October 15, 2025

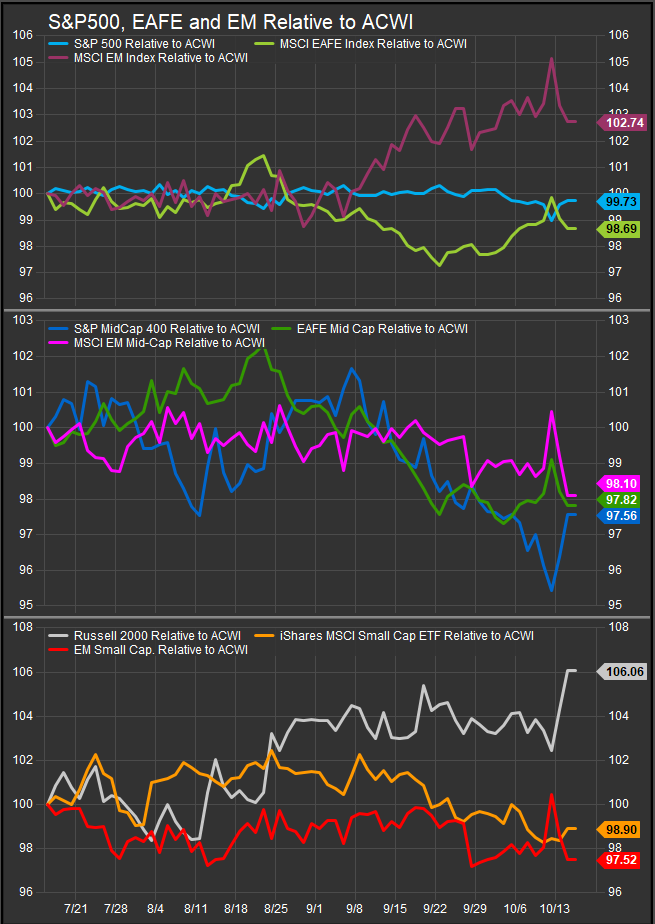

We talked last week about strength in EM Asian Technology shares, particularly in Korea and Taiwan. Those exposures continue to hold up well despite some near-term risk-off sentiment around the AI trade. The flip side of the coin is how investors should think about positioning for potential corrections as investors have begun to consider the friction between AI optimism and potential complications from global trade conflicts. This week, we dive into why core European equities have generally been haven plays when US markets are in correction mode. The pattern is well documented but has some key exceptions that we highlight. With EAFE stock perking up in the near-term along with US Small Cap stocks (chart below), there are some early signs of potential rotation.

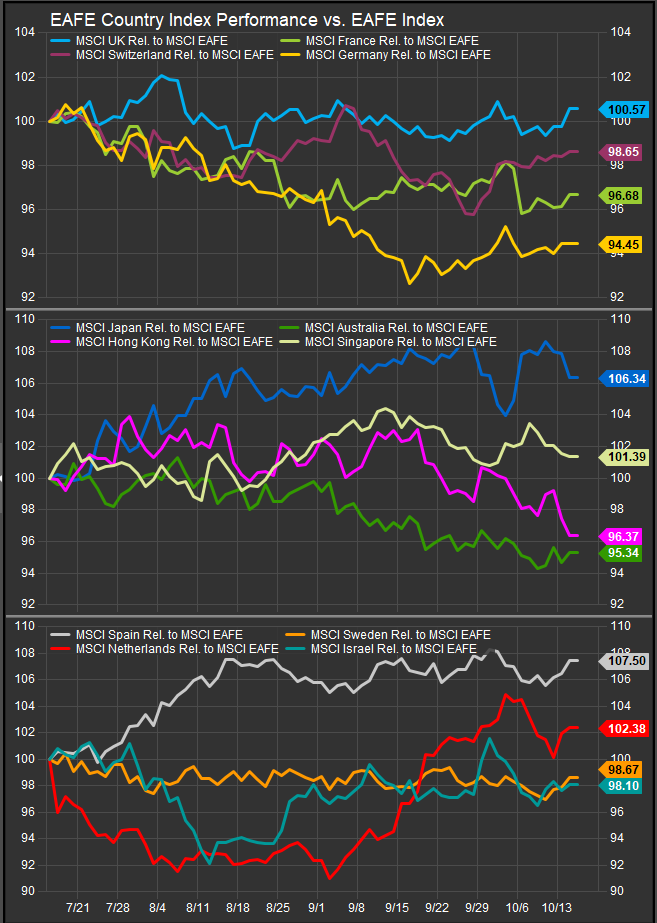

When global equity markets sell off, a curious but consistent pattern emerges: core European equities—particularly those in Germany, France, the Netherlands, and Switzerland (chart below)—often hold up better than their U.S. or emerging-market peers. This resilience is rooted in a combination of sector composition, valuation discipline, currency dynamics, and investor behavior, all of which help mitigate downside pressure when risk appetite fades.

