June 30, 2025

S&P 500 futures are up 0.4% in early trading, extending Friday’s momentum when both the S&P and Nasdaq closed at fresh all-time highs and capped off a strong week. Global markets are more mixed to start the week, with European equities mostly lower and Asia seeing a blend of modest gains and losses. Treasuries are firmer with some curve flattening, while the dollar is down 0.2%. Gold is up 0.3%, Bitcoin futures are higher by 0.5%, and WTI crude is slightly lower by 0.2%.

Trade policy remains a central theme. U.S.-Canada negotiations appear back on track after Canadian Prime Minister Carney announced the country would rescind its digital services tax—a move that led President Trump to abruptly suspend talks on Friday. Over the weekend, additional headlines pointed to progress on a potential U.S.-EU trade agreement ahead of the July 9 reciprocal tariff deadline. Meanwhile, China issued warnings that it may retaliate if U.S. trade deals with other nations undermine its interests.

On the legislative front, the “Big, Beautiful Bill” advanced past a key procedural vote in the Senate and could see a final vote as soon as today. A House vote may follow midweek, though final passage remains uncertain given resistance from several GOP representatives. In financial sector news, the Fed released its annual stress test results after Friday’s close, confirming that major U.S. banks remain well-capitalized and resilient to severe economic shocks.

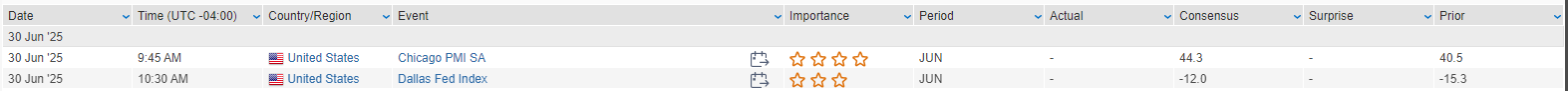

Today’s calendar is relatively light, with only the Chicago PMI and Dallas Fed manufacturing index on deck. Several Fed officials, including Atlanta’s Bostic and Chicago’s Goolsbee, are scheduled to speak. Market focus is already shifting to later this week, with the June nonfarm payrolls report due Thursday (ahead of the Friday holiday). Economists expect a continued cooling in the labor market, with a consensus forecast for 115K new jobs and a slight uptick in the unemployment rate to 4.3%. ISM manufacturing and services reports are also expected Tuesday and Thursday, respectively. Fed Chair Powell is set to speak Tuesday morning at the ECB’s Sintra policy forum.

On the corporate front, NVIDIA drew attention after reports of insider selling. Meta is making headlines for aggressively recruiting AI talent with lucrative offers. Tesla is trading lower amid concerns the reconciliation bill advancing through the Senate could phase out clean energy credits and eliminate EV incentives. Separately, the Department of Justice settled its antitrust case related to Hewlett Packard Enterprise’s acquisition of Juniper Networks, clearing the way for the deal to proceed

U.S. equities rebounded sharply off session lows on Friday (Dow +1.00%, S&P 500 +0.52%, Nasdaq +0.52%, Russell 2000 +0.02%), with the S&P 500 and Nasdaq notching fresh record highs and all major indexes logging weekly gains. The late-session rally came despite mixed economic prints and evolving trade headlines. Treasury yields rose slightly on the day but finished lower for the week, while gold fell and the dollar edged higher. Crude oil rose modestly, supported by ongoing OPEC+ discussions.

Trade remained a major market driver. The U.S. and China jointly confirmed a framework allowing Chinese firms to resume rare earth exports in exchange for the U.S. lifting select restrictions, effectively formalizing prior agreements from May and June. Commerce Secretary Lutnick said up to 10 more trade deals are close to finalization, though the White House downplayed the importance of the July 9 tariff deadline. President Trump also hinted at a significant pending trade deal with India but simultaneously escalated tensions with Canada by halting digital tax negotiations and threatening tariffs.

On the fiscal side, Treasury Secretary Bessent urged Congress to eliminate Section 899, following G7 consensus. Meanwhile, reconciliation bill negotiations remain mired in Senate procedural hurdles, though a potential SALT agreement with the House could ease passage. Markets also digested the latest Fed stress test results, released after the close, which could influence regulatory direction.

Economic data showed core PCE inflation rose 0.2% month-over-month in May, slightly above expectations, with the annual rate ticking up to 2.7%. Personal income and spending both declined unexpectedly, reflecting weakness in auto and gasoline purchases. The data added complexity to the Fed’s policy path, as hotter inflation and falling income may send mixed signals. Minneapolis Fed President Kashkari reiterated his expectation for two rate cuts this year, starting in September, though warned that tariff effects could delay action.

Finally, the University of Michigan’s final June consumer sentiment came in stronger than expected at 60.7, marking a 16% jump from May. Inflation expectations ticked lower for both the 1-year (5.0%) and 5-year (4.0%) horizons. While tariff-related fears have not disappeared, they appear to have moderated somewhat in recent weeks.

Sector Performance

- Top Gainers: Consumer Discretionary (+1.81%), Communication Services (+1.54%), Industrials (+1.01%)

- Laggards: Energy (-0.50%), Healthcare (+0.17%), Materials (+0.02%)

Consumer Discretionary

- NKE +15.2%: Beat Q4 EPS and revenue; Q1 guidance better than feared. Expects $1B tariff impact this year but says it can fully mitigate costs. Direct sales fell 14% (constant currency) on a 26% drop in digital.

- Cruise lines, homebuilders, airlines, and hotels broadly gained on trade optimism.

Communication Services

- TTD +1.9%: Upgraded to Outperform at Evercore on improving online ad trends and product momentum.

- META: Faces potential EU daily fines due to compliance concerns over its pay-or-consent ad model.

- AAPL: Modified App Store rules in EU to meet antitrust obligations.

Industrials

- APOG +5.9%: Beat on earnings, revenue, and margins. Raised FY guidance, citing effective tariff mitigation.

- AVAV: Announced progress in development of its Wildcat drone.

Consumer Staples

- UNFI +6.0%: Said recent cyberattack is now contained, though Q4 EBITDA will be impacted; distribution operations have resumed.

- EL +1.3%: Upgraded to Buy at HSBC, citing better earnings visibility and benefits from operational restructuring.

Financials

- BEN +2.9%: Upgraded to Buy at Goldman Sachs; cited improved performance in Alternatives and stabilizing outflows in Traditional strategies.

- TRU -1.8%: Declined after FHFA Director said all credit bureaus are under review.

- FICO, EFX also declined on similar regulatory concerns.

Real Estate

- Sector modestly higher, supported by falling long-term yields and improving sentiment data.

Utilities

- CEG gained on reports the Trump administration may seek to expand power generation to meet rising AI energy demands.

Technology

- MSFT: Reported delay of next-gen AI chip by six months.

- Broader tech up modestly, but TSLA underperformed and weighed on the sector.

Materials

- MP -8.6%: Dropped as the U.S.-China rare earths export deal potentially eases supply constraints, hurting U.S. producers.

Healthcare

- Managed care names outperformed, while pharma and biotech lagged.

Energy

- Sector lagged the broader market amid choppy crude trading and Middle East geopolitical uncertainty.

Eco Data Releases | Monday June 30th, 2025

S&P 500 Constituent Earnings Announcements | Monday June 30th, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.