July 23, 2025

As the dialogue on tariffs has evolved over the past months, investor perspective has evolved from a glass half empty (Q1’s near 20% correction) to a glass half full (April/May recovery) to something more optimistic (New all-time highs for US and EAFE equities).

At a conceptual level, realignment on global trade away from an integrated global supply chain has the potential to cause inefficiencies and raise the cost of doing business. However, while realignment is progressing and winners and losers are uncertain, there is growth potential out there for a larger set of equities than there used to be. One thing we’re seeing in the stocks is that investors are optimistically discounting growth on several sides of the trade pie. Adversarial relationships between the US and China for example, appear to be benefitting both stock markets in the near-term as well as Taiwanese equities. When we look at the stock charts of Taiwan Semi and Foxconn Internet Industries, we can see that the rivals are both being discounted positively in over the near-term (charts below).

TSM

Foxconn

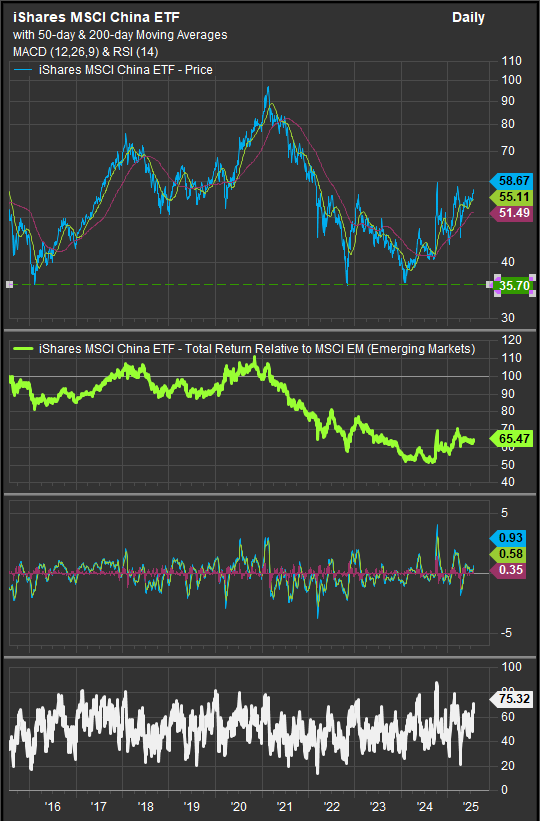

Chinese equities have been in bullish reversal since September 2024, but when considering the longer-term chart of Chinese equities (below), we can see that this intermediate-term bullish reversal comes off of support at secular low levels. Chinese shares discounted all of their gains in the aftermath of the pandemic and are now building some of that value back at a deliberate pace. We think this is a strong technical setup for the 2nd half of 2025 and beyond.

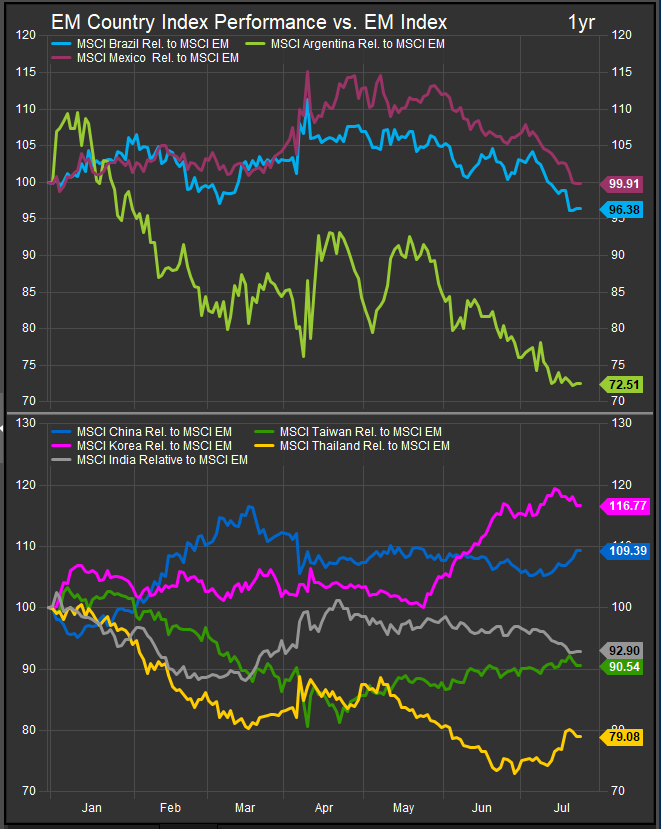

When considering the performance profile of the major EM country constituents (chart below), we see China shares perking up in the near-term, Korean shares leading YTD and Taiwanese shares executing a bullish pivot off the April low for equities. We are of the opinion that as trade developments reshape the world into multiple spheres of influence and trading blocs, US aligned nations and Chinese aligned nations both have a ramp to Growth over the next 1-2 years as the implications of global realignment are discounted out by investors.

Conclusion

Given the dominance of the global trade narrative as an investment theme for 2025, we wanted to point out that despite the potential for rising prices from tariffs, there is also potential for Growth as regional industrial networks adapt to the sundering of the global supply chain. If the world is to move apart into two or more spheres of political influence (US, China, potentially the EU and/or Japan), that may make supply chains more inefficient, but it will also create more business opportunities for a broader swath of companies. This should create some speculative motivations for investors and lead another leg of the bull market that started in 2023.

Data sourced from FactSet Research Systems Inc.