October 10, 2025

S&P futures flat following Thursday’s decline, which trimmed Wednesday’s record highs though left the S&P 500 and Nasdaq still positive for the week. European markets are broadly lower after a softer Asian session. Treasuries are firmer with the curve flattening and long-end yields down 3–4 bp. The Dollar Index is off 0.2% but remains on pace for a strong weekly gain. Gold is up 0.9% after Thursday’s 2.4% pullback, Bitcoin +0.4%, and WTI crude -1.1%.

Markets appear set for another catalyst-light session, with focus still dominated by macro uncertainty and the ongoing U.S. government shutdown, which shows little sign of resolution. Reports suggest BLS employees have been recalled to complete the September CPI report, easing concerns over a prolonged data vacuum. Attention is also turning to the missed federal paychecks, with an estimated 1.4M defense workers due to miss payment on Oct. 15.

Trade developments added some friction overnight as China announced new fees on U.S. cargo ships docking at its ports, coming ahead of the Trump–Xi meeting at the APEC summit in South Korea later this month. Meanwhile, the broader market tone remains framed by the bull–bear debate—with optimism around AI, easing Fed policy, resilient earnings, and Q4 seasonality offset by rising skepticism about AI “circularity” and weaker consumer data.

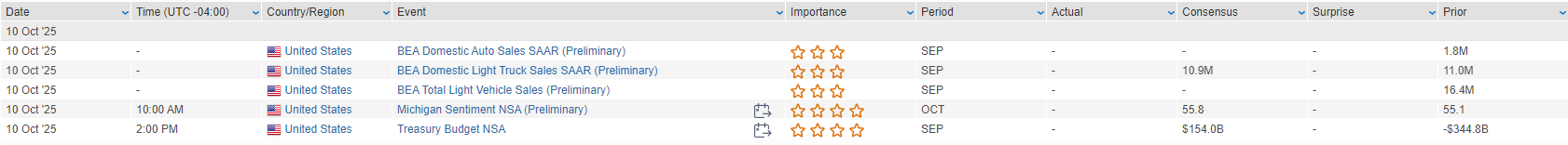

The main economic release today will be the flash September University of Michigan consumer sentiment, expected at 54.0 vs 55.1 prior, along with inflation expectations following their modest uptick in the recent NY Fed survey. Fedspeak features Chicago’s Goolsbee and St. Louis’s Musalem this morning, while SF’s Daly noted overnight that tariff-related inflation has been milder than feared but warned about unaddressed labor-market weakness.

Looking ahead, next week brings the start of Q3 earnings season (led by major banks on Oct. 14), a heavy slate of Fed speakers—including Powell at NABE (Tuesday), Governor Miran (Wednesday–Thursday), and Waller (Thursday)—plus the release of the Fed’s Beige Book on Wednesday. Uncertainty remains around whether key data like CPI (originally scheduled Oct. 15) will be released amid the shutdown.

Corporate Highlights

- QCOM: Chinese regulators opened a probe into its Autotalks acquisition announced in June, viewed as potential leverage for Xi ahead of APEC talks.

- NVDA: FT reported Chinese customs are conducting enhanced checks on chip imports to limit NVDA hardware from entering the country.

- GOOGL: The UK competition authority signaled possible additional actions over search dominance concerns.

- LEVI: Q3 results were ahead of expectations and FY guidance raised, though Q4 EPS outlook came in below estimates amid elevated expectations heading into the print.

U.S. equities finished lower Thursday (Dow -0.52% · S&P 500 -0.28% · Nasdaq -0.08% · Russell 2000 -0.61%), snapping a two-day winning streak though closing off session lows. Despite the pullback, the S&P 500 and Nasdaq remain on pace for weekly gains following recent record highs. Losses were broad-based across cyclicals, while select defensives and AI-linked names offered some support. Treasuries weakened slightly, with yields up ~1 bp and the 30-year auction tailing by 0.4 bp, though foreign demand remained solid. The Dollar Index rose 0.5%, gold fell 2.4% to below $4,000/oz, Bitcoin declined 2%, and WTI crude slipped 1.7% but remains higher for the week.