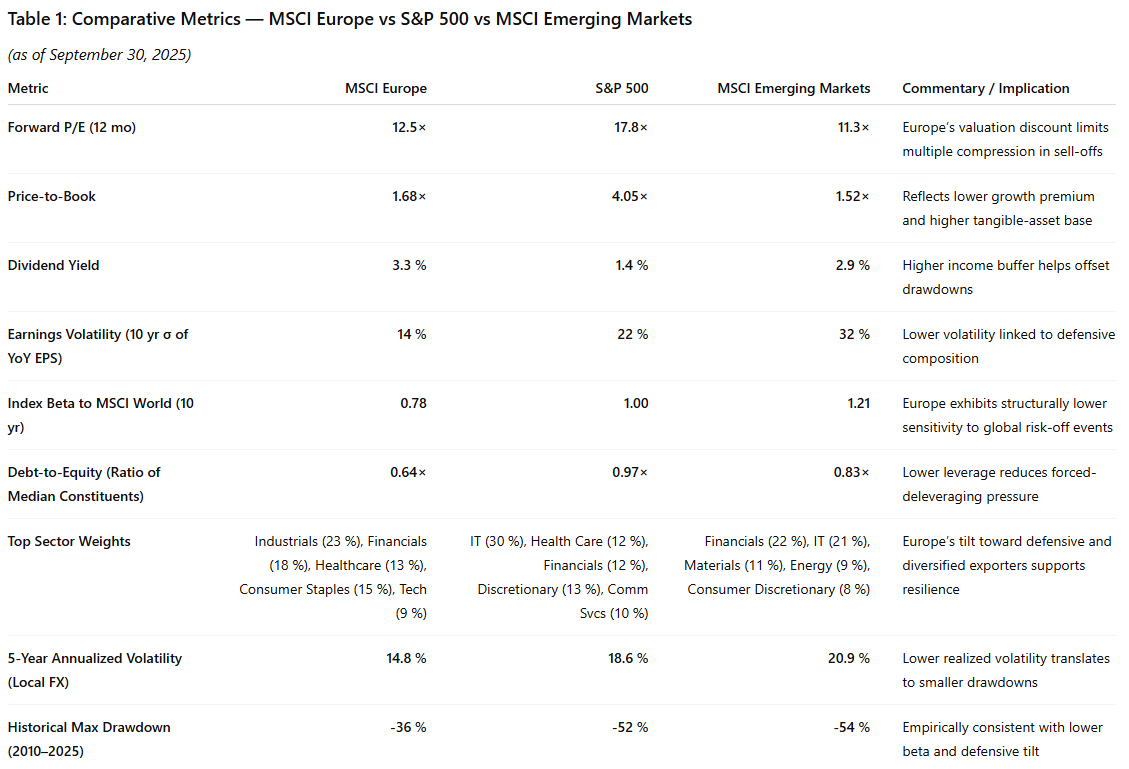

At the sector level, the composition of Europe’s major indices skews more defensive than that of the United States. The Euro Stoxx 50, for example, carries roughly 23% exposure to industrials, 15% to consumer staples, and 13% to healthcare, while information technology represents less than 9% of the benchmark. In contrast, the S&P 500 remains dominated by high-beta technology and consumer discretionary stocks, which together exceed 40% of index weight. Defensive European names such as Nestlé (NESN SW), Roche (ROG SW), Novartis (NOVN SW), L’Oréal (OR FP), and Unilever (ULVR LN) have globally diversified revenues, stable earnings, and strong pricing power. Their steady cash flows tend to outperform cyclical or growth-oriented peers when global earnings expectations fall.

Valuations are another major buffer. European equities typically trade at a persistent discount to their U.S. counterparts, both on forward and trailing metrics. As of late 2025, the MSCI Europe trades at approximately 12.5× forward earnings, compared with 17.8× for the S&P 500 and 11.3× for MSCI Emerging Markets. During market stress, multiple compression tends to be most severe for expensive growth stocks, meaning that Europe’s lower starting point provides a natural cushion. This valuation gap is reinforced by the region’s higher dividend yield, averaging around 3.3% for the MSCI Europe versus 1.4% for the S&P 500, offering income-oriented investors a tangible offset to price declines.

