July 14, 2025

S&P futures are down 0.3% in early Monday trading after a mostly lower week for U.S. equities. Defensive sectors such as consumer staples, money center banks, software, and managed care underperformed, while AI, energy, airlines, hotels, and homebuilders led. Momentum factor names continued to lag. Asian markets were mixed overnight, while Europe is down ~0.6%. Treasuries are steady, the dollar is slightly firmer, gold is up 0.5%, bitcoin futures are up 3.3%, and WTI crude gained 0.7%. Copper is off over 1% after last week’s 9% rally on tariff news.

The market tone remains cautious as Trump threatens new 30% tariffs on the EU and Mexico starting Aug. 1, stoking concerns he won’t extend the current tariff deadline again. Still, the “TACO” (tariff accommodation/counteroffer) narrative remains alive, though some warn of investor complacency. The Fed also remains under political scrutiny, though the focus is expected to return to the data as June CPI on Tuesday takes center stage. Markets are watching for signs of tariff-related inflation. Q2 earnings season begins this week with banks in focus, as investors assess margin pressure, hyperscaler capex trends, and FX impacts.

No major economic releases today. This week’s key data includes:

- Tuesday: June CPI (expected +0.3% m/m for both headline and core, pushing y/y to 2.7% and 3.0%, respectively)

- Wednesday: PPI, industrial production, Fed Beige Book

- Thursday: Retail sales (expected +0.1% m/m headline, +0.3% core), initial claims, import prices, Philly Fed, NAHB sentiment

- Friday: Preliminary Michigan sentiment, housing starts, and building permits

Heavy Fedspeak throughout the week includes appearances from Bowman, Barr, Barkin, Collins, Logan, Hammack, Williams, Kugler, Daly, Cook, and Waller.

Company Highlights

- AAPL: Offered up to $150M for U.S. Formula One streaming rights.

- AMZN: Underperformed despite 30%+ jump in Prime Day online spending.

- GOOGL: Paying $2.4B to license Windsurf AI technology and hire its CEO/staff.

- META: Completed acquisition of AI voice startup PlayAI.

- TSLA: Musk ruled out merger with xAI.

- SNPS/ANSS: Gained on Chinese conditional approval of their merger.

- BA: Rose after Air India crash probe cited accidental engine cutoff switches.

- KHC: Extended gains on reports of $20B grocery spinoff plan

U.S. equities finished lower on Friday (Dow -0.63%, S&P 500 -0.33%, Nasdaq -0.22%, Russell 2000 -1.26%), trimming recent gains after Thursday’s record closes for the S&P 500 and Nasdaq. While broader market weakness was led by airlines, casinos, chemicals, and homebuilders, select pockets like semiconductors, defense, and food stocks managed to outperform. Tariff concerns remained front and center, with former President Trump outlining a 35% tariff on Canadian imports starting Aug. 1, floating a 15–20% baseline tariff on most partners, and pledging a new letter to the EU. Reports also cast doubt on finalization of a recent Vietnam deal. Yields rose sharply on the long end of the curve, pushing 10–30Y rates back toward levels that pressured equities earlier this year. Bitcoin surged 4% to a fresh high above $118K, while gold gained 1.2% and crude oil bounced 2.8%. The dollar index rose 0.2%, led by gains against the yen.

There was no major U.S. economic data on Friday. However, Fed commentary remained in focus, with Chicago’s Goolsbee saying earlier tariff concerns had cooled, possibly opening the door to a rate cut—though this week’s new threats may prolong the Fed’s cautious stance. Looking ahead, next week brings the June CPI report on Tuesday (expected +0.3% m/m for both headline and core), retail sales on Thursday, and preliminary University of Michigan sentiment on Friday. Multiple Fed speakers are also scheduled throughout the week.

Sector performance was mixed Friday. Energy and consumer discretionary outperformed, rising 0.48% and 0.33%, respectively, helped by crude’s rebound and strength in select retail names. Real estate and utilities saw modest gains, while tech and communication services posted slight declines. Industrials were slightly negative despite strength in defense. On the downside, financials lagged most with a 1.00% loss, followed by healthcare (-0.88%), materials (-0.75%), and consumer staples (-0.38%), as tariff risks and weak earnings sentiment weighed on defensive areas.

Company Highlights by GICS Sector

Consumer Discretionary

- LEVI: Beat Q2 EPS on stronger sales and margins; raised FY25 outlook to include tariff mitigation.

- GOOS: Upgraded to Equal Weight at Barclays; noted margin tailwinds and tariff insulation.

- VC: Upgraded at Goldman and Baird on Toyota business and Asia growth potential.

- AMC: Upgraded at Wedbush citing box office normalization and premium screen demand.

- VFC: Downgraded on weak Vans sales.

- BYD: Downgraded after selling FanDuel stake to FLUT for $1.755B.

Consumer Staples

- KHC: Exploring spinoff of grocery assets at ~$20B valuation.

- PSMT: Q3 beat, Chile expansion underway despite FX headwinds.

- PFGC: Shares rose after reports of USFD merger interest.

Information Technology

- GOOGL: Reportedly agreed to steep discounts for U.S. government cloud contracts.

Financials

- PYPL, V, MA: Lower on JPM plan to charge fintechs for customer data access.

Industrials

- RCAT: Jumped on Pentagon drone procurement fast-track order.

- EXPD: Downgraded at BofA on flat growth outlook.

- LUCK: Acquired 58 sites for $306M.

Health Care

- CAPR: Dropped after FDA rejected Duchenne therapy filing.

- OSCR: Downgraded at Wells on exchange risk.

- MDT: Rose on CMS coverage proposal.

Materials

- FCX: Downgraded at UBS amid copper demand concerns.

- ALB: Downgraded to Sell on oversupply in lithium markets.

Eco Data Releases | Monday July 14th, 2025

No major data releases today

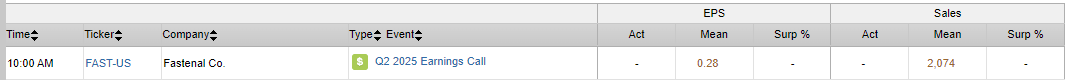

S&P 500 Constituent Earnings Announcements | Monday July 14th, 2025

Data sourced from FactSet Research Systems Inc.