August 29, 2025

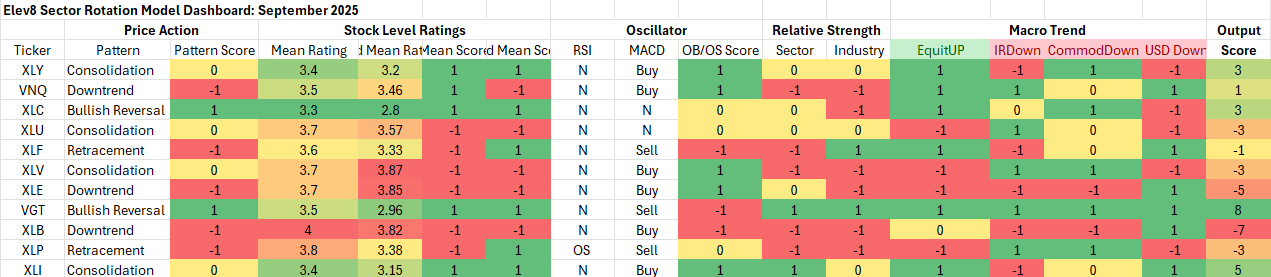

Elev8 Model Input Scores: September 2025

The table below shows the Elev8 model’s scores for September. Info Tech and Industrials sectors scored the highest in our model for the third month in a row, but we have shorted both sectors this month as we anticipate rotation. We think the emergence of a dovish Fed, renewed tariff concerns and extended valuations in leadership themes will catalyze some bottom-fishing. We are out of the Industrial, Materials and Staples sectors in September, the latter two on technical weakness and the former due to anticipation of emerging tariff related headwinds. Our Elev8 inputs are as follows:

Key: Pattern = L/T (1yr+) Price Pattern of the Sector ETF, Mean Rating = simple average of 1-6 ratings (buyàsell) of all stocks within the sector, WTD Mean Rating = Cap Weighted Sector Constituent rating, OB = Overbought, OS = Oversold, N=Neutral

Model Input Commentary

The current setup for equities presents a challenge to trend following models like Elev8. Our present structure leaves tactical discretion to the portfolio manager (yours truly) with a framework that considers macro events and positioning against the empirical inputs that make up the trend-following model. We are using our tactical discretion this month to override the model recommendations on our VGT and XLI positions. In simplest terms, we remain constructive on both sectors over the longer-term, but we think reflation from April – August has priced in a very bullish outlook on AI adoption and global trade, and we expect some backing and filling. The other dynamic to consider is the Fed. Rate cuts with the market near all-time highs are generally presumed to be bullish, but they historically favor bottom-fishing in their initial phases. We see the Consumer as a primary beneficiary of Fed easing, while low vol. and Value stocks have also been structurally out of favor. We would expect some profit taking in Tech and some re-allocation to sectors that have more obvious reflation opportunities.

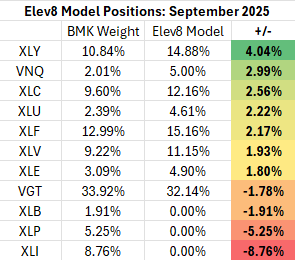

Elev8 Sector Rotation Model Portfolio: September Positioning vs. Benchmark Simulated S&P 500

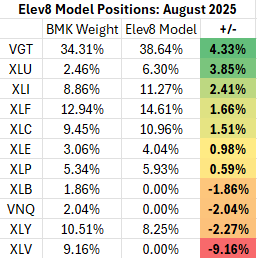

Previous Positioning as of last Rebalance: July 31, 2025

For September we’ve pared our Tech exposure to just below market weight. This has allowed us to add more cyclical exposure AND more low vol. exposure, both of which are expected beneficiaries of dovish Fed policy. We remain constructive on Tech and AI over the longer-term, but we are seeing some challenges to the narrative. We are also expecting some backup in rates and commodities prices given a dovish Fed, the US economy near full employment, robust demand for AI and the potential for tariff related cost pressures to emerge. We’ve dropped Consumer Staples in favor of Healthcare due to the clear negative impact that tariffs are having on the former, as already tight margins are getting squeezed as input costs rise and the consumer continues to be very price sensitive.

Conclusion

We are paring some upside exposures from the portfolio as the S&P 500 defied its seasonal pattern and traded to new all-time highs in August. We think that results in increased potential for continued correction in leadership themes as the impact of tariffs becomes more fully understood. A lot of good news was priced in for equities from April – August and we are expecting some backing and filling into Q3 earnings. We have bet on rate sensitive sectors to rally except in cases where tariff impact has proven deleterious.

About Elev8

We introduced the Elev8 Sector Rotation Model in September of 2024. Here’s a look under the hood at the inputs we use to score the 11 GICS Sectors for April and our resulting positions. The model includes up to 14 indicators that range from:

- Stock Level Technical Characteristics

- Macro-overlays:

- equity trend (S&P 500)

- interest rate trend (10yr US Treasury Yield)

- commodities trend (Bloomberg Commodities Index)

- USD trend (vs. EUR & Broad Currency Indices)

- Relative performance vs. the benchmark S&P 500

- Overbought/Oversold oscillator studies

We use the largest passive sector-based ETF by AUM ($) for each sector as our proxy for Elev8 sector positions. We select 8 out of 11 Sectors each month and have no exposure to the 3 with the lowest scores in our model.

Data from Factset Research Systems Inc.