COMMENTARY:

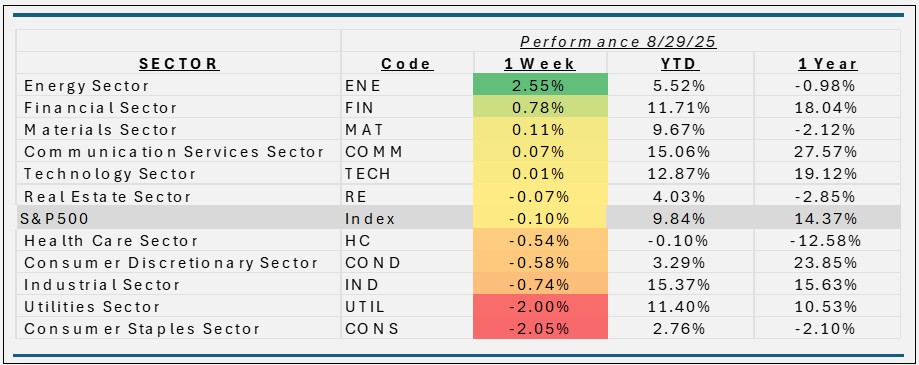

- The S&P 500’s modest 0.1% weekly drop conceals a dynamic tug-of-war: steady inflation and growing Fed easing hopes buoyed sentiment, while tech-sector wobbliness and tariff pressures pressured equities lower. Yet, the broader market held strong, powered by defensive sectors and wide investor participation, culminating in a rare fourth straight monthly gain for August.

- Energy was by far the best performing sector this week up 2.6% was driven by a combination of strong fuel demand, sharp inventory draws, and supportive macro conditions, including expectations of Fed rate cuts. On top of that, bullish technical signals helped reinforce the upward move. Exxon Mobil (+2.7%) & Chevron (+1.5%) the two largest weights in the sector ETF (~40% combined), their weekly strength was pivotal. Both stocks gained on the back of higher oil prices from declining inventories and seasonal demand strength.

- Consumer Staples decline of about 2% during the week stemmed from climbing inflation expectations and falling consumer confidence signaling demand pressure, compounded by weakness among other major holdings including big-box retailers, beverage producers, and tobacco companies. These factors converged to weigh on the defensive staples space Notable under performers included Costco Wholesale Corp. (-1.6%), and Proctor and Gamble (-1.0%). Walmar was the only company in the sector with a gain, up 15 bps.

- Utilities fell about 2% for the week reflected a combination of rate sensitivity, sector rotation, and technical selling, particularly after strong YTD performance. While long-term fundamentals remain solid, near-term investors appear to have rotated into sectors offering more near-term upside. NextEra Energy, one of the largest in the sector, fell 5.6%. Followed by Southern Co., which was off 2.3%.

- After all sector hitting a YTD gain last week, only Health Care is in negative territory now. These weeks (-0.2%) decline dragged YTD slightly under water (-0.1%). All other sectors are still up.

ETF Tidbits:

Investors navigated a cautious but opportunistic week: equities saw slight inflows, while bond strategies and financial sectors gained favor amid elevated inflation and Fed uncertainty. The crypto segment displayed notable divergence, underscoring shifting institutional sentiment.

| Asset Class / Theme | Net Flows & Highlights |

| U.S. Equity ETFs | +$571M—modest inflows amid Fed political risk |

| U.S. Bond ETFs | +$5.6B—inflows continue for 19 weeks |

| Money Market Funds | $12B outflows—shift toward yield elsewhere |

| Sector ETFs | Financials: +$1.54B; Tech & Precious Metals: +$550M+ each |

| Long-Term Mutual/ETF | ICI: ETF issuance +$21B; MF outflows −$10B; net +$11B (Aug 20) |

| Crypto ETFs (BTC) | +$440.8M weekly inflows; Bitcoin ETFs supported price floor |

| Crypto ETFs (ETH) | +$1.083B weekly; strong institutional tilt toward Ethereum ETFs |