COMMENTARY:

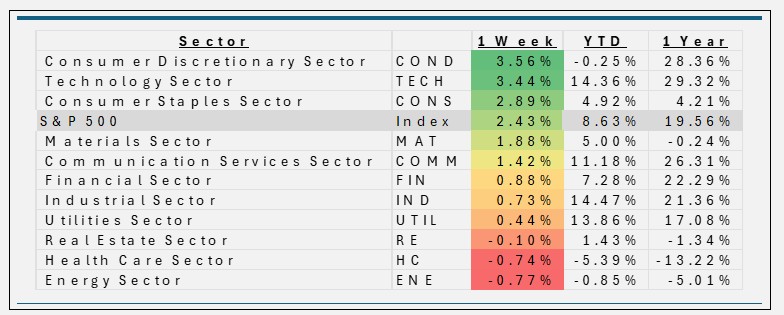

- S&P 500’s 2.4% rally this week was powered by a blend of exceptional earnings, tech/AI leadership, hawkish-to-dovish shifts in Fed policy outlook, and tariff clarity for key firms. Markets embraced risk, driven by confidence in corporate strength and easing monetary policy—even amid lingering concerns about inflation and global economic headwinds.

- The 3.6% weekly gain in the Consumer Discretionary put the sector in first place and reflects a powerful mix of hawk-to-dove Fed sentiment, standout earnings, and trade policy relief. Standouts like Expedia (+9.7%), Amazon (+3.7%) and Tesla (+8.9%) played outsized roles in the rally.

- Technology’s 3.4% jump last week was driven by a potent blend of mega-cap tech outperformance, surging AI demand, tariff exemption hopes, and accommodative macro expectations. Some of the high-flyers this week were: Nvidia (+5.2%), Apple (+13.3%) and Palantir Technologies (+21.2%). Many constituents directly benefited from strong earnings and sentiment in firms at the forefront of innovation—particularly those linked to AI and semiconductors.

- Energy and Health Care both fell just over 70 basis points each this week and were the bottom performers. Health Care’s underperformance stems mainly from deep-seated policy concerns and eroded investor confidence, while Energy lagged due to sharply lower oil prices, oversupply fears, and reduced drilling activity—factors that collectively dampened sector momentum.

- Year to date the top performing sectors continue to be Technology and Industrials both up about 14.4%. Health Care is still struggling and is down 5.4% this calendar year and off 13.2% for the whole one-year period.

ETF TIDBITS:

- U.S. ETFs are on track for a record year, having attracted $121 billion in July alone and a staggering $677 billion year-to-date. If the pace holds, they’re headed toward a full-year total of $1.3 trillion.

- The number of ETF issuers in the U.S. has surged, with 268 distinct firms as of August 2025—nearly double the count from three years ago. 2025 is on pace for 50–60 new entrants, many targeting niche investment strategies like derivative-income, crypto, and defined outcome ETFs.

- Private-credit ETFs are gaining attention as they open retail access to the $1.6 trillion private lending market—previously dominated by institutions. Some products offer partial liquidity but raise concerns over valuation transparency and compliance with SEC liquidity rules. The shift toward mainstream adoption—potentially even in 401(k) offerings—is prompting fresh regulatory scrutiny.

- Notably, while small-cap equity funds are experiencing ongoing outflows, global equity ETFs are gaining favor—now capturing 30% of equity flows despite representing only 19% of ETF AUM. Fixed-income ETFs are also drawing substantial interest, surpassing $200 billion in inflows.