October 28, 2025

S&P futures flat Tuesday morning after a strong Monday rally that saw the S&P 500 and Nasdaq both gain over 1%. Big Tech and semis led, while cyclicals outperformed defensives. Staples lagged and precious metals weighed on materials. Treasuries firmer (yields −1–2 bp), Dollar −0.1%, Gold −2.5%, Bitcoin −0.1%, and WTI −1.5%.

Markets remain in a holding pattern ahead of key catalysts: Mag 7 earnings midweek and the FOMC decision Wednesday, where the Fed is expected to cut rates by 25 bp to 3.75–4.0% and possibly signal an end to QT. The Trump–Xi meeting Thursday is expected to formalize last weekend’s trade “framework” deal. Sentiment stays upbeat on Fed easing, resilient growth, strong earnings, and AI momentum, with seasonality, buybacks, and short-covering supporting the right-tail narrative. However, a pickup in layoff announcements adds to labor-market softening concerns.

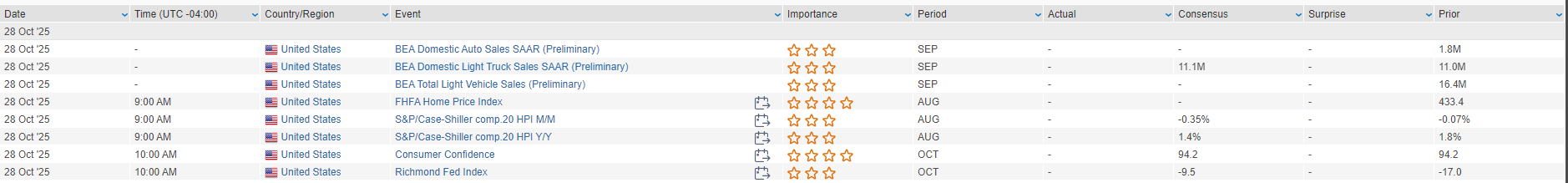

Today’s data includes Consumer Confidence, Richmond Fed, and Case-Shiller home prices, along with a $44B 7-year Treasury auction following strong 2- and 5-year demand.

