgraded at Mizuho; removed from Top Picks list ahead of earnings.

Healthcare

- Merck (MRK): Reported positive Phase 3 results for its oral PCSK9 drug enlicitide decanoate.

- Universal Health Services (UHS) -6.1%: Weighed down hospital stocks after management highlighted policy uncertainty and weak procedural volumes at a conference.

- Intuitive Surgical (ISRG) -5.6%: Downgraded to Sell at Deutsche Bank; concerns over narrowing competitive moat.

Financials

- Synchrony Financial (SYF) +2.7%: Announced new credit card partnership with Walmart; functionality to be embedded in OnePay app.

- Interactive Brokers (IBKR) -3.4%: Downgraded at Citi on valuation; flagged seasonal slowdown in account growth.

- Robinhood (HOOD) -2.0%: Fell alongside APP after exclusion from S&P 500 rebalancing.

Industrials

- Crane Co. (CR): Acquiring Precision Sensors & Instrumentation from Baker Hughes for $1.06B.

- ArcBest (ARCB) +5.6%: Rose after Q2 update showed stronger-than-expected May tonnage/day growth and improved import volume outlook.

Materials

- Goodyear Tire & Rubber (GT) +10.7%: Upgraded to Outperform at BNP Paribas Exane.

Communication Services

- WPP: CEO Mark Read to retire at year-end.

- Sirius XM (SATS) -8.5%: Reportedly considering Chapter 11 to protect wireless spectrum licenses amid federal investigations.

- Warner Bros. Discovery (WBD) -3.0%: Confirmed it will split into two public companies (streaming/studios and cable) by mid-2026.

Eco Data Releases | Tuesday June 10th, 2025

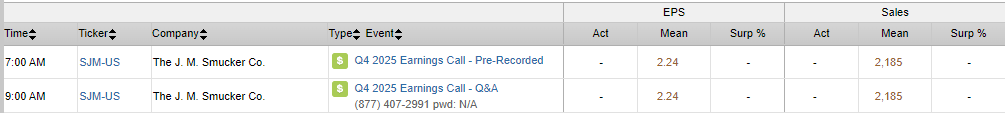

S&P 500 Constituent Earnings Announcements | Tuesday June 10th, 2025

Data sourced from FactSet Research Systems Inc.