Currency dynamics also play a stabilizing role. In risk-off environments, the euro and the Swiss franc often appreciate against risk-sensitive currencies, reflecting their low external debt and current account surpluses. The EUR/USD exchange rate, for instance, strengthened by nearly 5% in the fourth quarter of 2018 and 3% in mid-2022, coinciding with global equity corrections. For euro-based or CHF-based investors, this currency strength helps preserve purchasing power, while for U.S.-dollar investors, the effect depends on hedging strategy. Unhedged positions in European equities can outperform on a relative basis as the currency offsets local equity losses.

Investor positioning and flow dynamics further reinforce the pattern. Core Europe remains structurally under-owned in global portfolios. According to EPFR Global data, U.S. equities represented roughly 62% of global equity fund allocations in 2024, compared with less than 15% for developed Europe. When volatility spikes, de-risking typically begins in crowded U.S. or emerging-market exposures, while institutional investors rotate toward higher-dividend, lower-volatility European blue chips. Moreover, Europe’s investor base is dominated by pension funds and insurance companies with long-term, liability-matching mandates, rather than short-term retail flows. This structural stability reduces the likelihood of margin-call liquidation cascades or algorithmic selling that often exacerbates U.S. drawdowns.

Policy and market-structure differences also matter. The European Central Bank’s monetary stance, though occasionally restrictive, tends to involve fewer abrupt pivots than the U.S. Federal Reserve’s cycle of tightening and easing. During the 2022-2023 sell-off, for example, the ECB’s cumulative rate hikes totaled 450 basis points versus the Fed’s 525 basis points, and the ECB signaled earlier that policy would remain “restrictive for longer” without implying aggressive tightening. This communication discipline helped anchor European bond yields and credit spreads, limiting equity risk-premium volatility.

Empirically, the relative resilience of European markets has shown up across multiple downturns. In the Q4 2018 global growth scare, the MSCI Europe ex-UK fell approximately 12%, compared with a 19% decline in the S&P 500. During the 2022 tightening cycle, the Euro Stoxx 50 lost about 11% from peak to trough, while the S&P 500 slid nearly 19% over the same period. Even in the pandemic shock of March 2020, when European equities matched the global market’s initial drawdown, their 12-month recovery lag reflected slower growth expectations rather than deeper losses. Over longer horizons, the beta of MSCI Europe to MSCI World has averaged 0.78 over the past decade, underscoring its historically lower sensitivity to global equity risk.

However, Europe’s defensive bias is not absolute. If the correction is Europe-led—for example, a region-specific banking crisis or sovereign-debt flare-up—European indices can underperform sharply, as seen during the 2011–2012 sovereign debt crisis. Similarly, sharp U.S. dollar appreciation tends to erode the relative returns of European equities for dollar-based investors. And in periods of synchronized global weakness, the same export-heavy sectors that offer downside resilience early in a sell-off can lag in late-cycle recoveries as global trade volumes decline.

The table below provides a summary of the fundamental backdrop supporting European equities as a suitable exposure to consider for fully invested mandates in equity drawdown scenarios:

In sum, core European equities tend to outperform during global equity corrections because they combine defensive sector weightings, lower valuations, healthier balance sheets, and a more conservative investor base. These structural characteristics limit drawdowns relative to higher-beta markets like the United States or emerging economies. While Europe’s secular growth profile remains modest, its role as a relative safe haven in global equity downturns continues to make it an attractive diversification anchor within multi-asset portfolios.

Bibliography

- Bloomberg L.P., Equity Index Composition and Valuation Metrics, September 2025.

- MSCI Inc., MSCI Europe Index Factsheet, September 2025.

- Standard & Poor’s, S&P 500 Index Factsheet, September 2025.

- EPFR Global, Fund Flow Report: Global Equity Allocation Trends 2024–2025.

- European Central Bank, Monetary Policy Accounts and Rate Path Data, 2022–2025.

- IMF World Economic Outlook, External Balances and Currency Strength in Advanced Economies, April 2025.

- Refinitiv Datastream, Historical Index Performance and Beta Correlations, 2010–2025.

- Bank for International Settlements (BIS), FX Markets and Risk-Off Behavior, 2023.

Other data and charts sourced from FactSet Research Systems Inc.