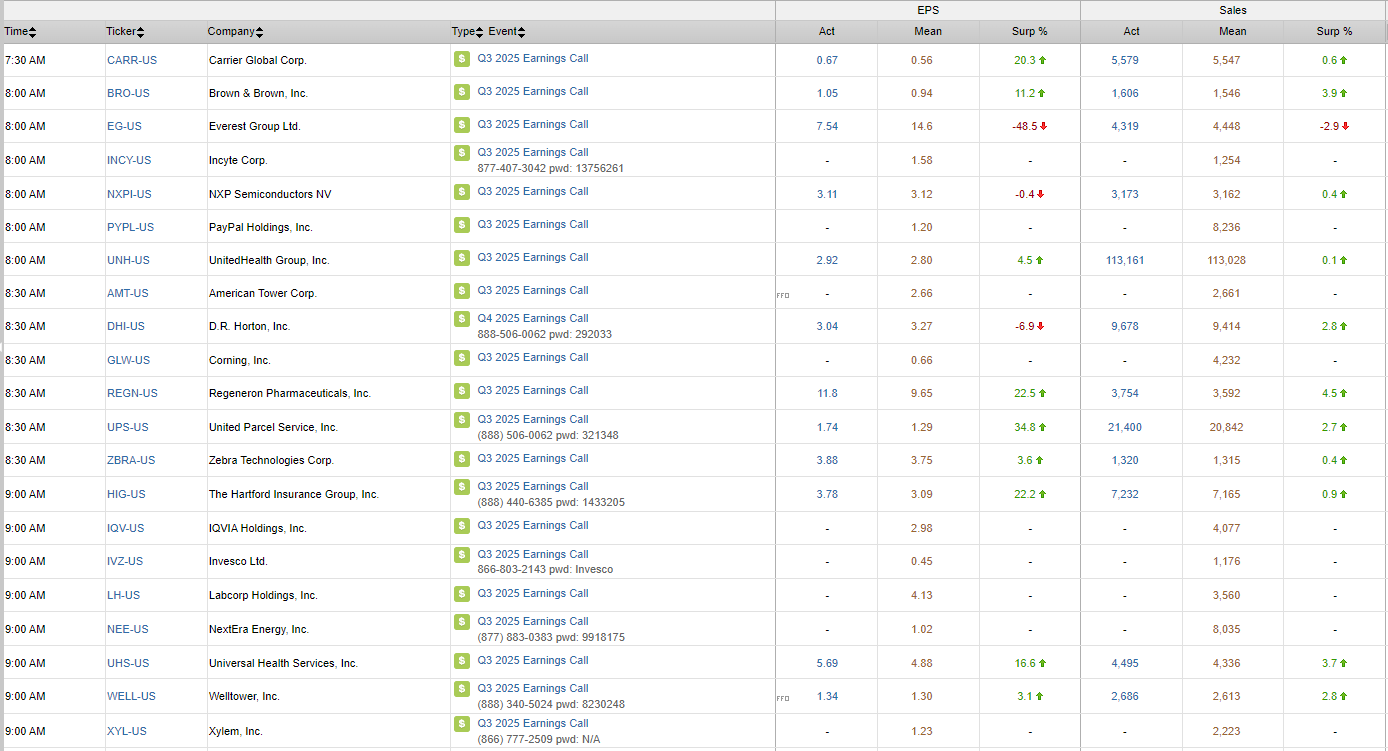

Corporate highlights:

- UPS + on Q3 beat; strong cost-cutting progress.

- UNH + on beat and raise.

- RCL − on light Q4 guidance despite solid demand.

- DHI − after miss, guided for continued sales incentives.

- AMZN − confirmed ~14K corporate job cuts (below earlier reports of 30K).

- PYPL + on payment integration with ChatGPT.

- NEE + on renewable-energy collaboration with GOOGL.

- QRVO + on report SWKS explored acquisition

U.S. finished near session highs on Monday (Dow +0.71% | S&P 500 +1.23% | Nasdaq +1.86% | Russell 2000 +0.28%). The S&P 500 and Nasdaq remain on pace for their sixth and seventh consecutive monthly advances, respectively, with momentum led by large-cap growth and AI-linked names. Treasuries were mixed with some flattening after a soft 2-year auction and a well-received 5-year sale. The Dollar Index slipped 0.1%, gold fell 2.9% (briefly below $4,000/oz), Bitcoin gained 4%, and WTI crude eased 0.3% after last week’s volatile 7% rally.

Markets were buoyed by optimism around a U.S.–China trade de-escalation, with reports of a “framework deal” to halt further tariff escalation ahead of Thursday’s Trump–Xi meeting at the APEC summit. While details remain sparse, expectations center on restoring the fragile truce seen earlier this year. Meanwhile, traders continued to price in Fed easing amid a solid macro backdrop and double-digit corporate earnings growth. The FOMC meets Wednesday and is widely expected to cut rates by 25 bp to 3.75–4.00%, with speculation that the Fed may also announce an end to QT.

Elsewhere, AI enthusiasm persisted, bolstered by Qualcomm’s data center chip announcement and AMD’s new government partnership. The week ahead marks the peak of Q3 earnings season, with 36% of S&P 500 constituents set to report. Focus will be on the Mag 7, with GOOGL, META, and MSFT due Wednesday and AAPL and AMZN on Thursday.

Economic data remained light amid the ongoing government shutdown. The Dallas Fed Manufacturing Index modestly missed expectations, showing continued contraction in new orders but improving employment trends. Price pressures eased further, though sentiment weakened on tariff concerns. Treasury auctions drew mixed demand, with strong foreign participation in the 5-year sale. The Consumer Confidence, Richmond Fed, and Case-Shiller reports follow Tuesday ahead of the FOMC decision midweek.

