October 20, 2025

S&P futures +0.3% in Monday morning trading, extending last week’s momentum after the major U.S. indexes each gained more than 1.5%. Leadership last week came from semiconductors, credit cards, apparel, staples retailers, airlines, restaurants, machinery, chemicals, and builders, while financials lagged on renewed regional-bank credit worries. Asian markets were higher overnight, led by Japan following a coalition agreement between the LDP and JIP. European equities are also firmer, up more than 0.5%. In macro markets, Treasury yields are modestly higher (~+1 bp), the Dollar Index is flat, gold +1.3%, Bitcoin +4%, and WTI crude -0.3%.

Risk sentiment is improving as several tailwinds emerge. Reports indicate a softening of U.S.–China trade tensions, with the White House reportedly easing tariff measures through expanded exemptions and carveouts—signaling a more pragmatic approach ahead of potential bilateral talks. The regional banking space is also stabilizing after last week’s credit headlines, with analysts and investors increasingly viewing those issues as idiosyncratic rather than systemic.

Earnings continue to support the bull case: roughly 86% of S&P 500 companies reporting so far have beaten EPS expectations, underscoring resilient corporate fundamentals. Positioning dynamics have improved as well, with retail investors remaining net buyers, while mutual fund redemptions and buyback blackout periods—recent technical headwinds—are expected to fade in the coming weeks. Historically positive late-October seasonality is also beginning to provide a tailwind as markets approach the final stretch of the month.

This week’s economic calendar is light until Friday’s October CPI release, delayed by the government shutdown. Consensus expects headline CPI +0.4% m/m and +3.1% y/y, and core CPI +0.3% m/m, +3.1% y/y. Other data includes Philly Fed non-manufacturing (Tue), existing home sales (Thu), flash October PMIs, final University of Michigan sentiment, and September new home sales (Fri).

There will be no Fedspeak this week ahead of the October 29 FOMC meeting, where the Fed is widely expected to deliver another 25 bp rate cut. Markets currently price roughly 50 bp of additional easing by year-end, reflecting expectations of a soft-landing scenario supported by easing inflation and resilient growth.

Overall, the tone remains constructive: macro crosscurrents persist, but earnings strength, fading trade risks, and improving seasonal and positioning dynamics are helping risk appetite stabilize into the final third of October

Earnings and Corporate Highlights

A busy earnings week lies ahead with 90 S&P 500 companies set to report.

- AAPL – FT and Bloomberg both highlighted stronger-than-expected iPhone 17 upgrade demand, supporting bullish sentiment on near-term unit growth.

- AMZN – Its AWS division reportedly suffered a widespread service disruption, though no long-term impact expected.

- TSLA – Proxy advisor ISS recommended shareholders vote against Musk’s $1T pay package, calling it excessive relative to governance standards.

- OpenAI – TechCrunch noted slowing downloads and user activity for the ChatGPT mobile app, though overall engagement remains high.

- BA – FAA cleared Boeing to resume 737 Max production for the first time in nearly two years, removing a key overhang.

- PSKY – Mass layoffs reportedly to begin the week of Oct 27 as part of restructuring.

- HOLX – Shares higher on reports that Blackstone and TPG are in advanced talks to acquire the company in a $17B+ leveraged buyout.

- COO – Up after reports that activist Jana Partners has taken a stake, potentially pushing for portfolio changes.

- EBC – Reuters reported activist investors urging the bank to explore a sale amid margin pressure.

Stocks rebounded Friday (Dow +0.52% · S&P 500 +0.53% · Nasdaq +0.52% · Russell 2000 -0.60%) , reclaiming part of Thursday’s slide as regional-bank stress appeared contained and earnings skewed constructive. Treasuries weakened with a bit of curve flattening (giving back pre-market strength). The Dollar Index +0.1% but -0.6% W/W (worst since early Aug). Gold -2.1% (still +5.3% W/W), Bitcoin -1.6%, and WTI +0.3% (but -3% W/W; third straight weekly decline).

Narrative-wise: credit jitters (ZION, WAL) persisted but drew pushback from banks and analysts; U.S.–China headlines were quiet (Trump again signaled high tariffs aren’t sustainable); AI remained under scrutiny on bubble/“circularity” concerns; the shutdown kept the data vacuum in focus. No major data prints; sell-side state tracking put initial claims near ~217K (wk ended 11-Oct). St. Louis Fed’s Musalem said the job market remains near full employment but has cooled; the Fed now heads into blackout before next Wednesday’s FOMC (another 25 bp cut widely expected). Looking ahead: Sept CPI (shutdown exception) due Fri, Oct 25, plus existing-home sales (Thu), flash PMIs and final Oct UMich (Fri). Earnings volume accelerates sharply over the next two weeks.

