August 26, 2025

The S&P 500 is showing some signs of rotation below the surface despite the index price continuing to sit near all-time highs. The story of August has been profit taking from the Tech Sector, specifically AI hyper-scalers and other attendant parts of the AI eco-system. The Fed has made dovish noises which has kept interest rates contained in the near-term on concerns that unemployment is starting to tick higher, and the labor market may need an assist in the second half of the year.

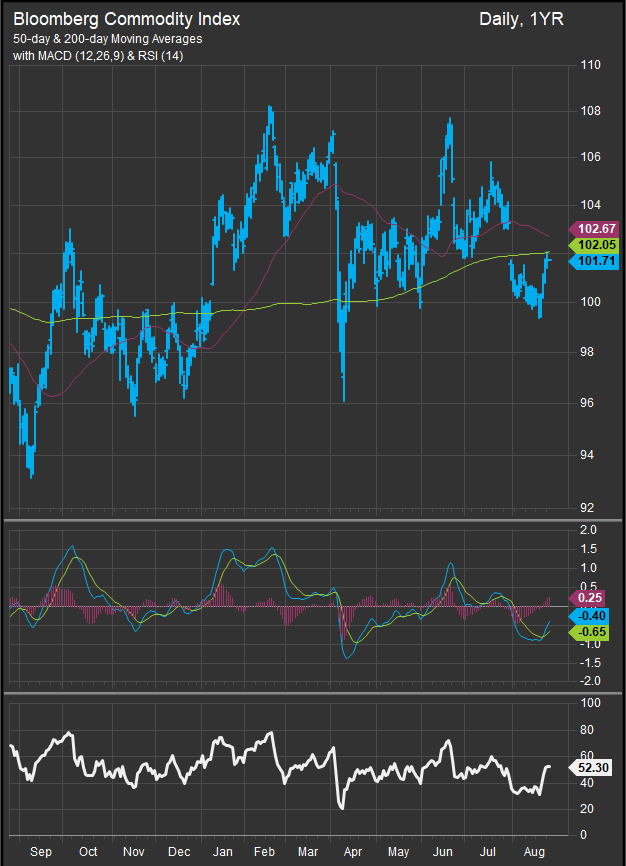

If rates move lower in anticipation of Fed easing and tariffs end up pushing prices higher, the likely outcome is inflationary. Historically the Materials sector and commodities prices benefit from inflation positioning. This cycle has been different largely because Energy stocks have generally been shunned given the secular trend towards alternative energy and electrification. When we look at the Bloomberg Commodities Index (BCOM, chart below), we can see that despite inflation concerns over the past 2+ years, the path of commodities prices remains sideways. However, from a tactical perspective the index is ticking higher from oversold levels.

Looking at the US Large Cap. Materials Sector performance vs. the S&P 500 as proxied by the XLB ETF (below) we can see the bid for Metals and Mining stocks (bottom panel) since the start of 2025. Construction Materials names (MLM, VMC) have also hooked higher since the S&P 500 index put in their April lows. Weakness persists for C&P names and Chemicals stocks which, despite weak petroleum prices, can’t seem to turn things around.

What Could be Changing?

There are a few ways Materials stocks could rebound from here. From a technical perspective, continued rotation out of the AI trade would likely provide an ambient tailwind to the other sectors of the market. Whether min vol. or high beta, more non-AI stocks drift into the “Value” bucket every time there’s a surge in AI enthusiasm. Over the longer-term this could setup another scenario like 2022 where inflation emerged against a backdrop of a very wide spread between Growth and Value. As in 2022, we think upwards pressure on rates would be the bearish “tell” if the Growth trade were to experience sustained selling.

The Fed could have a significant impact on sector trends as well. An easing cycle typically starts with a bid for lagging stocks, similar to what transpired in the 2nd half of 2024.

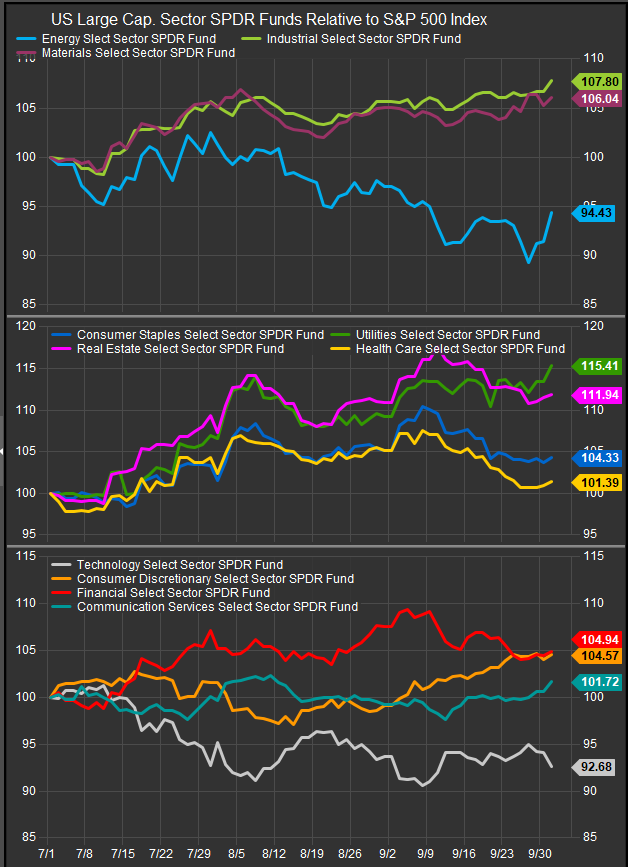

The chart below shows sector performance from July 1, 2024 through October 1, 2024.

We can see that investors responded to easing by selling Tech and Energy stocks and buying everything else while the Fed was ramping dovish policy. Looser financial conditions ended up triggering a rise in commodities prices and then interest rates which spoiled the party and set up the tariff induced correction to start 2025. Nonetheless, if an easing cycle is implemented despite the potentially inflationary setup, we would expect Materials stocks would perform more robustly than they have in 2023/24.

Finally, while economic data is moderating, the economy remains close to full employment and easing credit conditions could spur the housing market back into gear. We mentioned homebuilders in our weekly letter as showing signs of near-term bullish reversal. If rates stay lower, we could see housing and construction boost cyclical sectors while the AI trade cools down.

Conclusion

Over the long-term we expect the AI trade to remain central to the current bull market. However, the initial ramp for equities off the April lows have seen concentrated buying in AI themes. The Materials sector is structurally oversold and poised to benefit from any near-term rotation out of the AI trade. A rekindling of the housing/capex cycle and the potential need to hedge against inflation are two of the biggest reasons to think about adding Materials sector exposure. The sector has been challenged in this cycle, but just as we are seeing some bottom-fishing in Healthcare and Housing, we think there is potential for Materials stocks in a similar vein.

Data sourced from Factset Research Systems Inc.