Sector Highlights

Leadership was concentrated in growth-oriented sectors, with Communication Services (+2.30%), Technology (+2.02%), and Consumer Discretionary (+1.53%) driving the index higher on AI optimism and strong big-tech momentum. Defensive groups lagged, with Consumer Staples (−0.27%) and Materials (−0.25%) underperforming, while Real Estate (+0.27%), Utilities (+0.27%), and Healthcare (+0.28%) were broadly flat. Financials (+0.36%) and Industrials (+0.60%) saw modest gains amid consolidation headlines. Energy (+0.30%) trailed despite stable oil prices. Overall breadth improved, with market leadership firmly anchored in AI, semis, and large-cap tech heading into the week’s major earnings catalysts.

Information Technology

- Qualcomm (QCOM) +11.1% – Announced entry into the AI data center chip market, introducing its AI200 series to compete directly with Nvidia and AMD.

- AMD (AMD) – Announced a $1B U.S. government partnership to build two new supercomputers, reinforcing AI and semiconductor leadership.

- Snowflake (SNOW) +3.1% – CRO hinted at potential to reach $10B in annual revenue within two years; company reaffirmed Q3 and FY26 guidance in a subsequent 8-K filing.

- nCino (NCNO) +4.0% – Upgraded to overweight at Stephens, citing improving ACV momentum and valuation reset.

Communication Services

- Alphabet (GOOGL) +2.7% – Outperformed on optimism tied to the expanded Anthropic Cloud TPU partnership.

- Intellia Therapeutics (NTLA) −42.2% – Paused two Phase 3 gene-editing trials following a patient liver complication, reviving safety concerns for the class.

Consumer Discretionary

- Amazon (AMZN) – Reports indicate plans to cut up to 30,000 corporate roles to offset pandemic-era overhiring.

- lululemon (LULU) +1.8% – Reached deal with Fanatics to sell NFL apparel, marking a new category expansion.

- Five Below (FIVE) +2.5% – Upgraded to overweight at JPMorgan on strong Halloween sales and SSS momentum.

- Victoria’s Secret (VSCO) +5.1% – Upgraded to neutral from sell at Goldman Sachs; cited better execution and improving brand relevance.

- Harley-Davidson (HOG) −4.4% – Downgraded to underweight at Morgan Stanley on deteriorating pricing power and weak secular demand trends.

Industrials

- Huntington Bancshares (HBAN) −2.7% / Cadence Bank (CADE) +4.4% – HBAN announced a $7.4B all-stock acquisition of CADE, creating a larger super-regional lender; deal expected to close Q1 2026.

- American Water (AWK) −2.5% / Essential Utilities (WTRG) – Announced an all-stock merger valued at $63B, expected to be EPS-accretive in year one post-close.

- FTI Consulting (FCN) +5.5% – CEO Henry Gunby disclosed insider purchase of 7,500 shares.

Consumer Staples

- Keurig Dr Pepper (KDP) +7.6% – Beat on revenue, reaffirmed FY EPS guidance; announced $7B investment from Apollo and KKR to fund the JDE Peet’s deal and reduce leverage.

Financials

- Janus Henderson (JHG) +11.3% – Confirmed buyout proposal from Trian Partners and General Catalyst for $46/sh in cash, a 10.5% premium.

- SLM Corp (SLM) – Focus on credit metrics stability despite earnings miss; reaffirmed NCO guidance.

Health Care

- Organon (OGN) −22.9% – CEO resigned amid an audit probe revealing channel-stuffing practices for contraceptive Nexplanon.

- Doximity (DOCS) +2.5% – Upgraded to buy at BofA; expected to benefit from pharma marketing spend shift to healthcare providers.

Energy & Materials

- MP Materials (MP) −7.4% – Rare earth miners sold off on reports of potential delay in China’s export controls following U.S.–China “framework” deal.

- Avidity Biosciences (RNA) +42.4% – To be acquired by Novartis (NVS) for $72/sh in cash (~46% premium; $12B value).

- Dyne Therapeutics (DYN) +41.2% – Rallied in sympathy on M&A read-through.

Eco Data Releases | Tuesday October 28th, 2025

S&P 500 Constituent Earnings Announcements | Tuesday October 28th, 2025

Data sourced from FactSet Research Systems Inc.