July 29, 2025

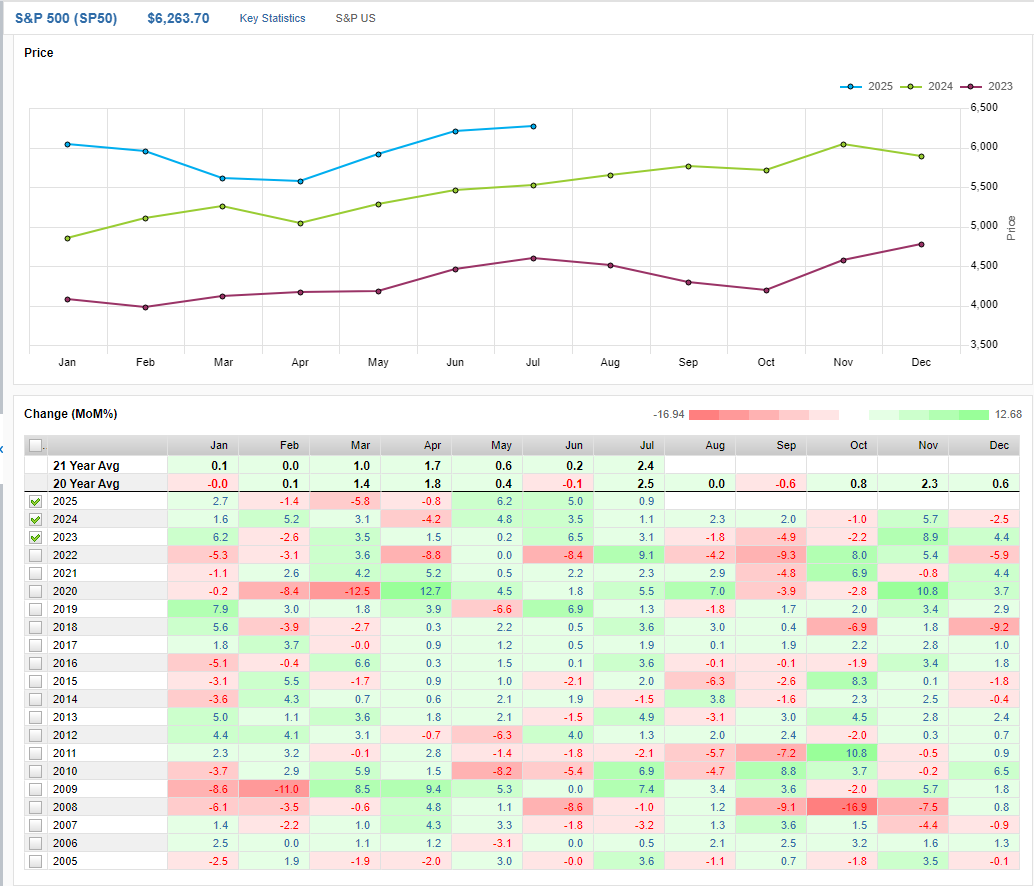

As July winds down with US and European Equities at all-time highs and EM equities appreciating as well, we come to the tactical concern of how to manage potential profit taking within a strong bull trend. Historically, the seasonal returns for the months of August-October have been the weakest average returns over the past 20 years (chart below).

When combining this data with the context of an overbought reading on the S&P 500 (chart below), we get a setup that invites profit taking. The standard rationale is that the institutional investor goes on vacation in August and isn’t around to accumulate near-term selling from shorter-term holders. This sets up some potential for over-reactions when price action is weaker than expected and Q3 earnings season is often one where optimistic projections from the first half of the year meet a more sober reality.

These dynamics are generalities of course, but they are born out by the data. When they are accompanied as they are now by pervasive oversold conditions in low vol. stocks (chart below, panel 2), then the table is set for some profit taking and a tactical rotation at least until overbought conditions are alleviated.

We think the current set up calls for some hedging into low vol. exposures into Utilities, Staples, Real Estate and/or Healthcare. We’re not suggesting a portfolio needs to be put in a bunker, but this isn’t the time to get out over our ski’s bullish either. We just need to keep in mind that while the trends have skewed bullish, many of the current circumstances have led to rising costs when they’ve existed in the past. Data has threaded a needle, both strong enough to encourage risk appetite, but weak enough to keep the Fed in the picture as a dovish backstop. These conditions aren’t grave, but they are somewhat precarious. We think this calls for keeping some powder dry as the calendar flips negative.

Data sourced from Factset Research Systems Inc.