Sector Highlights

Leadership rotated back toward Consumer Staples (+1.23%), Financials (+0.84%), Energy (+0.80%), Comm Services (+0.76%), Real Estate (+0.66%), Consumer Discretionary (+0.64%), and Healthcare (+0.63%). Laggards: Utilities (-0.38%), Materials (-0.35%), with Industrials (+0.05%) and Tech (+0.37%) trailing the tape. Big Tech was mostly firmer, though AMZN lagged; small-cap/most-shorted baskets underperformed.

Financials

- AXP +7.3% — Beat & raised; accelerating billed business (U.S. +9% y/y), stronger T&E; nudged up FY25 EPS and revenue growth floors.

- TFC +3.7% — Beat; fees solid, provision/NCOs below Street; modest top-line guide ahead; loan growth better.

- FITB +1.3% — EPS beat; NII/PPNR in line; NPLs fell for a second straight quarter.

- HBAN — Fee income beat; FY guide well received.

- ALLY +3.6% — Beat; origination momentum; raised 2025 NIM midpoint; trimmed FY NCO guide.

- STT -1.4% — Beat on EPS/rev via fees, but NII/NIM missed; expenses elevated; AUM +15% to $5.4T.

- IBKR -3.3% — Beat; new-account momentum/commissions up, but discussion of lower-rate headwinds.

- OZK -2.3% — EPS miss; NII/NIM in line; provision/NCOs higher; deposits/loans softer; cut at RJ.

- JEF +5.9% — Investor Day soothed credit fears tied to First Brands; upgrade at Oppenheimer.

- ZION +5.8% — Rebound after prior-day plunge on C&I charge-offs; upgrade at Baird, “idiosyncratic” framing aided sentiment.

Information Technology

- MU — Reportedly halting server-chip supply to Chinese data centers while continuing to serve other sectors.

- ORCL -6.9% — Gave back Thursday’s analyst-day pop (AI infra GM ~35%, higher OCI LT guide); Street flagged FY28 EPS below consensus.

- Tech hardware/China tech broadly firmer; tech components mixed.

Consumer Discretionary

- Rails/Parcels/Logistics: CSX +1.7% — EPS/rev beat; intermodal strength; reiterated FY CapEx; constructive setup into Q4/’26.

- Cruise lines, airlines gained; machinery/trucking lagged.

- PZZA (from prior days) remained supported by take-private chatter.

Consumer Staples

- Outperformed at the sector level; custody banks (Staples-adjacent flows) lagged; apparel retailers mixed.

Communication Services

- AMZN underperformed within big tech. Broader China tech firmer; media mixed.

Health Care

- GLP-1s weak: LLY -2.0%, NVO lower after Trump said obesity-drug out-of-pocket prices would fall “pretty fast.”

- RVMD +8.9% — FDA CNPV for daraxonrasib (RMC-6236).

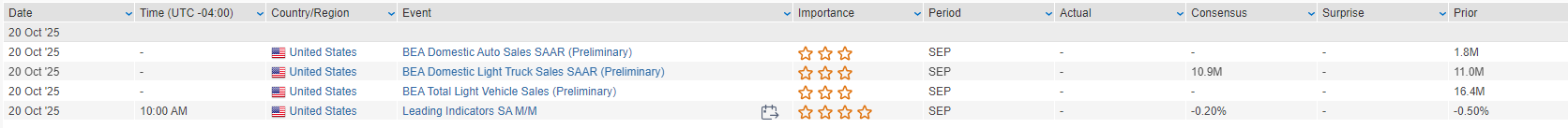

Eco Data Releases | Monday October 20th, 2025

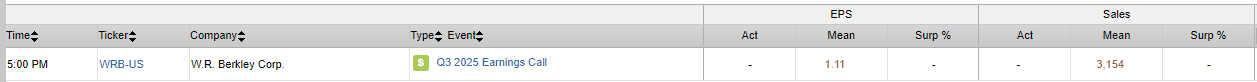

S&P 500 Constituent Earnings Announcements | Monday October 20th, 2025

Data sourced from FactSet Research Systems Inc.