The macro backdrop was largely unchanged. Investors continue to view the U.S. government shutdown as more nuisance than threat, though growing disruption to data releases and missed federal paychecks have drawn fresh attention. The FOMC minutes added little new, reiterating divisions among policymakers but reinforcing expectations for two more 25 bp rate cuts this year. Fed Governor Barr flagged concern over tariff-related inflation, while NY Fed’s Williams signaled further cuts may be needed to support employment. Markets remain anchored by a familiar bullish mix of AI optimism, strong earnings expectations, rising M&A, steady retail inflows, low volatility, and positive Q4 seasonality—tempered by growing skepticism around AI productivity claims and the health of the lower-end consumer.

Overseas, France’s Macron said he will appoint a new prime minister by Friday, while Trump’s Gaza peace plan reportedly secured agreement from Israel and Hamas for a ceasefire and hostage return.

Sector Highlights

Sector leadership reversed from midweek, with defensives outperforming and cyclicals leading declines.

- Outperformers: Consumer Staples (+0.61%), Communication Services (-0.05%), Technology (-0.07%), Healthcare (-0.16%), Consumer Discretionary (-0.20%), Utilities (-0.23%)

- Underperformers: Materials (-1.52%), Industrials (-1.44%), Energy (-1.30%), Real Estate (-0.44%), Financials (-0.33%)

Technology (-0.07%) — Mixed session for big tech; META and NVDA gained while AAPL fell.

- NVDA +1.8%: Reportedly led a funding round for Reflection AI; U.S. approved billions in chip exports to the UAE.

- TSM: Reported strong revenue growth on rising AI demand.

Consumer Staples (+0.61%) — Led by beverages and pet products.

- PEP +4.2%: Beat on Q3 EPS/revenue; improved FX outlook and beverage momentum; announced CFO transition.

- FRPT -6.4%: Downgraded at BofA; cited slowing pet category demand.

Industrials (-1.44%) — Broad weakness in transports, machinery, and building products.

- DAL +4.3%: Beat and raised guidance; noted accelerating sales trends and no impact from shutdown.

- AZZ -4.9%: Missed on Q2; management cited weak demand in construction and HVAC end markets.

- ARMK +3.2%: Won major multiyear UPenn Health System contract.

Healthcare (-0.16%) — Outperformed broader market on M&A and pharma strength.

- AKRO +16.3%: To be acquired by NVO for $4.7B cash (~16% premium).

- NEOG +16.5%: Beat earnings; reaffirmed FY guidance and announced cost-reduction measures.

Financials (-0.33%) — Super-regionals outperformed, but credit names weighed.

- JEF -7.9%: Disclosed $715M exposure to bankrupt First Brands Group.

- WAL -4.2%: Linked to same borrower through leveraged lending.

Energy (-1.30%) — Sector lagged despite firmer oil outlook.

- WTI -1.7%, though still up for the week.

- MP +2.4%: Gained after China added new elements to its rare-earth export control list.

Materials (-1.52%) — Weakness across industrial metals and packaging names.

- AA +4.3%: Benefited from Wells Fargo upgrade on stronger aluminum outlook.

- GPK -3.6%: Downgraded at BofA on oversupply and weak boxboard demand.

Consumer Discretionary (-0.20%) — Dragged by autos, apparel, and homebuilders.

- RACE -15.0%: Despite raised guidance, stock fell on lower-than-expected growth and EV target cut.

- TSLA: Under NHTSA investigation over FSD violations; shares modestly lower.

- HELE -25%: Earnings beat but weak guidance, pressured by tariffs and promotions.

Communication Services (-0.05%) — Mixed trading; media and China tech weaker, but retail favorites up modestly.

Utilities (-0.23%) & Real Estate (-0.44%) — Held up relatively well as defensive positioning persisted amid mixed rates backdrop.

Eco Data Releases | Friday October 10th, 2025

S&P 500 Constituent Earnings Announcements | Friday October 10th, 2025

No constituents report today

Data sourced from FactSet Research Systems Inc.