June 11, 2025

S&P 500 futures are down 0.1% following Tuesday’s gains that left the index less than 2% below its February record high. Most-shorted names continued to lead, alongside strength in big tech, energy, chemicals, builders, pharma, and transports. Asian equities rose overnight, with Hong Kong outperforming. European markets are up ~0.2%. Treasuries are slightly weaker, with long-end yields up ~2 bp. The dollar index is down 0.1%. Gold is flat, Bitcoin futures are off 0.4%, and WTI crude is down 0.2%.

Trade remains in focus after the U.S. and China agreed to a framework for implementing last month’s Geneva de-escalation, including mutual easing of export controls—though details remain limited and require Trump and Xi’s approval. Separately, the U.S. and Mexico are reportedly nearing a deal to partially exempt Mexican steel from new tariffs. Meanwhile, a U.S. Court upheld the legality of Trump’s IEEPA tariffs for now.

CPI is the main event today, with consensus expecting headline inflation to rise 0.2% m/m (2.5% y/y) and core CPI to rise 0.3% m/m (2.9% y/y), despite ongoing tariff concerns. The 10-year Treasury auction ($39B) is set for later today, with tomorrow’s $22B 30-year auction also in focus. Treasury Secretary Bessent is scheduled to testify before the House Ways and Means Committee at 10:00 a.m. ET. PPI and jobless claims arrive Thursday, followed by the University of Michigan sentiment report Friday.

Corporate Highlights

- Apple (AAPL): Execs defended AI strategy and Siri rebuild after underwhelming WWDC reception.

- Tesla (TSLA): Musk expressed regret over last week’s online comments toward Trump.

- Lockheed Martin (LMT): USAF reportedly cut its F-35 order request to Congress by half.

- Starbucks (SBUX): CEO said there’s strong interest in minority stake in China business.

- General Mills (GIS): Reportedly exploring sale of Häagen-Dazs stores in China.

- GameStop (GME): Mixed Q1—revenue light, but EPS and EBITDA better; stock up ~10% in past month.

- GitLab (GTLB): Underwhelmed despite revenue beat; no FY guide raise, though CRPO trends solid.

- Dave & Buster’s (PLAY): Q1 comps missed, but mgmt cited improving trends and turnaround traction.

- American Superconductor (AMSC): Declined on secondary offering news.

- Shutterstock (SSTK) & Getty Images (GETY): Higher after shareholder approval of merger.

- Stitch Fix (SFIX): Rose on return to positive y/y revenue growth.

U.S. equities ended higher in Tuesday’s session, with the S&P 500 up 0.55%, the Nasdaq gaining 0.63%, the Dow rising 0.25%, and the Russell 2000 advancing 0.56%. The S&P 500 is now just 1.7% from its February record close, and the Nasdaq is 2.3% off its December high. Markets closed near the highs of the day, led by continued strength in big tech, energy, and tariff-sensitive names. High short interest and YTD laggards also continued to outperform.

Treasuries were mostly unchanged with a slight bid at the long end; the day’s $58B 3-year note auction tailed modestly by 0.4 bp. The dollar index rose 0.1%, gold fell 0.3%, Bitcoin futures climbed 0.9%, and WTI crude dipped 0.5%.

Attention remained focused on ongoing U.S.-China trade talks in London, with no formal update, though Commerce Secretary Lutnick said discussions were going well and could wrap tonight. Reports suggest both sides are negotiating limited relaxation of export controls—China on rare earths, the U.S. on advanced technology. Meanwhile, U.S.-India trade discussions concluded on a constructive note, with an interim deal expected by month-end.

On the monetary policy front, speculation swirled around potential Fed Chair nominees. A Bloomberg report suggested Treasury Secretary Bessent is being considered, though the White House denied this. Kevin Warsh remains a leading candidate. The Fed remains in blackout ahead of next week’s FOMC meeting, with CPI data due Wednesday and a 30-year bond auction on Thursday.

In economic data, the NFIB Small Business Optimism Index rose to 98.8 in May, beating expectations and ending a four-month decline. The World Bank downgraded its 2025 global growth forecast to 2.3% from 2.7%, citing trade tensions.

Sector leadership on Tuesday came from Energy (+1.77%), Consumer Discretionary (+1.19%), and Healthcare (+1.09%), with Communication Services (+1.08%), Real Estate (+0.83%), and Materials (+0.56%) also posting solid gains. On the other end, Industrials lagged (-0.44%), while Financials (+0.06%), Consumer Staples (+0.16%), Utilities (+0.19%), and Technology (+0.46%) underperformed the broader market.

Information Technology

- TSMC (TSM) +2.6%: May sales jumped 39.6% y/y, ahead of expectations. Analysts cited AI strength and front-loaded demand amid tariff uncertainty

- IBM: Announced plans for a large-scale quantum computing system with a new processor design.

Health Care

- Insmed (INSM) +28.7%: Surged on positive Phase 2B results for its TPIP therapy in pulmonary arterial hypertension.

- Novo Nordisk (NVO) +5.1%: Rose after FT reported activist hedge fund Parvus had built a stake, aiming to influence upcoming CEO succession.

- Vertex (VRTX) -6.3%: Declined after reports of a share block being marketed by Goldman Sachs.

Consumer Staples

- J.M. Smucker (SJM) -15.6%: Missed on organic growth and offered weak FY26 EPS and FCF guidance; analysts cited cost pressures and slower pet and snack growth.

Consumer Discretionary

- Casey’s General Stores (CASY) +11.6%: Beat on earnings and margins; raised dividend ~14%. Fuel margins and comps exceeded expectations.

- McDonald’s (MCD) -1.4%: Downgraded to Sell at Redburn Atlantic, citing longer-term pressure from GLP-1 obesity drug trends.

Industrials

- Core & Main (CNM) -2.1%: In-line Q1 results, though came against high expectations. Fire protection business noted as a weaker area.

- Boeing (BA): Announced strong May orders; 737 Max production remains capped by FAA limits.

Materials

- Calavo Growers (CVGW) -16.3%: Reported weak Q2 results; flagged volume declines across both Fresh and Prepared segments, with weather impacts cited.

- CoreWeave (CRWV) -4.4%: Downgraded on concerns over pro forma financing structure, with less equity value than anticipated by company.

Financials

- Sezzle (SEZL) -7.1%: Filed suit against Shopify for alleged anticompetitive behavior in BNPL offerings. SHOP represented <5% of revenue; guidance reaffirmed.

- Citi: Reportedly planning to increase loan loss reserves by several hundred million dollars in Q2, according to the FT.

Communication Services

- Alphabet (GOOGL) +1.4%: Gained after Reuters reported OpenAI is adding Google Cloud to its infrastructure, broadening beyond its core Microsoft partnership.

- Meta (META): CEO Zuckerberg reportedly dissatisfied with Llama 4 progress, now directly overseeing AGI hiring efforts.

- Warner Bros. Discovery (WBD): Plans to split into streaming/studios and cable businesses by mid-2026 confirmed Monday; shares continued to trade lower.

Energy

- Energy Department: Projects a drop in U.S. crude production in 2026—the first annual decline since 2021.

Eco Data Releases | Wednesday June 11th, 2025

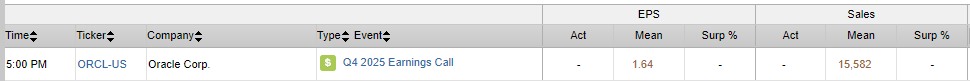

S&P 500 Constituent Earnings Announcements | Wednesday June 11th, 2025

Data sourced from FactSet Research Systems Inc.