COMMENTARY:

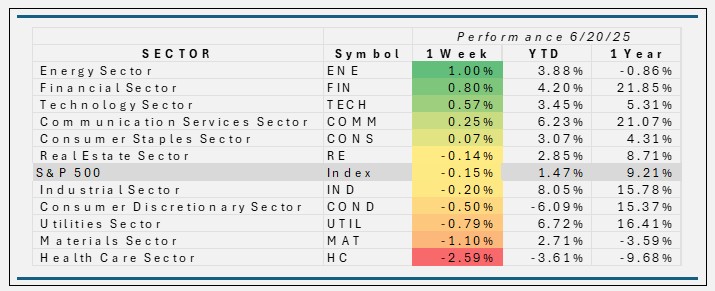

- The S&P 500’s minor decline of 15 basis points was driven by a combination of geopolitical risk, shifting Fed rate expectations, and sector-specific developments—most notably, a selloff in chipmakers and weakness in healthcare. Financials and Energy were the most supportive sectors, while Healthcare and Materials weighed on overall performance. The Fed kept rates steady and signaled a data-dependent stance, and emphasizing caution on rate cuts due to inflation uncertainty and possible economic impacts from tariffs.

- Energy was the winner this week. Ongoing geopolitical risk, resilient demand for energy, and sector rotation into energy equities all contributed to 1.0% gain. The largest positive contributors were Exxon Mobil and Chevron were up 2.3% and 2.5% respectively. ConocoPhillips, with additional support from Williams Companies, rounded out the top four performers this week.

- Financials gain of 0.80% was driven by robust trading revenues and capital markets activity at major banks, a supportive interest rate environment, and solid earnings from its largest constituents. The most impactful stocks were JPMorgan Chase (+3.8%), Bank of America (+3.2%), Wells Fargo (+4.2%), Goldman Sachs (+4.4%).

- Health Care’s 2.6% drop for the week ending June 20, 2025, was primarily due to the continued collapse of UnitedHealth Group (-3.7%) amid a federal criminal investigation, compounded by sector-wide weakness, persistent cost and regulatory pressures, and negative sentiment. Additional declines were from Johnson & Johnson (-4.7%), Eli Lilly (-6.9%), and AbbVie (-3.0%), amplifying the sector’s losses. This sector continues to be the worst performer year to date falling 9.7%.

- Persistent conflicts between Israel and Iran, and the possibility of direct U.S. military involvement, created ongoing market uncertainty and risk aversion. With recent developments over the weekend, investors will start next week with yet another thing to think about when looking at their sector allocations.

ETF TIDBITS:

ETF investors in the week ending June 20, 2025, focused on fixed income (especially active and short-duration strategies), volatility hedges, and global diversification, while seeking income and protection from economic and geopolitical uncertainty.

Geopolitical tensions and volatility shaped ETF flows, with energy, defense, and volatility ETFs gaining ground.

Crypto ETFs saw a notable sentiment reversal.

Meanwhile, thematic and sector ETFs in gold, metals, defense, and alternative energy continued to outperform, and ETF product innovation remained robust with new launches and growing interest in covered call strategies.