August 13, 2025

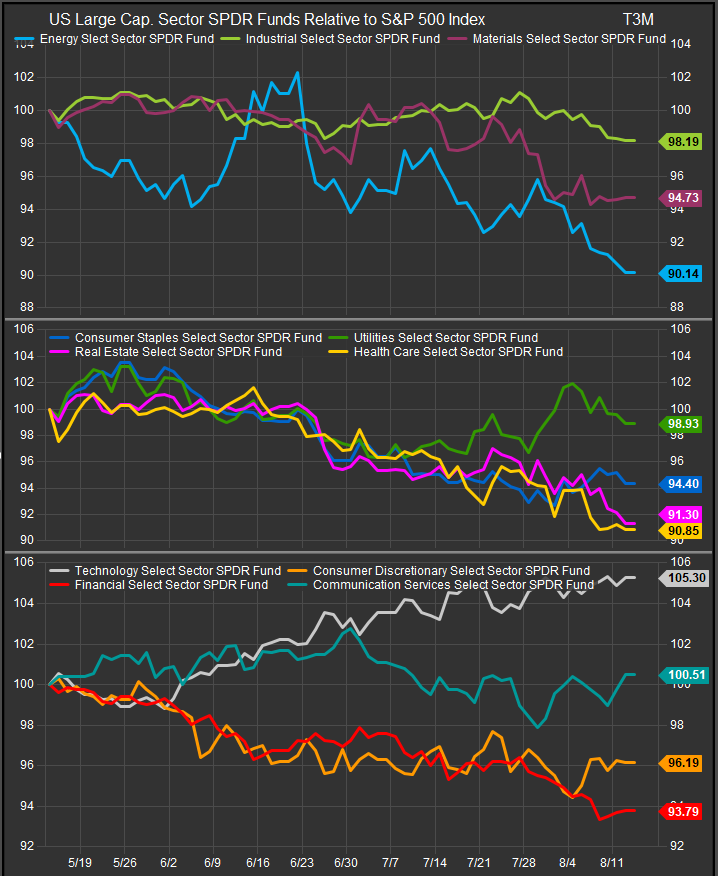

US equities touched another all-time high yesterday on the S&P 500 index. We’ve touched on our concerns about narrowing market breadth and an absence of new themes here. A lack of dynamism at the stock level is a growing concern for us, even though our trend following model remains bullishly aligned for continued Tech Sector outperformance. Since it is quite normal for equities to pause at the end of the summer, we can’t say we have an outright concern, but a lack of investor interest in anything but Technology stocks (chart below) creates and imbalance.

Given the above sector performance dynamics, the setup has created wide spread between the performance of Tech as conceptual growth and any other broad sector theme (low vol., commodities, cyclical high beta) as a rotation destination. The obvious question is then about whether we will tilt to risk on or risk off exposures. Interest rates aren’t giving us much of a clue as they are flat to lower which has benefitted low vol. AND high beta stocks when they moved lower than current levels in the summer of 2024. Earnings trends don’t help either because the tariff concerns investors have are likely to impact future results rather than last quarter’s where results pre-date tariff implementation.

Given these dilemmas, we need a signal that will give us some confidence regarding economic vitality. Our go to in these circumstances is one of the oldest indicators out there, Dow Theory.

Charles Dow developed his eponymous theory to have an indicator of economic health. He would look for new highs in the primary trend for equities to be confirmed by both the Dow Jones Industrials Average and the Dow Transportation Average. The theory rests on the rationale that industrial stocks get bid when manufacturing is robust AND goods are being shipped to consumer end points. Both indices need to be making periodic higher highs to confirm investor recognition of these dynamics.

Currently the Dow Industrials and Transports are holding their own, but are shy of confirming signals. The Dow Industrials (chart below) is on the cusp of making a significant multi-month new high and would register a Dow Theory signal above 45054.

The Dow Transportation Average has been weaker and sits about 7% below the 16,900 threshold needed to make a significant new high of its own in the primary (long-term trend).

Dow Theory has some subtlety to it. There is some flexibility to the interpretation of the “primary trend” with some debate about what constitutes a significant new high in the trend. We would advise that both the Dow Industrials and Transports have acted well enough in their bullish pivots off the April low, but both would help build bullish conviction with new highs above Q1 2025 levels. Currently both remain below leaving the door open for corrective top line price action.

Conclusion

Narrowing stock level breadth and sluggish economic data are creating a potential pivot point for the equity uptrend. We are monitoring the behavior of the Dow Industrials and Dow Transportation Averages to get confirmation on core economic activity that can support continued enthusiasm for conceptual Growth plays.

Data sourced from FactSet Research Systems Inc.